Exam 22: Multinational Performance Measurement and Compensation

Exam 1: The Accountants Vital Role in Decision Making171 Questions

Exam 2: An Introduction to Cost Terms and Purposes202 Questions

Exam 3: Cost-Volume-Profit Analysis165 Questions

Exam 4: Job Costing161 Questions

Exam 5: Activity-Based Costing and Management160 Questions

Exam 6: Master Budget and Responsibility Accounting179 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I190 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II156 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation178 Questions

Exam 10: Analysis of Cost Behaviour251 Questions

Exam 11: Decision Making and Relevant Information194 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management160 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis152 Questions

Exam 14: Period Cost Allocation180 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts192 Questions

Exam 16: Revenue and Customer Profitability Analysis165 Questions

Exam 17: Process Costing155 Questions

Exam 18: Spoilage, Rework, and Scrap155 Questions

Exam 19: Inventory Cost Management Strategies161 Questions

Exam 20: Capital Budgeting: Methods of Investment Analysis196 Questions

Exam 21: Transfer Pricing and Multinational Management Control Systems183 Questions

Exam 22: Multinational Performance Measurement and Compensation166 Questions

Select questions type

Answer the following question(s)using the information below:

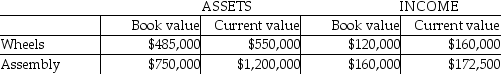

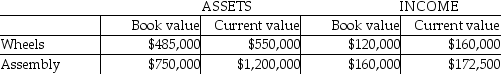

Carriage Ltd.manufactures baby carriages.The company has two divisions, Wheels and Assembly.Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures.The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's residual incomes based on book values, respectively?

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's residual incomes based on book values, respectively?

(Multiple Choice)

4.9/5  (33)

(33)

The most popular approach to incorporating the investment base into a performance measure is

(Multiple Choice)

4.8/5  (37)

(37)

List and describe the steps involved in making decisions on performance measures.

(Essay)

4.8/5  (37)

(37)

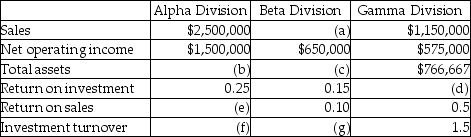

Use the information below to answer the following question(s).The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records.The main computer system was also severely damaged.The following information was salvaged:

-What is the Gamma Division's return on investment?

-What is the Gamma Division's return on investment?

(Multiple Choice)

4.8/5  (33)

(33)

The imputed cost of an investment is the required rate of return times the investment.

(True/False)

4.8/5  (40)

(40)

In establishing performance measures and compensation policy, the issues are interdependent and the decision maker may proceed through a series of decisions several times before selecting the performance measure(s).

(True/False)

4.9/5  (37)

(37)

A company has total assets of $500,000, a required rate of return of 10%, and operating income for the year was $200,000.What is the residual income?

(Multiple Choice)

4.8/5  (41)

(41)

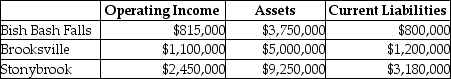

Answer the following question(s)using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million).Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities.The cost of equity capital is 15%, while the tax rate is 30%.  -Novella Ltd.reported a return on investment of 16%, an asset turnover of 6, and income of $190,000.On the basis of this information, the company's invested capital was

-Novella Ltd.reported a return on investment of 16%, an asset turnover of 6, and income of $190,000.On the basis of this information, the company's invested capital was

(Multiple Choice)

4.8/5  (41)

(41)

What disadvantage is there in using ROI and/or RI as performance measures?

(Multiple Choice)

4.8/5  (45)

(45)

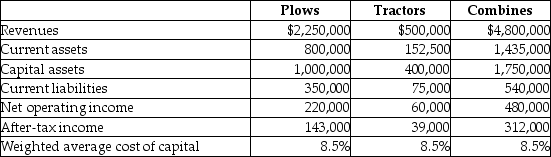

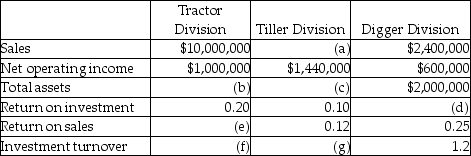

Kase Tractor Company allows its divisions to operate as autonomous units.Their results for the current year were as follows:

Required:

For each division compute the

a.return on sales

b.return on investment based on total assets employed

c.economic value added

d.residual income based on net operating income

Required:

For each division compute the

a.return on sales

b.return on investment based on total assets employed

c.economic value added

d.residual income based on net operating income

(Essay)

4.9/5  (36)

(36)

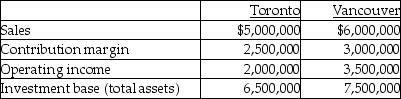

Use the information below to answer the following question(s).Berger Publishing has two divisions which operate autonomously.Their results for the past year were as follows:

The company's desired rate of return is 15%.

-What are the respective return on investment ratios for the Toronto and Vancouver divisions?

The company's desired rate of return is 15%.

-What are the respective return on investment ratios for the Toronto and Vancouver divisions?

(Multiple Choice)

4.9/5  (40)

(40)

The absence of good performance measures restricts the owner's ability to motivate managers through

(Multiple Choice)

4.7/5  (36)

(36)

Answer the following question(s)using the information below:

Carriage Ltd.manufactures baby carriages.The company has two divisions, Wheels and Assembly.Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures.The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's return on investment based on current values, respectively?

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's return on investment based on current values, respectively?

(Multiple Choice)

4.7/5  (36)

(36)

Use the information below to answer the following question(s).The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a flood, which destroyed some of its accounting records.The main computer system was also severely damaged.The following information was salvaged:

-What is the Tractor Division's investment turnover?

-What is the Tractor Division's investment turnover?

(Multiple Choice)

4.9/5  (40)

(40)

What the first step in selecting appropriate performance measures?

(Multiple Choice)

4.8/5  (42)

(42)

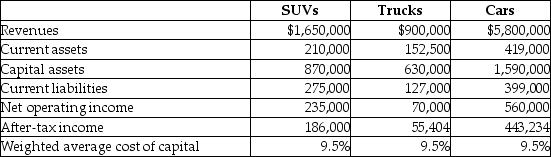

Jim's Quality Pre-owned Auto Sales Ltd.allows its divisions to operate as autonomous units.Their results for the current year were as follows:

Required:

For each division compute the

a.return on sales

b.return on investment based on total assets employed

c.economic value added

d.residual income based on net operating income

Required:

For each division compute the

a.return on sales

b.return on investment based on total assets employed

c.economic value added

d.residual income based on net operating income

(Essay)

4.9/5  (40)

(40)

Some companies present financial and non-financial performance measures for various organization units in a single report called the financial performance scorecard.

(True/False)

5.0/5  (35)

(35)

The Auto Division of Fran Corporation has $2.5 million in total assets and $200,000 in liabilities, while the Transportation Division has $5 million in total assets and $3 million in liabilities.What are the imputed costs of the Auto division and of the Transportation division, respectively, if the corporation has a required rate of return of 11%?

(Multiple Choice)

4.8/5  (36)

(36)

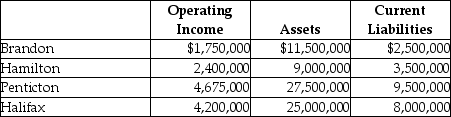

Coptermagic Company supplies helicopters to corporate clients.Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million and book value of $8 million.The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%.Coptermagic has profit centres in four divisions that operate autonomously.The company's results for the past year are as follows:

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

(Essay)

5.0/5  (36)

(36)

Good performance measures do not change significantly with the manager's performance but change with factors that are beyond the manager's control.

(True/False)

4.9/5  (33)

(33)

Showing 141 - 160 of 166

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)