Exam 6: Efficient Diversification

Exam 1: Investments: Background and Issues75 Questions

Exam 2: Asset Classes and Financial Instruments85 Questions

Exam 3: Securities Markets90 Questions

Exam 4: Mutual Funds and Other Investment Companies85 Questions

Exam 5: Risk and Return: Past and Prologue83 Questions

Exam 6: Efficient Diversification84 Questions

Exam 7: Capital Asset Pricing and Arbitrage Pricing Theory85 Questions

Exam 8: The Efficient Market Hypothesis86 Questions

Exam 9: Behavioral Finance and Technical Analysis87 Questions

Exam 10: Bond Prices and Yields93 Questions

Exam 11: Managing Bond Portfolios85 Questions

Exam 12: Macroeconomic and Industry Analysis89 Questions

Exam 13: Equity Valuation88 Questions

Exam 14: Financial Statement Analysis84 Questions

Exam 15: Options Markets88 Questions

Exam 16: Option Valuation85 Questions

Exam 17: Futures Markets and Risk Management87 Questions

Exam 18: Portfolio Performance Evaluation87 Questions

Exam 19: Globalization and International Investing70 Questions

Exam 20: Hedge Funds60 Questions

Exam 21: Taxes,inflation,and Investment Strategy73 Questions

Exam 22: Investors and the Investment Process81 Questions

Select questions type

You are recalculating the risk of ACE stock in relation to the market index and you find the ratio of the systematic variance to the total variance has risen.You must also find that the ____________.

(Multiple Choice)

4.8/5  (31)

(31)

The _______ decision should take precedence over the _____ decision.

(Multiple Choice)

4.9/5  (44)

(44)

A stock has a correlation with the market of 0.45.The standard deviation of the market is 21% and the standard deviation of the stock is 35%.What is the stock's beta?

(Multiple Choice)

4.7/5  (33)

(33)

An investor can design a risky portfolio based on two stocks,A and B. The standard deviation of return on stock A is 24% while the standard deviation on stock B is 14%. The correlation coefficient between the return on A and B is 0.35. The expected return on stock A is 25% while on stock B it is 11%. The proportion of the minimum variance portfolio that would be invested in stock B is approximately _________.

(Multiple Choice)

4.9/5  (40)

(40)

You put half of your money in a stock portfolio that has an expected return of 14% and a standard deviation of 24%.You put the rest of you money in a risky bond portfolio that has an expected return of 6% and a standard deviation of 12%.The stock and bond portfolio have a correlation 0.55.The standard deviation of the resulting portfolio will be ________________.

(Multiple Choice)

4.8/5  (38)

(38)

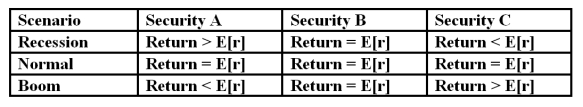

Based on the outcomes in the table below choose which of the statements is/are correct:  I.The covariance of Security A and Security B is zero

II.The correlation coefficient between Security A and C is negative

III.The correlation coefficient between Security B and C is positive

I.The covariance of Security A and Security B is zero

II.The correlation coefficient between Security A and C is negative

III.The correlation coefficient between Security B and C is positive

(Multiple Choice)

4.8/5  (35)

(35)

The ________ is equal to the square root of the systematic variance divided by the total variance.

(Multiple Choice)

4.9/5  (37)

(37)

Harry Markowitz is best known for his Nobel prize winning work on _____________.

(Multiple Choice)

4.9/5  (28)

(28)

The market value weighted average beta of firms included in the market index will always be _____________.

(Multiple Choice)

5.0/5  (38)

(38)

Which risk can be diversified away as additional securities are added to a portfolio?

I.Total risk

II.Systematic risk

III.Firm specific risk

(Multiple Choice)

4.8/5  (37)

(37)

As you lengthen the time horizon of your investment period and decide to invest for multiple years you will find that ________.

I.the average risk per year may be smaller over longer investment horizons

II.the overall risk of your investment will compound over time

III.your overall risk on the investment will fall

(Multiple Choice)

4.9/5  (34)

(34)

An investor can design a risky portfolio based on two stocks,A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock B is 15%. The correlation coefficient between the return on A and B is 0%. The standard deviation of return on the minimum variance portfolio is _________.

(Multiple Choice)

4.8/5  (42)

(42)

Adding additional risky assets to the investment opportunity set will generally move the efficient frontier _____ and to the ______.

(Multiple Choice)

5.0/5  (46)

(46)

Which of the following is a correct expression concerning the formula for the standard deviation of returns of a two asset portfolio where the correlation coefficient is positive?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following correlation coefficients will produce the most diversification benefits?

(Multiple Choice)

4.8/5  (35)

(35)

Consider two perfectly negatively correlated risky securities,A and B. Security A has an expected rate of return of 16% and a standard deviation of return of 20%. B has an expected rate of return of 10% and a standard deviation of return of 30%. The weight of security B in the minimum variance portfolio is _________.

(Multiple Choice)

4.9/5  (39)

(39)

The figures below show plots of monthly excess returns for two stocks plotted against excess returns for a market index.  -Which stock is riskier to a non-diversified investor who puts all his money in only one of these stocks?

-Which stock is riskier to a non-diversified investor who puts all his money in only one of these stocks?

(Multiple Choice)

4.7/5  (35)

(35)

Suppose that a stock portfolio and a bond portfolio have a zero correlation.This means that ______.

(Multiple Choice)

4.9/5  (42)

(42)

Showing 41 - 60 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)