Exam 5: Time Value of Money

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

How long would it take for you to save an adequate amount for retirement if you deposit $40,000 per year into an account beginning today that pays 12 percent per year if you wish to have a total of $1,000,000 at retirement?

(Multiple Choice)

4.7/5  (35)

(35)

The effective rate of interest differs from the nominal rate of interest in that it reflects the impact of compounding frequency.

(True/False)

4.8/5  (25)

(25)

China Manufacturing Agents, Inc. is preparing a five-year plan. Today, sales are $1,000,000. If the growth rate in sales is projected to be 10 percent over the next five years, what will the dollar amount of sales be in year five?

(Essay)

4.9/5  (37)

(37)

The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity for interest rates greater than zero.

(True/False)

4.7/5  (37)

(37)

The rate of return earned on an investment of $50,000 today that guarantees an annuity of $10,489 for six years is approximately

(Multiple Choice)

4.8/5  (43)

(43)

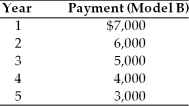

You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well. However, the method of paying for the two models is different. Model A requires $5,000 per year payment for the next five years. Model B requires the following payment schedule. Which model should you buy if your opportunity cost is 8 percent?

(Essay)

4.8/5  (29)

(29)

Alexis owns stock in a company which has consistently paid a growing dividend over the last 10 years. The first year Alexis owned the stock, she received $4.50 per share and in the 10th year, she received $4.92 per share. What is the growth rate of the dividends over the last 10 years?

(Multiple Choice)

4.7/5  (39)

(39)

A firm wishes to establish a fund which, in 10 years, will accumulate to $10,000,000. The fund will be used to repay an outstanding bond issue. The firm plans to make deposits, which will earn 12 percent, to this fund at the end of each of the 10 years prior to maturity of the bond. How large must these deposits be to accumulate to $10,000,000?

(Essay)

4.8/5  (37)

(37)

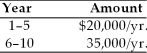

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 14 percent.

(Multiple Choice)

4.8/5  (42)

(42)

The present value of an ordinary annuity of $350 each year for five years, assuming an opportunity cost of 4 percent, is

(Multiple Choice)

5.0/5  (33)

(33)

In their meeting with their advisor, Mr. and Mrs. O'Rourke concluded that they would need $40,000 per year during their retirement years in order to live comfortably. They will retire 10 years from now and expect a 20-year retirement period. How much should Mr. and Mrs. O'Rourke deposit now in a bank account paying 9 percent to reach financial happiness during retirement?

(Essay)

4.7/5  (28)

(28)

To expand its operation, International Tools Inc. has applied to the International Bank for a 3-year, $3,500,000 loan. Prepare a loan amortization table assuming 10 percent rate of interest.

(Essay)

4.8/5  (38)

(38)

Aunt Tillie has deposited $33,000 today in an account which will earn 10 percent annually. She plans to leave the funds in this account for seven years earning interest. If the goal of this deposit is to cover a future obligation of $65,000, what recommendation would you make to Aunt Tillie?

(Essay)

4.8/5  (41)

(41)

Jia has just won a $20 million lottery, which will pay her $1 million at the end of each year for 20 years. An investor has offered her $10 million for this annuity. She estimates that she can earn 10 percent interest, compounded annually, on any amounts she invests. She asks your advice on whether to accept or reject the offer. What will you tell her? (Ignore Taxes)

(Essay)

4.8/5  (33)

(33)

The future value of a $10,000 annuity due deposited at 12 percent compounded annually for each of the next 5 years is

(Multiple Choice)

4.8/5  (35)

(35)

Congratulations! You have just won the lottery! However, the lottery bureau has just informed you that you can take your winnings in one of two ways. Choice X pays $1,000,000. Choice Y pays $1,750,000 at the end of five years from now. Using a discount rate of 5 percent, based on present values, which would you choose? Using the same discount rate of 5 percent, based on future values, which would you choose? What do your results suggest as a general rule for approaching such problems? (Make your choices based purely on the time value of money.)

(Essay)

4.8/5  (31)

(31)

Future value increases with increases in the interest rate or the period of time funds are left on deposit.

(True/False)

4.7/5  (41)

(41)

Calculate the present value of an annuity of $3,900 each year for four years, assuming an opportunity cost of 10 percent.

(Essay)

4.7/5  (39)

(39)

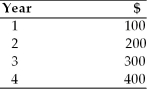

During her four years at college, Hayley received the following amounts of money at the end of each year from her grandmother. She deposited her money in a saving account paying 6 percent rate of interest. How much money will Hayley have on graduation day?

(Essay)

4.8/5  (31)

(31)

Showing 21 - 40 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)