Exam 3: Time Value of Money: an Introduction

Exam 1: Corporate Finance and the Financial Manager86 Questions

Exam 2: Introduction to Financial Statement Analysis108 Questions

Exam 3: Time Value of Money: an Introduction112 Questions

Exam 4: Time Value of Money: Valuing Cash Flow Streams67 Questions

Exam 5: Interest Rates110 Questions

Exam 6: Bonds107 Questions

Exam 7: Stock Valuation64 Questions

Exam 8: Investment Decision Rules122 Questions

Exam 9: Fundamentals of Capital Budgeting113 Questions

Exam 10: Stock Valuation: a Second Look48 Questions

Exam 11: Risk and Return in Capital Markets110 Questions

Exam 12: Systematic Risk and the Equity Risk Premium104 Questions

Exam 13: The Cost of Capital110 Questions

Exam 14: Raising Equity Capital107 Questions

Exam 15: Debt Financing101 Questions

Exam 16: Capital Structure109 Questions

Exam 17: Payout Policy110 Questions

Exam 18: Financial Modeling and Pro Forma Analysis95 Questions

Exam 19: Working Capital Management108 Questions

Exam 20: Short-Term Financial Planning110 Questions

Exam 21: Option Applications and Corporate Finance102 Questions

Exam 22: Mergers and Acquisitions47 Questions

Exam 23: International Corporate Finance108 Questions

Exam 24: Leasing46 Questions

Exam 25: Insurance and Risk Management38 Questions

Exam 26: Corporate Governance45 Questions

Select questions type

A backhoe can dig 180 feet of trench per hour and costs $720 per hour to hire and operate. A ditch digger can dig 6 feet of trench per hour. Based on this information, what is the most a ditch digger can charge for per hour when digging ditches?

(Multiple Choice)

4.8/5  (40)

(40)

A metal fabrication company is pricing raw supplies of aluminum. The following are the costs to the company to receive one ton of aluminum from various sources. Which source offers the best price for aluminum per ton?

(Multiple Choice)

4.8/5  (42)

(42)

Dollar amounts received at different points in time cannot be compared in absolute terms.

(True/False)

4.9/5  (47)

(47)

Whenever a good trades in a competitive market, the price determines the value of the good.

(True/False)

4.8/5  (27)

(27)

Heavy Duty Company, a manufacturer of power tools, decides to offer a rebate of $130 on its 16-inch mid-range chain saw, which currently has a retail price $490. Heavy Duty's marketers estimate that, as a result of the rebate, sales of this model will increase from 60,000 to 80,000 units next year. The profit margin for Heavy Duty before the rebate is $180. Based on the given information, is the decision to give the rebate a wise one?

(Multiple Choice)

4.9/5  (39)

(39)

You are scheduled to receive $10,000 in one year. What will be the effect of an increase in the interest rate on the present value of this cash flow?

(Multiple Choice)

4.7/5  (38)

(38)

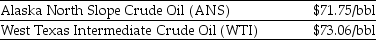

Use the information for the question(s)below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS)crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI)crude. Another oil refiner is offering to trade you 10,100 bbl of Alaska North Slope (ANS)crude oil for 9,950 bbl of West Texas Intermediate (WTI)crude oil. Assuming you just purchased 9,950 bbl of WTI crude at the current market price, the total revenue (cost)to you if you take the trade is closest to ________.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS)crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI)crude. Another oil refiner is offering to trade you 10,100 bbl of Alaska North Slope (ANS)crude oil for 9,950 bbl of West Texas Intermediate (WTI)crude oil. Assuming you just purchased 9,950 bbl of WTI crude at the current market price, the total revenue (cost)to you if you take the trade is closest to ________.

(Multiple Choice)

4.8/5  (31)

(31)

The rule of 72 tells you approximately how long it takes for money invested at a given rate of compound interest to double in value.

(True/False)

4.8/5  (35)

(35)

A firm that provides tax services to the public intends to offer a premium tax-return service at a higher price than their current services. The managers of the company ask experts in marketing to determine how much an effective ad campaign for such a service would cost, and by how much sales would increase. They consult experts in economics to calculate the increases in revenue from the success of the campaign, experts in operations to determine the cost of offering the service, and experts in strategy to anticipate possible counter-moves by competitors. Which of the following points about the role of financial managers does this example illustrate?

(Multiple Choice)

4.7/5  (39)

(39)

A company intends to install new management software for its warehouse. The software will cost $47,000 to buy and will cost an additional $148,000 to install and implement. It is anticipated that it will save the company $44,000 through reductions in staff and $69,000 in general inventory costs in the first year after installation. What is the total benefit to the company in the first year if they choose to install the software?

(Multiple Choice)

4.8/5  (36)

(36)

Explain the role played by some of the other management disciplines in financial decision making.

(Essay)

4.9/5  (38)

(38)

If an arbitrage opportunity exists, an investor can act quickly in the hope of making a risk-free profit.

(True/False)

4.8/5  (31)

(31)

"If equivalent investment opportunities trade simultaneously in different competitive markets, then they must trade for the same price in both markets." What do we call the above statement?

(Multiple Choice)

4.8/5  (35)

(35)

A dollar today and a dollar in one year may be considered to be equivalent.

(True/False)

4.8/5  (39)

(39)

On Commodity Exchange A, it is possible to buy and sell crude oil at $116 per barrel, while on Commodity Exchange B crude oil can be bought and sold at $117 per barrel. If there are transaction costs of 1% when buying or selling on either exchange, what is the net effect of buying a barrel of oil on Exchange A and selling it on Exchange B?

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following best explains why you cannot use the price of rolled oats at a local supermarket as the competitive market value of rolled oats?

(Multiple Choice)

4.8/5  (37)

(37)

What is the present value (PV)of $100,000 received six years from now, assuming the interest rate is 8% per year?

(Multiple Choice)

4.9/5  (39)

(39)

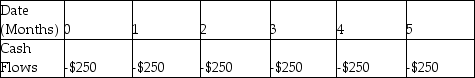

Which of the following situations is best described by the timeline shown below?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following best explains why market prices are useful to a financial manager when performing a cost-benefit analysis?

(Multiple Choice)

4.8/5  (40)

(40)

An elderly relative offers to sell you their used 1958 Cadillac Eldorado for $52,000. You note that very similar cars are selling on the open market for $87,000. You don't care for classic cars and would rather buy a new Ford Explorer for $35,000. What is the net value of buying the Cadillac?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 81 - 100 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)