Exam 7: Analyzing Common Stocks

Exam 1: The Investment Environment76 Questions

Exam 2: Securities Markets and Transactions95 Questions

Exam 3: Investment Information and Securities Transactions114 Questions

Exam 4: Return and Risk108 Questions

Exam 5: Modern Portfolio Concepts96 Questions

Exam 6: Common Stocks116 Questions

Exam 7: Analyzing Common Stocks106 Questions

Exam 8: Stock Valuation102 Questions

Exam 9: Market Efficiency, Behavioral Finance, and Technical Analysis112 Questions

Exam 10: Fixed-Income Securities118 Questions

Exam 11: Bond Valuation112 Questions

Exam 12: Mutual Funds: Professionally Managed Portfolios113 Questions

Exam 13: Managing Your Own Portfolios109 Questions

Exam 14: Options: Puts and Calls115 Questions

Exam 15: Commodities and Financial Futures96 Questions

Select questions type

The inventory turnover rate for a firm is 14.5 as compared to the relevant industry rate of 13.2.In this case, the firm is

(Multiple Choice)

4.8/5  (35)

(35)

An investor should buy a stock only if the prevailing market price exceeds the intrinsic value of the stock.

(True/False)

4.8/5  (42)

(42)

When the economic outlook for an industrial sector is strong, the outlook for many of the stocks of firms within that sector will also be strong.

(True/False)

4.8/5  (39)

(39)

The purpose of economic analysis is to gain an insight into the underlying health or vitality of the economy and to formulate expectations about future security prices.

(True/False)

4.7/5  (36)

(36)

An investment should offer an expected return commensurate with the risk involved.

(True/False)

4.9/5  (38)

(38)

A company may appear to be profitable on its income statement, but fail to generate strong cash flows.

(True/False)

4.8/5  (32)

(32)

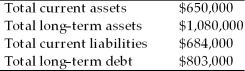

On September 30, the Simpson Company reported the following information on its financial statements.

What is the amount of the stockholder's equity in the Simpson Company?

What is the amount of the stockholder's equity in the Simpson Company?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is a readily available source of industry comparisons:

(Multiple Choice)

4.8/5  (36)

(36)

Substituting EBITDA for EBIT when computing the times interest earned ratio will make the company appear

(Multiple Choice)

4.8/5  (37)

(37)

EBITDA stands for earnings before inflation, taxes, depreciation, and adjustments.

(True/False)

4.9/5  (35)

(35)

Nadine Enterprises has total assets of $240,000, a debt-equity ratio of 0.60, and a return on assets of 9%.What is the return on equity?

(Multiple Choice)

4.8/5  (47)

(47)

If a firm has an equity multiplier of 3, this means that the firm has $3 in equity for every $1 in long-term debt.

(True/False)

4.8/5  (35)

(35)

List and explain the various stages of the growth cycle of an industry.Also discuss the merit of investing in the industry during each of the various stages.

(Essay)

4.8/5  (36)

(36)

Fundamental analysis can only be profitable if some securities are at least temporarily mispriced.

(True/False)

4.8/5  (38)

(38)

Return on equity can be expressed mathematically as "(net profit margin)(total asset turnover)(equity multiplier)."

(True/False)

4.9/5  (37)

(37)

Which of the following are considered in the company analysis phase of a fundamental analysis of a firm?

I.the composition and growth in sales

II.the capital structure of the firm

III.the outlook of the national economy

IV.the composition and liquidity of the company's assets

(Multiple Choice)

4.8/5  (33)

(33)

A company has sales of $640,000, net profit after taxes of $23,000, and a total asset turnover of 2.5.What is the return on assets?

(Multiple Choice)

5.0/5  (44)

(44)

Investors who conduct industry analyses typically favor companies with strong market positions over companies with less secure market positions because firms with strong market positions tend to

I.be price leaders.

II.benefit more from economies of scale.

III.have better R&D programs.

IV.have lower production costs.

(Multiple Choice)

4.8/5  (40)

(40)

Showing 21 - 40 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)