Exam 5: Consolidation: Non-Controlling Interest

Exam 1: Accounting for Investments56 Questions

Exam 2: Business Combinations55 Questions

Exam 3: Consolidation: Wholly Owned Subsidiaries56 Questions

Exam 4: Consolidations: Intragroup Transactions66 Questions

Exam 5: Consolidation: Non-Controlling Interest61 Questions

Exam 6: Accounting for Investments in Associates and Joint Ventures58 Questions

Exam 7: Accounting for Foreign Currency57 Questions

Exam 8: Accounting for Foreign Investments56 Questions

Exam 9: Reporting for Not-For-Profit Organizations57 Questions

Exam 10: Reporting for Public Sector Entities58 Questions

Select questions type

Resnick Inc. acquired 75% shareholding in Canty Ltd. for $20 million. Book value of net identifiable assets of Canty is $14 million. The fair value of Canty's asset is the same as their book value except accounts receivables which are impaired by $1 million. Book value of assets is $54 million while book value of liabilities is $40 million. The tax rate is 30%.

Required:

Calculate goodwill using the partial goodwill method.

(Essay)

4.7/5  (37)

(37)

When a parent increases its ownership interest, the difference between the amount that was paid by the parent and the amount that was transferred from the non-controlling interest is allocated to equity.

(True/False)

4.9/5  (33)

(33)

What are the characteristics for a transaction to require an adjustment to the calculation of the NCI share of equity?

(Essay)

4.8/5  (32)

(32)

Tamer Limited is a subsidiary of Wallen Limited. When Wallen acquired its 60% interest, the retained earnings of Tamer Limited were $20 000. At the beginning of the current period, Tamer Limited's retained earnings had increased to $50,000. Tamer earned net income of $10 000 during the current period. The share of the non-controlling interest in the equity of Tamer Limited at the reporting date is:

(Multiple Choice)

4.7/5  (31)

(31)

A parent's consolidated net income which includes it's fully and partially owned subsidiaries is best described as:

(Multiple Choice)

4.9/5  (41)

(41)

Manuel Ltd. purchases 65% of Faiz Co. Under the entity method of consolidation, what is allocated to non-controlling interest?

(Multiple Choice)

5.0/5  (38)

(38)

Ownership interests in a subsidiary entity that do not belong to the parent entity are known as:

(Multiple Choice)

4.9/5  (33)

(33)

On January 1, 2011 Glass Inc. acquired 80% of the share capital of Crystal Ltd. For $400,000. At this date, the equity of Crystal consisted of:

Share capital: $200,000

Retained earnings: $75,000

At January 1, 2011 all of Crystal's identifiable assets and liabilities were recorded at fair value except for the following:

Equipment (cost ) Carrying amount: Fair value:

Land Carrying amount: Fair V alue: The equipment had a further useful life of 5 years. The land is still on hand. Glass uses the partial goodwill method.

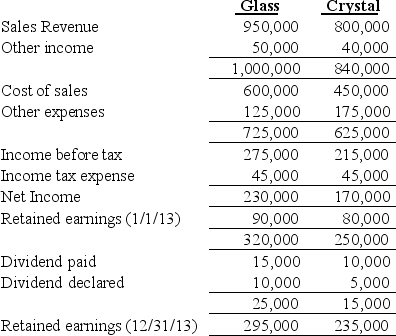

Financial information for the two companies at December 31, 2013 is as follows:

Additional information:

1. During 2012, Crystal sold some inventory to Glass for $10,000. This inventory had originally cost Crystal $4,000. At December 31, 2012, 20% of these remained unsold by Glass.

2. The ending inventory of 2013, of Glass, included inventory sold to it by Crystal at a profit of $4,000 before tax. This had cost Crystal $15,000.

3. The tax rate is 30%.

4. Glass's share capital has always been $100,000.

5. On January 1, 2014, Glass sold 10% of its ownership in Crystal so that it now owns 70%. They received $30,000 for the shares.

Required:

(a)Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b)Calculate the effect on consolidated equity in 2014 from the sale of the shares.

Additional information:

1. During 2012, Crystal sold some inventory to Glass for $10,000. This inventory had originally cost Crystal $4,000. At December 31, 2012, 20% of these remained unsold by Glass.

2. The ending inventory of 2013, of Glass, included inventory sold to it by Crystal at a profit of $4,000 before tax. This had cost Crystal $15,000.

3. The tax rate is 30%.

4. Glass's share capital has always been $100,000.

5. On January 1, 2014, Glass sold 10% of its ownership in Crystal so that it now owns 70%. They received $30,000 for the shares.

Required:

(a)Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b)Calculate the effect on consolidated equity in 2014 from the sale of the shares.

(Essay)

4.8/5  (28)

(28)

Kafka Ltd. purchased 80% of Littman Ltd. for $700,000. At the time of acquisition, the carrying value of Littman's net identifiable assets was $1,000,000 and the fair value was $1,350,000. The companies pay tax at the rate of 30%. What is the amount of the goodwill under the partial goodwill method?

(Multiple Choice)

4.9/5  (36)

(36)

Where does the non-controlling interest (NCI)appear on the statement of financial position?

(Multiple Choice)

4.9/5  (37)

(37)

The calculation of the NCI is necessary both for the Statement of Changes in Equity and for the Statement of Financial Position.

(True/False)

4.9/5  (38)

(38)

Which of the following statements regarding the partial goodwill method is FALSE?

(Multiple Choice)

4.9/5  (37)

(37)

When preparing consolidated financial statements, any profit or loss that arises in relation to the intragroup transfer of services is regarded as:

(Multiple Choice)

4.8/5  (42)

(42)

Ownership interests in a subsidiary entity that do not belong to the parent entity are known as un-owned interests.

(True/False)

4.8/5  (43)

(43)

Chase Ltd. purchased 60% of Latham Ltd. for $1,500,000. At the date of acquisition, the carrying value of Latham's net identifiable assets was $1,800,000 and the fair value was $2,200,000 after accounting for the tax effect. The fair value of the NCI at that date is $1,000,000. What is the amount of the goodwill under the full goodwill method?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following statements relating to a gain on bargain purchase is FALSE?

(Multiple Choice)

4.7/5  (37)

(37)

If a gain on bargain purchase arises on a business combination, the non-controlling interest is allocated 100% of the gain.

(True/False)

4.8/5  (35)

(35)

Under the entity concept of consolidation, the group consists of the combined assets and liabilities of the parent and the subsidiary.

(True/False)

4.8/5  (32)

(32)

Kiara Ltd. acquired 90% of Udder Ltd. for $200,000 less than the fair value. How should this $200,000 be treated on Kiara's consolidated financial statements?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 61

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)