Exam 7: Accounting for Foreign Currency

Exam 1: Accounting for Investments56 Questions

Exam 2: Business Combinations55 Questions

Exam 3: Consolidation: Wholly Owned Subsidiaries56 Questions

Exam 4: Consolidations: Intragroup Transactions66 Questions

Exam 5: Consolidation: Non-Controlling Interest61 Questions

Exam 6: Accounting for Investments in Associates and Joint Ventures58 Questions

Exam 7: Accounting for Foreign Currency57 Questions

Exam 8: Accounting for Foreign Investments56 Questions

Exam 9: Reporting for Not-For-Profit Organizations57 Questions

Exam 10: Reporting for Public Sector Entities58 Questions

Select questions type

On March 1, 2013, Chacin Ltd. issued a purchase order to No Worries (New Zealand)Inc. to acquire equipment for $400,000 New Zealand dollars. On the same day, Chacin entered into a forward contract to receive $400,000 New Zealand dollars on July 31, 2013. The equipment was delivered on June 1, 2013 and payment was made July 31, 2013. Chacin has an April 30 year-end. The following information has been provided: Date Spot Rate March 1,2013 .7686 .7810 Apri1 30,2013 .7702 .7818 June 1,2013 .7940 .7985 July 31,2013 .7995 n/a Assume that the transaction qualifies as a hedge. What is the cost of the hedge?

(Multiple Choice)

4.8/5  (34)

(34)

What are the steps involved in the translation of the financial statements into a presentation currency?

(Essay)

4.8/5  (37)

(37)

Under IFRS, which of the following statements is false regarding hedging?

(Multiple Choice)

4.9/5  (41)

(41)

A transaction gain or loss at the settlement date is a change in the exchange rate quoted by a foreign exchange trader.

(True/False)

4.7/5  (41)

(41)

Functional currency is the currency in which the company conducts its primary business activity.

(True/False)

4.8/5  (38)

(38)

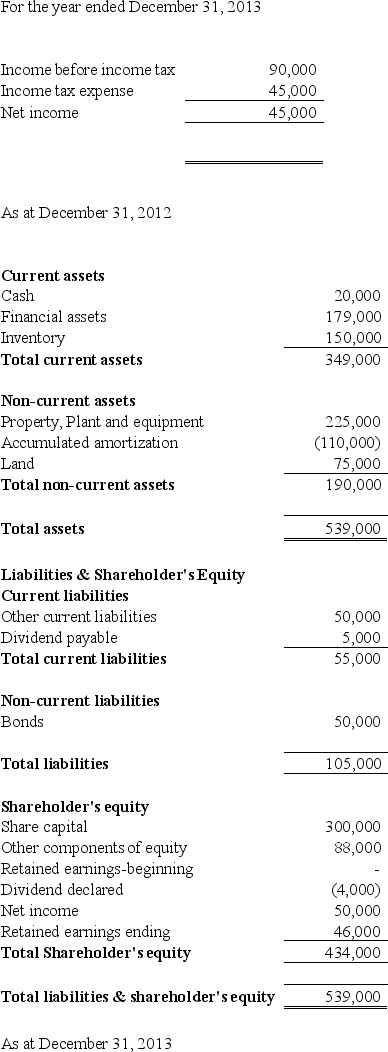

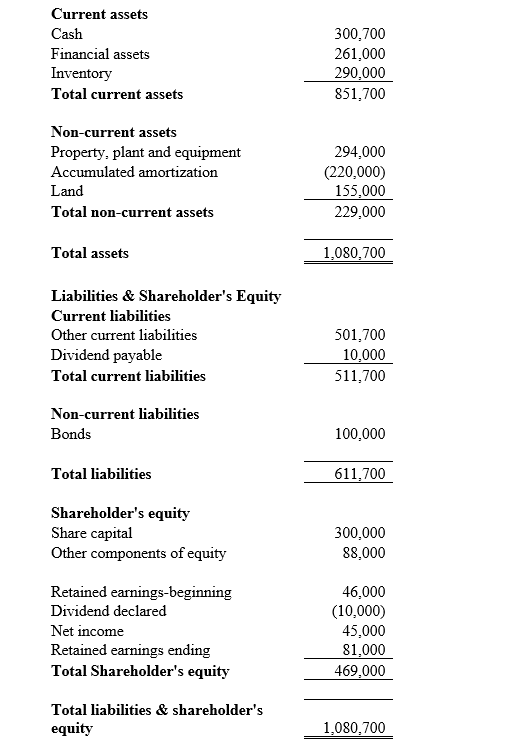

Mori Inc. is a company located in Canada and it uses the Canadian dollar as its functional currency. Mori Inc. began operations on January 1, 2012. Its shareholders are European. They would like the financial statements to be presented in Euros. The following is an excerpt from Mori Inc.'s financial statements for the 2012 and 2013 years. The changes in Other Comprehensive Income occurred evenly throughout the years. Dividends were declared at year-end.

For the year ended December 31, 2012 Income before income tax 100,000 Income tax expense 50,000 Net income 50,000

The following exchange rates exist for the Euro relative to the Canadian dollar:

January 1, 2012 $1 Canadian = $1.40 Euro

December 31, 2012 $1 Canadian = $1.45 Euro

Average 2012 = $1 Canadian = $1.47 Euro

December 31, 2013 = $1 Canadian = $1.50 Euro

Average 2013 = $1 Canadian = $1.52 Euro

Required:

Translate the Mori Inc. financial statements as at December 31, 2013 from its functional currency to its presentation currency.

The following exchange rates exist for the Euro relative to the Canadian dollar:

January 1, 2012 $1 Canadian = $1.40 Euro

December 31, 2012 $1 Canadian = $1.45 Euro

Average 2012 = $1 Canadian = $1.47 Euro

December 31, 2013 = $1 Canadian = $1.50 Euro

Average 2013 = $1 Canadian = $1.52 Euro

Required:

Translate the Mori Inc. financial statements as at December 31, 2013 from its functional currency to its presentation currency.

(Essay)

4.9/5  (32)

(32)

Where is the ineffective portion of a cash-flow hedge recognized on the financial statements?

(Multiple Choice)

4.8/5  (38)

(38)

On June 1, 2013, Vandelay Co. entered into a 90-day forward contract to sell $1,000,000 Singapore dollars (USD)to its bank on August 29, 2013. The following information has been provided:

June 1, 90-day forward rate USD$1 = $0.9750

June 30, 60-day forward rate USD$1 = $0.9630

August 29, spot rate USD$1 = $0.948

Vandelay has a June 30 year-end. What is the exchange gain (loss)at June 30, 2013?

(Multiple Choice)

4.9/5  (41)

(41)

Companies sometimes purchase derivative financial instruments to speculate on future foreign currency movements or to protect themselves from future fluctuations in currency rates.

(True/False)

5.0/5  (26)

(26)

What exchange rate is usually used to report non-monetary assets on the statement of financial position?

(Multiple Choice)

4.8/5  (41)

(41)

On June 1, 2013, Donlands Canada Co. entered into a 90-day forward contract to sell $500,000 Singapore dollars (SGD)to its bank on August 29, 2013. The following information has been provided:

June 1, 90-day forward rate SGD$1 = $0.7750

July 1, 60-day forward rate SGD$1 = $0.7630

August 29, spot rate SGD$1 = $0.748

Donlands has a June 30 year-end. What is the exchange gain (loss)at June 30, 2013?

(Multiple Choice)

4.9/5  (39)

(39)

When a company selects a presentation currency for its financial statements that is different than its functional currency, the statements must be translated into the ____________ currency.

(Multiple Choice)

4.9/5  (40)

(40)

Exchange gains and losses on accounts receivable/payable that are denominated in a foreign currency are _______.

(Multiple Choice)

4.8/5  (32)

(32)

Dante Ltd. manufactures and distributes transmissions to various companies in Europe. On April 2, 2013, Dante entered into a sales contract with a company in Germany to sell 1,000 transmissions. The contract price is €2,000 per transmission. Five hundred transmissions are to be delivered on June 30, 2013 and the remaining half is to be delivered on December 20, 2013. Payment is due in two instalments with half due on August 31, 2013 and the remaining half due January 30, 2014. However, the customer has the right to cancel the contract with 30 days' notice.

On April 2, 2013 Dante entered into a forward contract to hedge against the Euro exchange rate for €1 million coming due on January 31, 2014. Dante has a December 31 year end.

Delivery of the transmissions occurred on the dates specified and the company collected the receivables due and settled the forward contract January 30, 2014.

The exchange rates were as followed:

Forward rate to January 30, Canadian equivalent of euro Spot rate 2014 Apri1 2,2013 1.50 1.54 June 30,2013 1.51 1.57 August 31, 2013 1.53 1.58 December 20,2013 1.55 1.56 December 31,2013 1.54 1.55 January 30, 2014 1.56 settled Required:

Assume that the forward contract is designated as a cash flow hedge since the sale is highly probable. Prepare the journal entries to record the sales and the hedge. Dante reports under IFRS.

(Essay)

4.9/5  (43)

(43)

The historical rate is the exchange rate at the beginning of the reporting period and the closing rate is the exchange rate at the end of the reporting period.

(True/False)

4.9/5  (41)

(41)

In order to identify the foreign exchange component of a transaction, a company must establish the currency in which its books and records should be maintained. This is the ___________________________

(Multiple Choice)

4.8/5  (40)

(40)

Upon translation, assets and liabilities are translated at the _________ rate at the presentation date and income statement items are translated using the _______ rate for the period.

(Multiple Choice)

4.9/5  (33)

(33)

When a company selects a presentation currency for its financial statements that is different than its functional currency, the statements must be translated into the functional currency.

(True/False)

4.8/5  (36)

(36)

What is the effect of fluctuations in exchange rates on accounts payable?

(Multiple Choice)

4.9/5  (42)

(42)

Showing 21 - 40 of 57

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)