Exam 10: Management Control in Decentralized Organizations

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

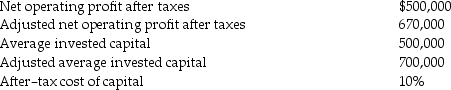

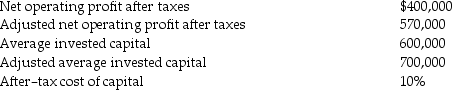

Yoon Company reports the following information:  The adjusted figures reflect adjustments used by Stern Stewart & Company.

What is the EVA for Yoon Company?

The adjusted figures reflect adjustments used by Stern Stewart & Company.

What is the EVA for Yoon Company?

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

C

The increasing sophistication of telecommunications facilitates decentralization in organizations.

Free

(True/False)

4.9/5  (22)

(22)

Correct Answer:

True

Capital turnover can be increased by decreasing investment.

Free

(True/False)

4.8/5  (32)

(32)

Correct Answer:

True

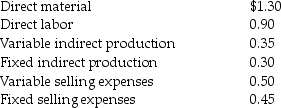

Sweater Division manufactures sweaters.The buttons used in production are purchased from an outside supplier at a cost of $4.50 per sweater.The buttons can also be purchased in house from Supply Division for $4.00 per sweater.The cost data for the buttons produced by Supply Division are as follows:

Variable selling expenses are not incurred on inside transfers.Assume Supply Division has excess capacity.

Required:

A)What is the minimum transfer price that Supply Division should charge Sweater Division for the transferred buttons?

B)What is the maximum transfer price that Sweater Division should pay Supply Division for the transferred buttons?

Variable selling expenses are not incurred on inside transfers.Assume Supply Division has excess capacity.

Required:

A)What is the minimum transfer price that Supply Division should charge Sweater Division for the transferred buttons?

B)What is the maximum transfer price that Sweater Division should pay Supply Division for the transferred buttons?

(Short Answer)

4.9/5  (37)

(37)

Increasing capital turnover is one of the advantages of implementing the JIT philosophy.

(True/False)

4.8/5  (36)

(36)

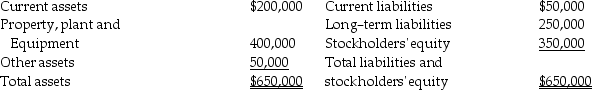

The following information is available for Timber Company:  Invested capital is defined as total assets less current liabilities.What is invested capital?

Invested capital is defined as total assets less current liabilities.What is invested capital?

(Multiple Choice)

4.9/5  (34)

(34)

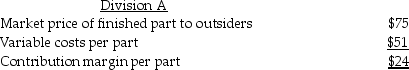

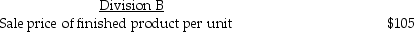

Steven Company's records reveal the following:

Variable costs:

Variable costs:

The variable costs of Division B will be incurred whether it buys from Division A or from an outside supplier.Division A wants to transfer the parts to Division B for $81 each.Division B can buy the parts for $75 per unit from an outside supplier.Division A has no excess capacity.The manager of Division B should ________.

The variable costs of Division B will be incurred whether it buys from Division A or from an outside supplier.Division A wants to transfer the parts to Division B for $81 each.Division B can buy the parts for $75 per unit from an outside supplier.Division A has no excess capacity.The manager of Division B should ________.

(Multiple Choice)

4.9/5  (35)

(35)

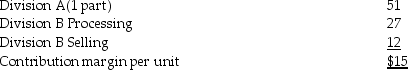

The following information is available for the Trompeter Company:  What is the capital turnover ratio?

What is the capital turnover ratio?

(Multiple Choice)

4.8/5  (27)

(27)

Why do some companies prefer the use of economic profit over return on investment in decision-making?

(Multiple Choice)

4.8/5  (24)

(24)

The rate of return on net book value decreases as equipment ages.

(True/False)

4.8/5  (37)

(37)

Assuming a company uses a cost-based pricing system for transfer pricing,which of the following items would NOT be used?

(Multiple Choice)

4.8/5  (34)

(34)

Companies will not suffer negative consequences if they overemphasize meeting a budget when evaluating managers.

(True/False)

4.8/5  (24)

(24)

Managers' incentives for performance are defined as the ________.

(Multiple Choice)

4.7/5  (31)

(31)

In cases of constrained capacity,the opportunity cost of transferring a product internally is zero.

(True/False)

4.9/5  (38)

(38)

An ideal performance metric would measure and reward the manager for ________ factors and neither reward nor punish the manager for ________ factors.

(Multiple Choice)

4.9/5  (35)

(35)

________ is the original cost of a long-term asset less accumulated depreciation.

(Multiple Choice)

4.7/5  (34)

(34)

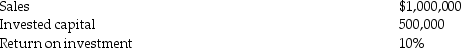

Yun Company reports the following information:  The adjusted figures reflect adjustments used by Stern Stewart & Company.What is the EVA for Yun Company?

The adjusted figures reflect adjustments used by Stern Stewart & Company.What is the EVA for Yun Company?

(Multiple Choice)

4.8/5  (30)

(30)

The variable cost of Part X is $50 per unit and the full cost of the part is $80 per unit.The part is produced in Country Z and transferred to a plant in Country B.Country Z has a 30% income tax rate.Country B has a 50% income tax rate and an import duty equal to 10% of the price of the item.Part X can be transferred at full cost or variable cost.Assume Part X is transferred at full cost.By using full cost instead of variable cost for the transfer price,the income tax effect per unit in Country Z is ________.

(Multiple Choice)

4.9/5  (31)

(31)

Showing 1 - 20 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)