Exam 14: Financial Statement Analysis Online

Exam 1: Managerial Accounting and the Business Environment49 Questions

Exam 2: Cost Terms, Concepts, and Classifications103 Questions

Exam 3: Cost Behaviour: Analysis and Use106 Questions

Exam 4: Cost-Volume-Profit Relationships401 Questions

Exam 5: Systems Design: Job-Order Costing108 Questions

Exam 6: Systems Design: Process Costing130 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making120 Questions

Exam 8: Variable Costing: a Tool for Management135 Questions

Exam 9: Budgeting128 Questions

Exam 10: Standard Costs and Overhead Analysis223 Questions

Exam 11: Reporting for Control193 Questions

Exam 12: Relevant Costs for Decision Making88 Questions

Exam 13: Capital Budgeting Decisions180 Questions

Exam 14: Financial Statement Analysis Online200 Questions

Select questions type

An increase in the market price of a company's common shares will immediately affect which of the following?

(Multiple Choice)

4.8/5  (43)

(43)

The price-earnings ratio is determined by dividing the price of a product by its profit margin.

(True/False)

4.9/5  (30)

(30)

Which of the following is NOT a potential source of financial leverage?

(Multiple Choice)

4.9/5  (34)

(34)

Orange Company's current ratio at the end of Year 2 was closest to which of the following?

(Multiple Choice)

4.8/5  (39)

(39)

March Company's average sale period (turnover in days)for Year 2 was closest to which of the following? Round your intermediate calculations to 2 decimal places.

(Multiple Choice)

4.8/5  (35)

(35)

Oratz Company's accounts receivable turnover for Year 2 was closest to which of the following?

(Multiple Choice)

4.8/5  (36)

(36)

Karl Company has total assets of $170,000 and total liabilities of $110,000.The company's debt-to-equity ratio is closest to which of the following?

(Multiple Choice)

4.9/5  (47)

(47)

A company's current ratio and acid-test ratios are both greater than 1.0 to 1.If obsolete inventory is written off,what would be the effect?

(Multiple Choice)

4.8/5  (34)

(34)

Larned Company's return on total assets for Year 2 was closest to which of the following?

(Multiple Choice)

4.9/5  (40)

(40)

Laroche Company's return on total assets for Year 2 was closest to which of the following?

(Multiple Choice)

4.7/5  (42)

(42)

Marcial Company's accounts receivable turnover for Year 2 was closest to which of the following?

(Multiple Choice)

4.7/5  (37)

(37)

Orange Company's dividend yield ratio on December 31,Year 2 was closest to which of the following?

(Multiple Choice)

4.9/5  (36)

(36)

Arget Company's net income last year was $600,000.The company had 150,000 common shares and 60,000 preferred shares.There was no change in the number of common or preferred shares outstanding during the year.The company declared and paid dividends last year of $1.10 per common share and $0.60 per preferred share.The earnings per common share was closest to which of the following?

(Multiple Choice)

4.9/5  (39)

(39)

Starrs Company has current assets of $300,000 and current liabilities of $200,000.Which of the following transactions would increase its working capital?

(Multiple Choice)

4.8/5  (41)

(41)

Marcell Company's working capital (in thousands of dollars)at the end of Year 2 was closest to which of the following?

(Multiple Choice)

4.8/5  (36)

(36)

Larosa Company's dividend yield ratio on December 31,Year 2 was closest to which of the following?

(Multiple Choice)

4.9/5  (40)

(40)

Larosa Company's return on common shareholders' equity for Year 2 was closest to which of the following?

(Multiple Choice)

4.8/5  (34)

(34)

Draban Company's working capital is $38,000,and its current liabilities are $59,000.The company's current ratio is closest to which of the following?

(Multiple Choice)

4.8/5  (46)

(46)

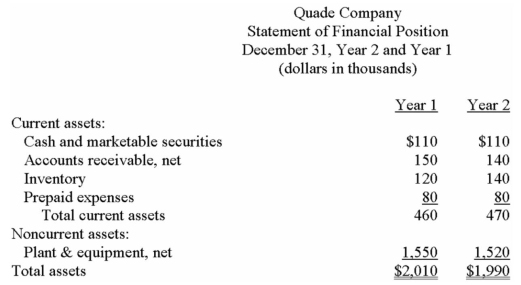

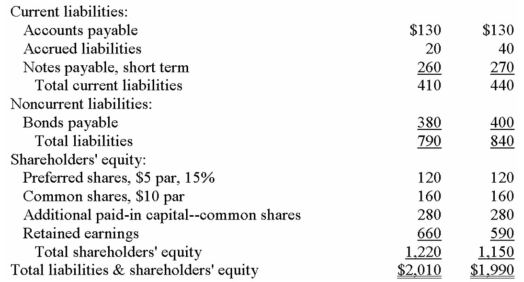

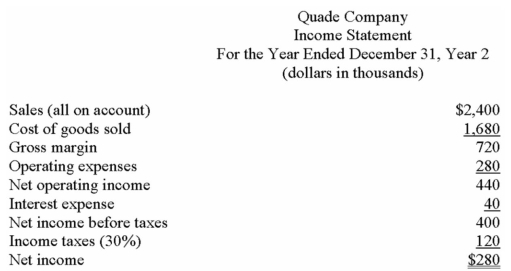

Financial statements for Quade Company appear below:

Total dividends paid during Year 2 were $210,000,of which $18,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $230.

Required:

Calculate the following for Year 2:

a)Earnings per share.

b)Price-earnings ratio.

c)Dividend yield ratio.

d)Return on total assets.

e)Return on common shareholders' equity.

f)Book value per share.

Total dividends paid during Year 2 were $210,000,of which $18,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $230.

Required:

Calculate the following for Year 2:

a)Earnings per share.

b)Price-earnings ratio.

c)Dividend yield ratio.

d)Return on total assets.

e)Return on common shareholders' equity.

f)Book value per share.

(Essay)

4.9/5  (37)

(37)

Larosa Company's price-earnings ratio on December 31,Year 2 was closest to which of the following?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 21 - 40 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)