Exam 6: Analyzing and Journalizing Payroll

Exam 1: The Need for Payroll and Personal Records70 Questions

Exam 2: Computing Wages and Salaries79 Questions

Exam 3: Social Security Taxes70 Questions

Exam 4: Income Tax Withholding56 Questions

Exam 5: Unemployment Compensation Taxes67 Questions

Exam 6: Analyzing and Journalizing Payroll54 Questions

Select questions type

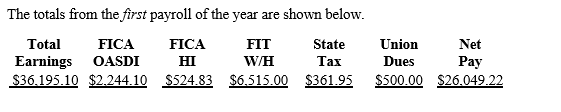

Exhibit 6-1

The totals from the first payroll of the year are shown below.

-Refer to Exhibit 6-1.Journalize the entry to record the payroll.

-Refer to Exhibit 6-1.Journalize the entry to record the payroll.

Free

(Essay)

4.9/5  (45)

(45)

Correct Answer:

Wages Expense

36,195.10

FICA Taxes Payable-OASDI

2,244.10

FICA Taxes Payable-HI

524.83

Employees FIT Payable

6,515.00

Employees SIT Payable

361.95

Union Dues Payable

500.00

Cash

26,049.22

The total of the net amount paid to employees each payday is credited to either the cash account or the salaries payable account.

Free

(True/False)

4.9/5  (26)

(26)

Correct Answer:

True

The entry to record the employer's payroll taxes usually includes credits to the liability accounts for FICA (OASDI and HI),FUTA,and SUTA taxes.

Free

(True/False)

4.8/5  (41)

(41)

Correct Answer:

True

Which of the following items would require an adjusting entry at the end of each accounting period?

(Multiple Choice)

4.9/5  (42)

(42)

In order to prepare Forms W-2,an employer would utilize the employee's earnings record.

(True/False)

4.9/5  (32)

(32)

When recording the deposit of FUTA taxes owed,the proper entry is:

(Multiple Choice)

4.8/5  (39)

(39)

The employee's earnings record provides information for each of the following except:

(Multiple Choice)

4.7/5  (41)

(41)

Companies usually provide a separate column in the payroll register to record the employer's payroll taxes.

(True/False)

4.8/5  (47)

(47)

Under the Consumer Credit Protection Act,disposable earnings are the earnings remaining after any deductions for health insurance.

(True/False)

4.9/5  (37)

(37)

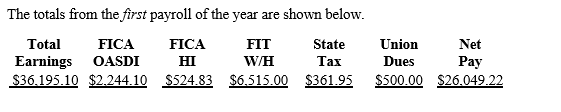

Exhibit 6-1

The totals from the first payroll of the year are shown below.

-Refer to Exhibit 6-1.Journalize the adjustment for accrued wages for the following Monday,which is the end of the accounting period.The gross payroll for that day is $7,475.

-Refer to Exhibit 6-1.Journalize the adjustment for accrued wages for the following Monday,which is the end of the accounting period.The gross payroll for that day is $7,475.

(Essay)

4.8/5  (35)

(35)

At the time that the entry is made to record the employer's payroll taxes,the SUTA tax is recorded at the net amount (0.6%).

(True/False)

4.8/5  (31)

(31)

Under the provisions of the Consumer Credit Protection Act,an employer can discharge an employee simply because the employee's wage is subject to garnishment for a single indebtedness.

(True/False)

4.8/5  (43)

(43)

Since vacation time is paid when used,there is no need to accrue this time in a liability account at the end of each accounting period.

(True/False)

4.8/5  (42)

(42)

In recording the monthly adjusting entry for accrued wages at the end of the accounting period,the amount of the adjustment would usually be determined by:

(Multiple Choice)

4.9/5  (37)

(37)

Deductions from gross pay in the payroll register are reflected on the credit side of the journal entry to record the payroll.

(True/False)

4.9/5  (25)

(25)

Tax withholdings from employees' pays reduce the amount of the debit to Salary Expense in the payroll entry.

(True/False)

4.9/5  (39)

(39)

The payroll taxes incurred by an employer are FICA,FUTA,and SUTA.

(True/False)

5.0/5  (45)

(45)

If wages are paid weekly,postings to the employee's earnings record would be done once a month.

(True/False)

4.7/5  (45)

(45)

The adjusting entry to record the accrued vacation pay at the end of an accounting period includes credits to the tax withholding liability accounts.

(True/False)

4.7/5  (39)

(39)

The employer's payroll tax expenses are recorded by all employers at the time these taxes are actually paid.

(True/False)

4.8/5  (42)

(42)

Showing 1 - 20 of 54

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)