Exam 3: Financial Statements and Ratio Analysis

Exam 1: The Role of Managerial Finance111 Questions

Exam 2: The Financial Market Environment104 Questions

Exam 3: Financial Statements and Ratio Analysis218 Questions

Exam 4: Long- and Short-Term Financial Planning189 Questions

Exam 5: Time Value of Money185 Questions

Exam 6: Interest Rates and Bond Valuation214 Questions

Exam 7: Stock Valuation172 Questions

Exam 8: Risk and Return214 Questions

Exam 9: The Cost of Capital130 Questions

Exam 10: Capital Budgeting Techniques148 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements184 Questions

Exam 12: Leverage and Capital Structure213 Questions

Exam 13: Payout Policy133 Questions

Exam 14: Working Capital and Current Assets Management325 Questions

Exam 15: Current Liabilities Management171 Questions

Select questions type

A U.S.parent company's foreign retained earnings are not adjusted for currency movements to reflect each year's operating profits or losses.

(True/False)

4.9/5  (43)

(43)

The letter to stockholders is the primary communication from management in an annual report.

(True/False)

4.8/5  (40)

(40)

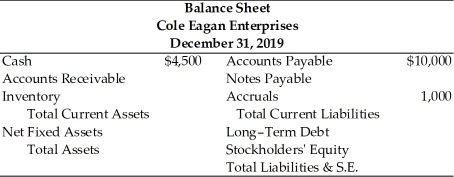

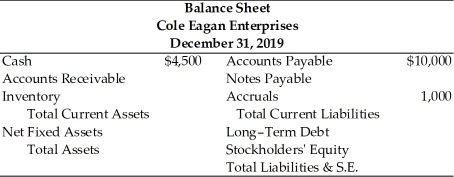

Table 3.1  Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Total assets for CEE in 2019 were ________.(See Table 3.1)

Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Total assets for CEE in 2019 were ________.(See Table 3.1)

(Multiple Choice)

4.9/5  (31)

(31)

________ ratios are a measure of the speed with which various accounts are converted into sales or cash.

(Multiple Choice)

4.9/5  (39)

(39)

Table 3.1  Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Inventory for CEE in 2019 was ________.(See Table 3.1)

Information (2019 values)

1.Sales totaled $110,000

2.The gross profit margin was 25 percent.

3.Inventory turnover was 3.0.

4.There are 360 days in the year.

5.The average collection period was 65 days.

6.The current ratio was 2.40.

7.The total asset turnover was 1.13.

8.The debt ratio was 53.8 percent.

-Inventory for CEE in 2019 was ________.(See Table 3.1)

(Multiple Choice)

4.8/5  (42)

(42)

The financial leverage multiplier is the ratio of ________.

(Multiple Choice)

4.8/5  (40)

(40)

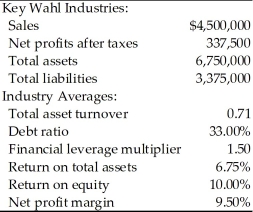

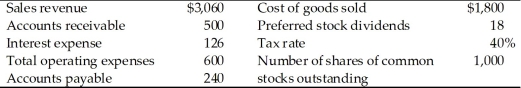

Construct the DuPont system of analysis using the following financial data for Key Wahl Industries and determine which areas of the firm need further analysis.

Key Financial Data

(Essay)

4.9/5  (36)

(36)

In 2018,Target Corp.reported sales of $71.9 billion,cost of goods sold of $51.1 billion,operating profit of $4.3 billion,and net income of $2.9 billion.Target has no preferred stock outstanding.It's net profit margin that year was ________.

(Multiple Choice)

4.8/5  (36)

(36)

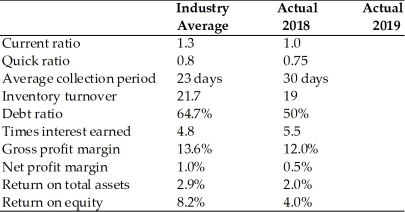

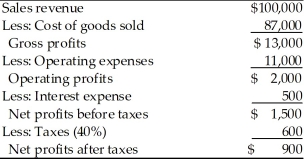

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

Dana Dairy Products

For the Year Ended December 31,2019

Income Statement

Dana Dairy Products

For the Year Ended December 31,2019  Balance Sheet

Dana Dairy Products

December 31,2019

Balance Sheet

Dana Dairy Products

December 31,2019  -The current ratio for Dana Dairy Products in 2019 was ________.(See Table 3.2)

-The current ratio for Dana Dairy Products in 2019 was ________.(See Table 3.2)

(Multiple Choice)

4.8/5  (31)

(31)

A firm with a gross profit margin which meets industry standard and a net profit margin which is below industry standard may have excessive ________.

(Multiple Choice)

4.8/5  (25)

(25)

FASB Standard No.52 mandates that U.S.-based companies must translate their foreign-currency-denominated assets and liabilities into dollars using the ________.

(Multiple Choice)

4.8/5  (28)

(28)

The net profit margin measures the percentage of each sales dollar remaining after all costs and expenses,including interest,taxes,and common stock dividends,have been deducted.

(True/False)

4.9/5  (31)

(31)

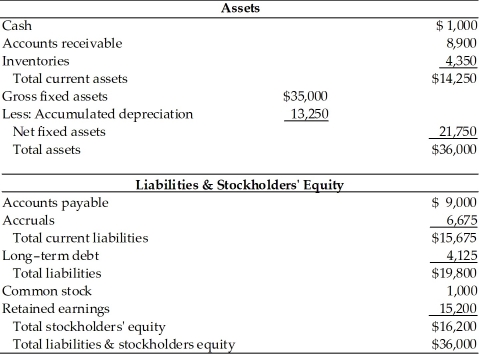

A firm has the following accounts and financial data for 2019:  The firm's earnings available to common shareholders for 2019 is ________.

The firm's earnings available to common shareholders for 2019 is ________.

(Multiple Choice)

4.7/5  (44)

(44)

Generally accepted accounting principles are authorized by the Financial Accounting Standards Board (FASB).

(True/False)

4.9/5  (31)

(31)

Candy Corporation had pretax profits of $1.2 million,an average tax rate of 34 percent,and it paid preferred stock dividends of $50,000.There were 100,000 shares outstanding and no interest expense.What was Candy Corporation's earnings per share?

(Multiple Choice)

4.8/5  (31)

(31)

The current ratio provides a measure of a firm's ability to meet its long-term obligations.

(True/False)

4.8/5  (34)

(34)

In 2018,Target Corp.reported sales of $71.9 billion,cost of goods sold of $51.1 billion,operating profit of $4.3 billion,and net income of $2.9 billion.Target has no preferred stock outstanding.It's operating profit margin that year was ________.

(Multiple Choice)

4.8/5  (39)

(39)

The gross profit margin measures the percentage of each sales dollar left after a firm has paid for its goods and operating expenses.

(True/False)

4.8/5  (35)

(35)

Below are recent inventory turnover ratios for four companies.The companies,listed in no particular order are Tiffany & Co.(a manufacturer and retailer of fine jewelry),Deere & Co.(maker of heavy duty agricultural equipment),Boeing (aircraft manufacturer),and Sprouts (a grocery chain focusing on organic products).Think about which of these companies operate in businesses that tend to have very slow or very fast inventory turnover.Which one below is the inventory turnover ratio for Sprouts?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 121 - 140 of 218

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)