Exam 7: Analyzing Common Stocks

Exam 1: The Investment Environment76 Questions

Exam 2: Securities Markets and Transactions95 Questions

Exam 3: Investment Information and Securities Transactions114 Questions

Exam 4: Return and Risk108 Questions

Exam 5: Modern Portfolio Concepts96 Questions

Exam 6: Common Stocks116 Questions

Exam 7: Analyzing Common Stocks106 Questions

Exam 8: Stock Valuation102 Questions

Exam 9: Market Efficiency, Behavioral Finance, and Technical Analysis112 Questions

Exam 10: Fixed-Income Securities118 Questions

Exam 11: Bond Valuation112 Questions

Exam 12: Mutual Funds: Professionally Managed Portfolios113 Questions

Exam 13: Managing Your Own Portfolios109 Questions

Exam 14: Options: Puts and Calls115 Questions

Exam 15: Commodities and Financial Futures96 Questions

Select questions type

Quick Cement has a return on assets of 8%.If it has $1.5 million in total assets and a total asset turnover of 2, it follows that the firm must have a net profit margin of

(Multiple Choice)

4.8/5  (37)

(37)

The security analysis process should help investors to

I.purchase investments that are priced at or above their intrinsic value.

II.sell investments that are priced above their intrinsic value.

III.purchase investments that are priced below their intrinsic value.

IV.identify investments appropriate for their goals.

(Multiple Choice)

4.9/5  (41)

(41)

High dividend payout ratios are more of a concern to analysts than low payout ratios.

(True/False)

4.9/5  (41)

(41)

Which of the following may be signs of future problems for a company?

I.Inventories growing faster than sales.

II.Rapidly increasing debt to equity ratio.

III.Cash flow from operations is higher than net income.

IV.Current liabilities increasing faster than current assets.

(Multiple Choice)

4.9/5  (49)

(49)

Developing a general economic outlook assists in the identification of industries and firms that might be good investment opportunities.

(True/False)

4.9/5  (45)

(45)

Worcester Corporation has a P/E ratio of 15.Natick Corporation is in the same industry as Worcester, but has a P/E ratio of 20.Possible interpretations of this discrepancy include

(Multiple Choice)

4.9/5  (36)

(36)

Advocates of the efficient market hypothesis would argue that it is virtually impossible for any investor to consistently outperform the market.

(True/False)

4.8/5  (40)

(40)

To predict the demand for an industrial sector, it is essential to understand the economic forces that affect the industry.

(True/False)

4.8/5  (26)

(26)

To determine whether a pharmaceutical company's profitability ratios indicate strength or weakness, we should

I.compare them to others in the same industry.

II.compare them to companies in unrelated industries such as energy or banking.

III.compare them to previous years.

IV.compare them to absolute standards established by the CFA Institute.

(Multiple Choice)

4.9/5  (45)

(45)

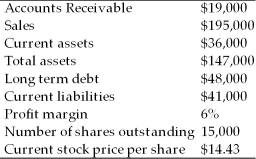

The following information is available for the Oil Creek Corporation.

(a)What is the current ratio?

(b)What is the net working capital?

(c)What is the net income?

(d)What is the return on equity?

(e)What is the total asset turnover?

(f)What is the debt-equity ratio?

(g)What is the accounts receivable turnover?

(h)What is the earnings per share (EPS)?

(i)What is the price to earnings (P/E)ratio?

(a)What is the current ratio?

(b)What is the net working capital?

(c)What is the net income?

(d)What is the return on equity?

(e)What is the total asset turnover?

(f)What is the debt-equity ratio?

(g)What is the accounts receivable turnover?

(h)What is the earnings per share (EPS)?

(i)What is the price to earnings (P/E)ratio?

(Essay)

4.8/5  (45)

(45)

A company has annual sales of $160 million, a net profit margin of 4%, and total assets of $90 million.It carries $10 million in accounts receivable, $25 million in inventory, has $55 million in total debt, and 5 million shares of common stock outstanding.Based on this information, the company's return on equity (ROE)is

(Multiple Choice)

4.8/5  (35)

(35)

Return on assets is a very important analytical tool because it measures how effectively management is using a firm's assets to generate profits.

(True/False)

4.8/5  (44)

(44)

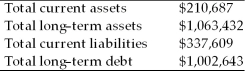

On March 31, Adolpha, Inc.reported the following information on its financial statements.

What is the available net working capital for Adolpha, Inc.?

What is the available net working capital for Adolpha, Inc.?

(Multiple Choice)

4.8/5  (37)

(37)

The debt to equity ratio should be approximately the same across all industrial sectors.

(True/False)

4.8/5  (25)

(25)

Historical comparisons will reveal whether a company's performance is improving or deteriorating.

(True/False)

4.9/5  (36)

(36)

Which of the following tend to increase security market prices?

I.An increase in industrial production

II.An increase in corporate profits

III.An increase in the federal deficit when the economy is strong

IV.An increase in interest rates

(Multiple Choice)

4.8/5  (36)

(36)

Which stage of an industry's growth cycle offers the greatest opportunity for an investor who is seeking capital gains?

(Multiple Choice)

4.7/5  (37)

(37)

ROE = (net profit margin)(total asset turnover)(equity multiplier).What is the advantage of using this expanded version of the ROE formula versus using the simplified version which is net income divided by total equity?

(Essay)

4.8/5  (36)

(36)

Which of the following accounting practices are potentially misleading or even fraudulent?

I.capitalization of operating expenses

II.accrual rather than cash basis reporting

III.off-balance sheet liabilities

IV.recognizing revenues prematurely

(Multiple Choice)

4.7/5  (33)

(33)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)