Exam 23: Flexible Budgets and Standard Costs

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows157 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Management Accounting161 Questions

Exam 17: Job Order and Process Costing168 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools160 Questions

Exam 19: Cost-Volume-Profit Analysis163 Questions

Exam 20: Short-Term Business Decisions164 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money152 Questions

Exam 22: The Master Budget and Responsibility Accounting155 Questions

Exam 23: Flexible Budgets and Standard Costs165 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

The sales volume variance is the difference between the static budget and the flexible budget amounts, and is caused by actual sales volume being different than budgeted sales volume.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

True

Price Variance = (Actual Price x Actual Quantity) - (Standard Price x Standard Quantity).

Free

(True/False)

4.7/5  (35)

(35)

Correct Answer:

False

An unfavorable sales volume variance in operating income suggests a(n):

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

A favorable flexible budget variance in sales revenues suggests a(n):

(Multiple Choice)

4.7/5  (35)

(35)

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:

Materials: 1.5 pounds per unit; \ 4.00 per pound Labor: 2.0 hours per unit; \ 18.00 per hour

-

During the first quarter, Faas produced 5,000 units of this product. Actual direct materials costs were $29,750. Actual direct labor costs were $184,800.

For purposes of preparing the flexible budget, what is the total standard direct labor cost at a production volume of 5,000 units?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is one of the reasons why companies use standard costs?

(Multiple Choice)

4.9/5  (36)

(36)

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:

Materials: 1.5 pounds per unit; \ 4.00 per pound Labor: 2.0 hours per unit; \ 18.00 per hour

-

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the labor cost records showed that the company used 11,000 direct labor hours and actual total direct labor costs were $184,800.

How much is the direct labor efficiency variance?

(Multiple Choice)

4.8/5  (31)

(31)

The sales volume variance arises because the number of units actually sold differs from the number of units expected to be sold according to the static budget.

(True/False)

4.9/5  (31)

(31)

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:

Materials: 1.5 pounds per unit; \ 4.00 per pound Labor: 2.0 hours per unit; \ 18.00 per hour

-

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the labor cost records showed that the company used 11,000 hours of direct labor and actual direct labor costs were $184,800. The direct labor efficiency variance was $18,000 U. Which of the following would be a logical explanation for this variance?

(Multiple Choice)

4.8/5  (32)

(32)

Raymie Food Products is famous for their specialty fruit cake. The main ingredient of the cake is dried fruit, which Raymie purchases by the pound. In addition, the production requires a certain amount of direct labor. Raymie uses a standard cost system, and at the end of the first quarter, there was an unfavorable materials efficiency variance. Which of the following would be a logical explanation for that variance?

(Multiple Choice)

4.8/5  (36)

(36)

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:

Materials: 1.5 pounds per unit; \ 4.00 per pound Labor: 2.0 hours per unit; \ 18.00 per hour

-

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750.

How much is the direct materials efficiency variance?

(Multiple Choice)

4.8/5  (36)

(36)

Which one of the following is NOT a reason for using standard costs?

(Multiple Choice)

4.9/5  (30)

(30)

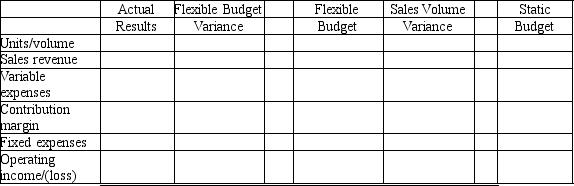

Onyx Company prepared a static budget at the beginning of the month. At the end of the month, the company is analyzing actual results versus budget using flexible budget methodology. Data are as follows:

Static budget: Sales volume: 1,000 units Price: $70 per unit

Variable expense: $32 per unit Fixed expenses: $37,500 per month

Operating income: $500

Actual results: Sales volume: 990 units Price: $74 per unit

Variable expense: $35 per unit Fixed expenses: $33,000 per month

Operating income: $5,610

Using the format below, please prepare an income statement performance report:

(Essay)

4.7/5  (34)

(34)

When a manufacturing company uses standard costing methodology in their journal entries and accounts, the Work in process account records all transactions at standard cost amounts.

(True/False)

4.9/5  (37)

(37)

The production manager of a company was experiencing high defect rate on the assembly line, which was slowing production and causing wastage of valuable materials. He decided to purchase a higher grade of material which would be more reliable, but he was worried that the cost of the new material might negatively impact operating income. This situation could have produced which of the following variances?

(Multiple Choice)

4.7/5  (38)

(38)

When a company is using standard costs, only unfavorable variances need to be explained or investigated.

(True/False)

4.8/5  (24)

(24)

When analyzing overhead costs, which of the following is a key point to investigate?

(Multiple Choice)

4.9/5  (35)

(35)

A company was experiencing slow production rates, and lower production volumes than demanded by management, so a new factory manager was hired. Upon investigation, she found that the workers were poorly motivated and not closely supervised. Midway through the quarter, she started an incentive program and paid out cash bonuses when workers hit their production targets. Within a short time, production output increased, but the bonuses had to be charged to the direct labor budget, and she was worried about the impact of these costs on operating income. This situation could have produced which of the following variances?

(Multiple Choice)

4.9/5  (37)

(37)

The production manager of a company was experiencing high defect rate on the assembly line, which was slowing production and causing wastage of valuable materials. He decided to purchase a higher grade of material which would be more reliable, but he was worried that the cost of the new material might negatively impact operating income. This situation could have produced which of the following variances?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 1 - 20 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)