Exam 5: Risk and Return: Past and Prologue

Exam 1: Investments: Background and Issues75 Questions

Exam 2: Asset Classes and Financial Instruments85 Questions

Exam 3: Securities Markets90 Questions

Exam 4: Mutual Funds and Other Investment Companies85 Questions

Exam 5: Risk and Return: Past and Prologue83 Questions

Exam 6: Efficient Diversification84 Questions

Exam 7: Capital Asset Pricing and Arbitrage Pricing Theory85 Questions

Exam 8: The Efficient Market Hypothesis86 Questions

Exam 9: Behavioral Finance and Technical Analysis87 Questions

Exam 10: Bond Prices and Yields93 Questions

Exam 11: Managing Bond Portfolios85 Questions

Exam 12: Macroeconomic and Industry Analysis89 Questions

Exam 13: Equity Valuation88 Questions

Exam 14: Financial Statement Analysis84 Questions

Exam 15: Options Markets88 Questions

Exam 16: Option Valuation85 Questions

Exam 17: Futures Markets and Risk Management87 Questions

Exam 18: Portfolio Performance Evaluation87 Questions

Exam 19: Globalization and International Investing70 Questions

Exam 20: Hedge Funds60 Questions

Exam 21: Taxes,inflation,and Investment Strategy73 Questions

Exam 22: Investors and the Investment Process81 Questions

Select questions type

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a treasury bill with a rate of return of 6%.

-The return on the risky portfolio is 15%.The risk-free rate as well as the investor's borrowing rate is 10%.The standard deviation of return on the risky portfolio is 20%.If the standard deviation on the complete portfolio is 25%,the expected return on the complete portfolio is _________.

(Multiple Choice)

4.8/5  (31)

(31)

Your timing was good last year.You invested more in your portfolio right before prices went up and you sold right before prices went down.In calculating historical performance measures which one of the following will be the largest?

(Multiple Choice)

4.9/5  (37)

(37)

Consider the following two investment alternatives.First,a risky portfolio that pays 20% rate of return with a probability of 60% or 5% with a probability of 40%.Second,a treasury bill that pays 6%.If you invest $50,000 in the risky portfolio,your expected profit would be _________.

(Multiple Choice)

4.8/5  (38)

(38)

Historical returns have generally been __________ for stocks of small firms as/than for stocks of large firms.

(Multiple Choice)

4.8/5  (37)

(37)

Annual percentage rates can be converted to effective annual rates by means of the following formula:

(Multiple Choice)

4.9/5  (42)

(42)

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of treasury bills that pay 5% and a risky portfolio, P, constructed with 2 risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%.

-The dollar values of your positions in X,Y,and treasury bills would be _________,__________ and __________ respectively if you decide to hold a complete portfolio that has an expected return of 8%.

(Multiple Choice)

5.0/5  (36)

(36)

Consider the following two investment alternatives.First,a risky portfolio that pays 15% rate of return with a probability of 40% or 5% with a probability of 60%.Second,a treasury bill that pays 6%.The risk premium on the risky investment is _________.

(Multiple Choice)

4.7/5  (41)

(41)

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a treasury bill with a rate of return of 6%.

-The slope of the capital allocation line formed with the risky asset and the risk-free asset is _________.

(Multiple Choice)

4.9/5  (41)

(41)

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of treasury bills that pay 5% and a risky portfolio, P, constructed with 2 risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%.

-To form a complete portfolio with an expected rate of return of 11%,you should invest __________ of your complete portfolio in treasury bills.

(Multiple Choice)

4.8/5  (35)

(35)

An investment earns 10% the first year,15% the second year and loses 12% the third year.Your total compound return over the three years was ______.

(Multiple Choice)

4.8/5  (37)

(37)

Suppose you pay $9,800 for a $10,000 par Treasury bill maturing in two months.What is the annual percentage rate of return for this investment?

(Multiple Choice)

4.9/5  (30)

(30)

One method to forecast the risk premium is to use the _______.

(Multiple Choice)

4.8/5  (40)

(40)

The Manhawkin Fund has an expected return of 16% and a standard deviation of 20%.The risk free rate is 4%.What is the reward-to-volatility ratio for the Manhawkin Fund?

(Multiple Choice)

4.8/5  (34)

(34)

Which one of the following would be considered a risk-free asset in real terms as opposed to nominal?

(Multiple Choice)

4.8/5  (36)

(36)

You have an EAR of 9%.The equivalent APR with continuous compounding is _____.

(Multiple Choice)

4.7/5  (44)

(44)

From 1926 to 2008 the world stock portfolio offered _____ return and _____ volatility than the portfolio of large U.S.stocks.

(Multiple Choice)

4.7/5  (38)

(38)

You have calculated the historical dollar weighted return,annual geometric average return and annual arithmetic average return.You always reinvest your dividends and interest earned on the portfolio.Which method provides the best measure of the actual average historical performance of the investments you have chosen?

(Multiple Choice)

4.7/5  (31)

(31)

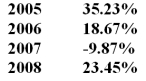

You have the following rates of return for a risky portfolio for several recent years:  -The annualized average return on this investment is

-The annualized average return on this investment is

(Multiple Choice)

4.8/5  (31)

(31)

Rank the following from highest average historical return to lowest average historical return from 1926-2008.

I.Small stocks

II.Long term bonds

III.Large stocks

IV.T-bills

(Multiple Choice)

4.9/5  (41)

(41)

Showing 41 - 60 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)