Exam 5: Risk and Return: Past and Prologue

Exam 1: Investments: Background and Issues75 Questions

Exam 2: Asset Classes and Financial Instruments85 Questions

Exam 3: Securities Markets90 Questions

Exam 4: Mutual Funds and Other Investment Companies85 Questions

Exam 5: Risk and Return: Past and Prologue83 Questions

Exam 6: Efficient Diversification84 Questions

Exam 7: Capital Asset Pricing and Arbitrage Pricing Theory85 Questions

Exam 8: The Efficient Market Hypothesis86 Questions

Exam 9: Behavioral Finance and Technical Analysis87 Questions

Exam 10: Bond Prices and Yields93 Questions

Exam 11: Managing Bond Portfolios85 Questions

Exam 12: Macroeconomic and Industry Analysis89 Questions

Exam 13: Equity Valuation88 Questions

Exam 14: Financial Statement Analysis84 Questions

Exam 15: Options Markets88 Questions

Exam 16: Option Valuation85 Questions

Exam 17: Futures Markets and Risk Management87 Questions

Exam 18: Portfolio Performance Evaluation87 Questions

Exam 19: Globalization and International Investing70 Questions

Exam 20: Hedge Funds60 Questions

Exam 21: Taxes,inflation,and Investment Strategy73 Questions

Exam 22: Investors and the Investment Process81 Questions

Select questions type

The price of a stock is $38 at the beginning of the year and $41 at the end of the year.If the stock paid a $2.50 dividend what is the holding period return for the year?

(Multiple Choice)

4.8/5  (30)

(30)

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a treasury bill with a rate of return of 6%.

-A portfolio that has an expected value in one year of $1,100 could be formed if you _________.

(Multiple Choice)

4.8/5  (38)

(38)

An investor invests 70% of her wealth in a risky asset with an expected rate of return of 15% and a variance of 5% and she puts 30% in a Treasury bill that pays 5%.Her portfolio's expected rate of return and standard deviation are __________ and __________ respectively.

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following are correct arguments supporting passive investment strategies?

I.Active trading strategies may not guarantee higher returns but guarantee higher costs

II.Passive investors can free ride on the activity of knowledge investors whose trades force prices to reflect currently available information

III.Passive investors are guaranteed to earn higher rates of return than active investors over sufficiently long time horizons

(Multiple Choice)

4.8/5  (30)

(30)

Published data on past returns earned by mutual funds are required to be ______.

(Multiple Choice)

4.9/5  (44)

(44)

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of treasury bills that pay 5% and a risky portfolio, P, constructed with 2 risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%.

-To form a complete portfolio with an expected rate of return of 8%,you should invest approximately __________ in the risky portfolio.This will mean you will also invest approximately __________ and __________ of your complete portfolio in security X and Y respectively.

(Multiple Choice)

4.8/5  (37)

(37)

The holding period return on a stock was 32%.Its beginning price was $25 and its cash dividend was $1.50.Its ending price must have been _________.

(Multiple Choice)

4.9/5  (41)

(41)

You have an APR of 7.5% with continuous compounding.The EAR is _____.

(Multiple Choice)

4.7/5  (37)

(37)

During the 1926 to 2008 period the Sharpe ratio was greatest for which of the following asset classes?

(Multiple Choice)

4.8/5  (34)

(34)

Suppose you pay $9,400 for a $10,000 par Treasury bill maturing in six months.What is the effective annual rate of return for this investment?

(Multiple Choice)

4.8/5  (40)

(40)

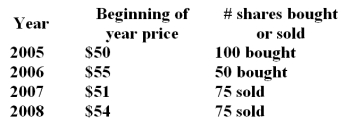

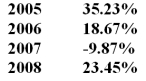

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends  -What is the dollar weighted return over the entire time period?

-What is the dollar weighted return over the entire time period?

(Multiple Choice)

4.9/5  (26)

(26)

You have the following rates of return for a risky portfolio for several recent years:  -If you invested $1,000 at the beginning of 2005 your investment at the end of 2008 would be worth ___________.

-If you invested $1,000 at the beginning of 2005 your investment at the end of 2008 would be worth ___________.

(Multiple Choice)

4.9/5  (38)

(38)

If nominal rate of return on investment is 6% and inflation is 2% over a holding period,what is the real rate of return on this investment?

(Multiple Choice)

4.8/5  (40)

(40)

In the mean-standard deviation graph,the line that connects the risk-free rate and the optimal risky portfolio,P,is called _________.

(Multiple Choice)

4.7/5  (26)

(26)

According to historical data,over the long run which of the following assets has the best chance to provide the best after inflation,after tax rate of return?

(Multiple Choice)

4.9/5  (28)

(28)

During the 1926 to 2008 period the geometric mean return on Treasury bills was _________.

(Multiple Choice)

4.7/5  (31)

(31)

Showing 21 - 40 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)