Exam 12: Cost Allocation

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

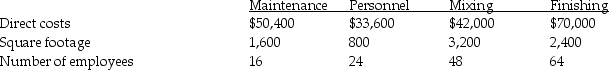

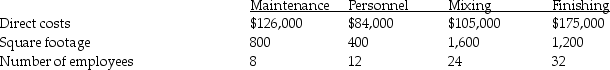

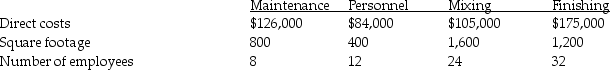

Marcos Company has two service departments,Maintenance and Personnel.Marcos Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Maintenance Department after the Personnel Department cost allocation would be ________.

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

B

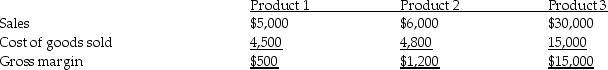

Gonzalez Company makes three types of products.The company has two types of customers.The cost to serve all customers is $12,000 and is allocated to customer types based on the number of manager visits to customer locations.The following data are available:

What is the gross profit margin for all three products for Customer Type 1?

What is the gross profit margin for all three products for Customer Type 1?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

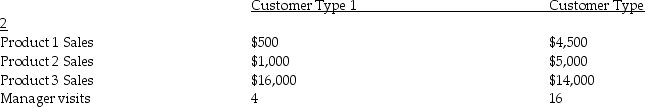

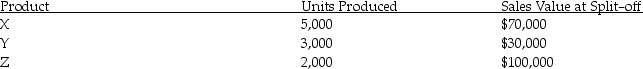

Falcon Company manufactures three products from a joint process.Joint costs for the year amounted to $300,000.The following data was available:  Assume the physical-units method of allocating joint costs is used.What amount of joint costs is allocated to Product Y?

Assume the physical-units method of allocating joint costs is used.What amount of joint costs is allocated to Product Y?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

For external financial reporting,only ________ costs are assigned to products or services.For internal financial reporting,any ________ costs can be assigned to products or services.

(Multiple Choice)

4.8/5  (32)

(32)

By-products normally have significant sales value in comparison with other jointly-produced products emerging at the split-off point.

(True/False)

4.8/5  (34)

(34)

Allocating fixed costs based on long-range plans may inadvertently result in a tendency of mangers to ________.

(Multiple Choice)

4.8/5  (32)

(32)

The preferred cost driver for costs from central services is either actual or estimated usage.

(True/False)

4.9/5  (31)

(31)

Corker Company manufactures three products from a joint process.Joint costs for the year amounted to $250,000.The following data was available:  Assume the relative-sales-value method of allocating joint costs is used.What amount of joint costs is allocated to Product X?

Assume the relative-sales-value method of allocating joint costs is used.What amount of joint costs is allocated to Product X?

(Multiple Choice)

4.9/5  (34)

(34)

When determining the cost of main products from a joint production process,________ is NOT included.

(Multiple Choice)

4.9/5  (31)

(31)

The logical cost driver for costs from janitorial services is square feet.

(True/False)

4.9/5  (27)

(27)

Derby Company has two service departments,Maintenance and Personnel.Derby Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?

Assume the step-down method is used to allocate service department costs and the Personnel Department is allocated first.What is the total cost of the Finishing Department after allocation of the service departments costs?

(Multiple Choice)

5.0/5  (31)

(31)

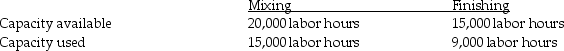

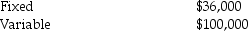

Rodney Company has two production departments called Mixing and Finishing.The maintenance department serves both production departments.Budgeted fixed costs for the maintenance department are $30,000.Budgeted variable costs for the maintenance department are $5.00 per labor hour.Other relevant data follow:  Actual maintenance department costs:

Actual maintenance department costs:

The amount of variable maintenance department costs allocated to the Finishing Department should be ________.

The amount of variable maintenance department costs allocated to the Finishing Department should be ________.

(Multiple Choice)

4.8/5  (37)

(37)

Assume the cost object is customers.Why should indirect costs associated with customers be allocated to customers instead of producing departments?

(Multiple Choice)

4.9/5  (33)

(33)

When using the step-down method,once a service department's costs are allocated to other departments,nothing is ever allocated back to it.

(True/False)

4.8/5  (26)

(26)

Theresa Company has two service departments,Maintenance and Personnel.Theresa Company also has two production departments,Mixing and Finishing.Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees.The following information has been gathered for the current year:  If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.

If the direct method is used to allocate service department costs,then the total cost of the Mixing Department after allocation would be ________.

(Multiple Choice)

4.9/5  (39)

(39)

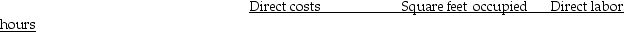

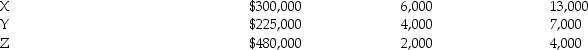

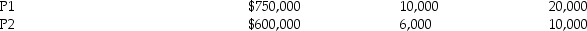

Puma Company has three service departments,X,Y and Z and two production departments,P1 and P2.Costs in Departments X and Y are allocated based on square feet and costs in Department Z are allocated based on direct labor hours.

The following data are available:

Service Department:

Service Department:

Producing Department:

Producing Department:

Assume the direct method of allocating service department costs is used.

Required:

A)What is the total cost of Producing Department P1 after allocating the service departments' costs?

B)What is the total cost of Producing Department P2 after allocating the service departments' costs?

Assume the direct method of allocating service department costs is used.

Required:

A)What is the total cost of Producing Department P1 after allocating the service departments' costs?

B)What is the total cost of Producing Department P2 after allocating the service departments' costs?

(Essay)

4.8/5  (33)

(33)

Some service department activities support customers rather than the production process.These costs are traced directly to ________ instead of ________.

(Multiple Choice)

4.9/5  (41)

(41)

Budgeted cost rates are used for allocating variable costs of service departments to user departments because ________.

(Multiple Choice)

4.8/5  (31)

(31)

Showing 1 - 20 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)