Exam 6: Internal Control and Accounting for Cash

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Understanding the Accounting Cycle149 Questions

Exam 3: The Double-Entry Accounting System157 Questions

Exam 4: Accounting for Merchandising Businesses153 Questions

Exam 5: Accounting for Inventories134 Questions

Exam 6: Internal Control and Accounting for Cash141 Questions

Exam 7: Accounting for Receivables144 Questions

Exam 8: Accounting for Long-Term Operational Assets157 Questions

Exam 9: Accounting for Current Liabilities and Payroll122 Questions

Exam 10: Accounting for Long-Term Debt157 Questions

Exam 11: Proprietorships,partnerships,and Corporations154 Questions

Exam 12: Statement of Cash Flows129 Questions

Exam 13: Financial Statement Analysis129 Questions

Select questions type

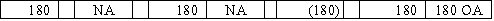

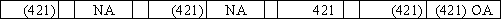

While performing its monthly bank reconciliation,the bookkeeper for the Mosaic Company discovered that a check written for $421 for advertising expense was recorded in the firm's books as $241.Which of the following shows the effect of the correcting entry on the financial statements?

(Short Answer)

4.8/5  (38)

(38)

How will a certified check be treated in a company's bank reconciliation?

(Multiple Choice)

5.0/5  (37)

(37)

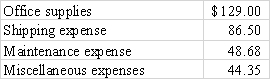

Fern's Flowers established a $400 petty cash fund.The following expenditures were made from the fund:

A count of the cash in the fund revealed a balance of $89.00.

Required: a)Show the effect of establishing the fund on the accounting equation.

b)For what amount must the check be written to replenish the fund?

c)Prepare the journal entry to record the recognition of expenditures paid from the fund and replenishment of the fund.

(Essay)

4.7/5  (35)

(35)

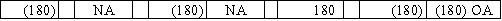

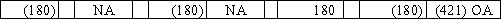

Blake Company established a petty cash fund in the amount of $400.At the end of the accounting period,the petty cash box contained receipts for expenditures amounting to $180 and $215 in cash.What effect will the entries to replenish the fund have on assets and expenses?

(Short Answer)

4.8/5  (34)

(34)

Use the following to answer questions

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-Assuming that the unadjusted bank balance was $500,determine the unadjusted book balance.

(Multiple Choice)

4.9/5  (34)

(34)

The most favorable audit opinion that a company can receive is a(n):

(Multiple Choice)

4.9/5  (40)

(40)

In a company's bank reconciliation,an outstanding check is a check that:

(Multiple Choice)

4.8/5  (37)

(37)

Use the following to answer questions

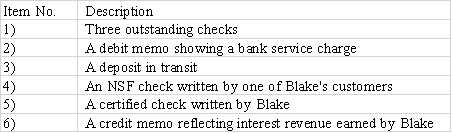

A review of the bank statement and accounting records of the Blake Company revealed the following items:

-Which of the item(s)would be subtracted from the company's unadjusted book balance to determine the true cash balance?

-Which of the item(s)would be subtracted from the company's unadjusted book balance to determine the true cash balance?

(Multiple Choice)

4.9/5  (36)

(36)

Preparing a bank reconciliation is a requirement to obtain an unqualified audit opinion,but is not an important internal control for a business.

(True/False)

4.7/5  (36)

(36)

The purpose of a petty cash fund is to eliminate the need for control over a business's small cash disbursements.

(True/False)

4.8/5  (36)

(36)

An error is considered material if it would trigger an IRS audit.

(True/False)

4.8/5  (37)

(37)

The primary focus of financial statement audits is the discovery of fraud.

(True/False)

4.8/5  (40)

(40)

List three measures that a business can use to achieve strong internal controls.

Any three of the following:

(Essay)

4.9/5  (32)

(32)

In preparing a bank reconciliation,typical adjustments to the bank balance are deposits in transit and outstanding checks.

(True/False)

4.8/5  (34)

(34)

All adjustments to the unadjusted cash balance on a bank reconciliation require journal entries,but no adjustments to the bank statement balance require journal entries.

(True/False)

4.8/5  (32)

(32)

Indicate whether each of the following statements regarding internal controls is true or false.

_____ a)The Sarbanes-Oxley Act of 2002 requires public companies to evaluate their internal controls and report those findings with SEC filings.

_____ b)The Sarbanes-Oxley Act applies to all companies,while the Enterprise Risk Management (ERM)framework is used by public companies only.

_____ c)Enterprise Risk Management (ERM)is an expansion of the earlier framework of the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

_____ d)The COSO framework includes five interrelated components: separation of duties,quality employees,prenumbered documents,physical controls,and performance evaluations.

_____ e)Congress passed the Sarbanes-Oxley Act in 2002 in response to high profile fraud cases such as Enron and WorldCom.

(Short Answer)

4.8/5  (43)

(43)

Use the following to answer questions

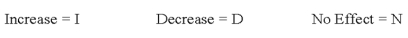

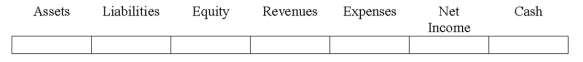

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

-During the process of preparing the bank reconciliation,an employee for Heath Company discovered that the bank deducted a check from the Hearst Company (a different company).

-During the process of preparing the bank reconciliation,an employee for Heath Company discovered that the bank deducted a check from the Hearst Company (a different company).

(Essay)

4.8/5  (41)

(41)

If the financial statements cannot be relied upon because they contain one or more material departures from GAAP,the auditor will issue the following type of audit opinion:

(Multiple Choice)

4.9/5  (30)

(30)

Showing 41 - 60 of 141

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)