Exam 19: International Managerial Finance

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

The center of the Euro-equity market, which deals in international equity issues is

(Multiple Choice)

4.8/5  (37)

(37)

Countries that experience high inflation rates will see their currencies decline in value relative to the currencies of countries with lower inflation rates.

(True/False)

4.8/5  (34)

(34)

All of the following are positive approaches of coping with political risk EXCEPT

(Multiple Choice)

4.7/5  (38)

(38)

Offshore Centers are cities or states that have achieved prominence as major centers for Euromarket business.

(True/False)

4.8/5  (34)

(34)

A short-term financial decision based on an MNC management's expectation that the local foreign currency will appreciate may be

(Multiple Choice)

4.9/5  (35)

(35)

All of the following are considered to be major or "hard" currencies EXCEPT

(Multiple Choice)

4.7/5  (30)

(30)

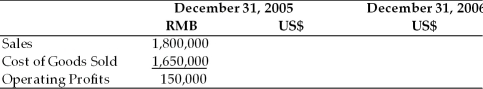

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2005, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2006. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2005 and December 31, 2006, the Chinese government revalues (appreciates) the RMB by 20 percent.

Translation of Income Statement  Translation of Balance Sheet

Translation of Balance Sheet

(Essay)

4.8/5  (42)

(42)

In the international context, the ________ interest rate involves only the MNC parent's currency, while the ________ interest rate includes any forecast appreciation or depreciation of a foreign currency relative to that of the MNC parent.

(Multiple Choice)

4.8/5  (38)

(38)

The risk resulting from the effects of changes in foreign exchange rates on the translated value of a firm's accounts denominated in a given foreign currency is

(Multiple Choice)

4.9/5  (34)

(34)

In the most emerging/developing countries (including China) over the past 30 years, foreign direct investment (FDI) came overwhelmingly in the form or mergers and acquisitions rather than through establishments.

(True/False)

4.9/5  (35)

(35)

A partnership under which the participants have contractually agreed to contribute specified amounts of money and expertise in exchange for stated proportions of ownership and profit is called

(Multiple Choice)

4.8/5  (30)

(30)

The risk attached to international cash flows are all of the following EXCEPT

(Multiple Choice)

4.9/5  (36)

(36)

In the international context, the effective interest rate equals to the nominal rate plus (or minus) any forecast appreciation (or depreciation) of a foreign currency relative to the currency of the MNC parent.

(True/False)

4.8/5  (37)

(37)

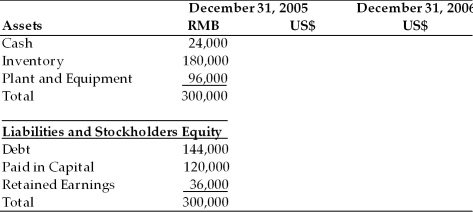

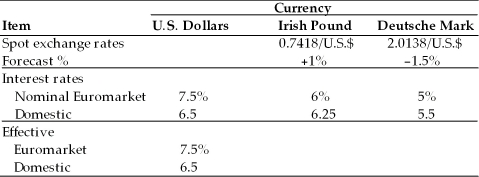

A multinational company has two subsidiaries, one in Ireland (local currency, Irish pound) and the other in West Germany (local currency, Deutsche mark). Pro forma statements of operations indicate the following short-term financial needs for each subsidiary (in equivalent U.S. dollars): Ireland: $25 million excess cash to be invested (lent); West Germany: $10 million funds to be raised (borrowed)

The following financial data is also available:  (a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(b) Where should the funds be invested?

(c) Where should the funds be raised?

(a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(b) Where should the funds be invested?

(c) Where should the funds be raised?

(Essay)

4.8/5  (39)

(39)

FASB No. 52 requires U.S. multinationals first to convert the financial statement accounts of foreign subsidiaries into their functional currency and then to translate the accounts into the parent firm's currency using the all-current-rate method.

(True/False)

4.9/5  (21)

(21)

In capital budgeting for a multinational, the starting discount rate to which risks stemming from foreign exchange and political factors can be added, and from which benefits reflecting the parent's lower capital costs may be subtracted is

(Multiple Choice)

5.0/5  (28)

(28)

Foreign bond is an international bond that is sold primarily in countries other than the country of the currency in which the issue is denominated.

(True/False)

4.8/5  (28)

(28)

Showing 41 - 60 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)