Exam 10: Using Financial Statement Analysis to Evaluate Firm Performance

Exam 1: Business: Whats It All About226 Questions

Exam 2: Qualities of Accounting Information180 Questions

Exam 3: Accruals and Deferrals: Timing Is Everything in Accounting260 Questions

Exam 4: Payment for Goods and Services: Cash and Accounts Receivable195 Questions

Exam 5: The Purchase and Sale of Inventory249 Questions

Exam 6: Acquisition and Use of Long-Term Assets217 Questions

Exam 7: Accounting for Liabilities308 Questions

Exam 9: Preparing and Analyzing the Statement of Cash Flows277 Questions

Exam 10: Using Financial Statement Analysis to Evaluate Firm Performance273 Questions

Exam 11: Quality of Earnings, corporate Governance, and Ifrs159 Questions

Select questions type

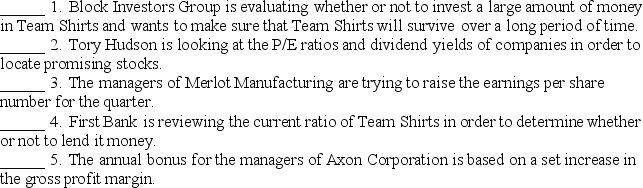

Indicate which of the following ratios are being used in each situation.Some ratios may be used more than once.Others may not be used at all.

a.solvency

b.profitability

c.market indicator

d.liquidity

(Short Answer)

4.7/5  (30)

(30)

Markot Corporation purchased $400,000 of securities and classified them as available-for-sale.The market value of the securities went down to $375,000.Markot Corporation should ________.

(Multiple Choice)

4.8/5  (44)

(44)

Wilson Wong received an inheritance from his grandfather.Wilson wants to invest the money in stocks.He is interested in long-term investments in companies with solid financial performance.Explain to Wilson the four major categories of financial ratios and how they are used to help investors analyze the performance of companies.

(Essay)

4.7/5  (34)

(34)

Ratios used to determine whether or not a company can pay its bills on time are ________.

(Multiple Choice)

4.8/5  (44)

(44)

Which financial statement(s)do you need to calculate the cash from operations to current liabilities ratio?

(Multiple Choice)

4.9/5  (33)

(33)

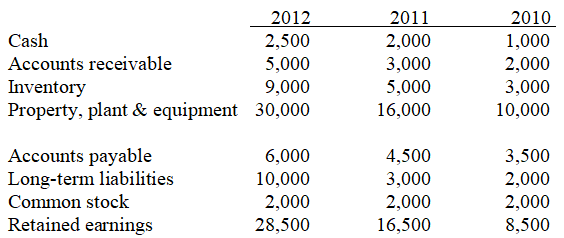

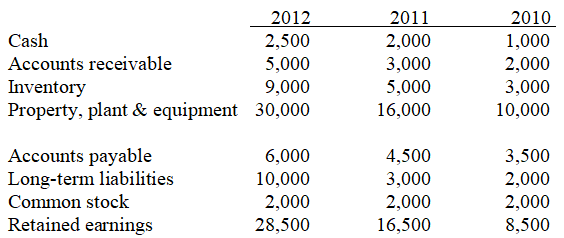

The following information is from Acme's annual report for the years ended Dec. 31:

-Refer to the Acme annual report above.Calculate return on equity for 2012.

-Refer to the Acme annual report above.Calculate return on equity for 2012.

(Multiple Choice)

4.9/5  (31)

(31)

Which financial statement(s)do you need to calculate the accounts receivable turnover ratio?

(Multiple Choice)

4.9/5  (35)

(35)

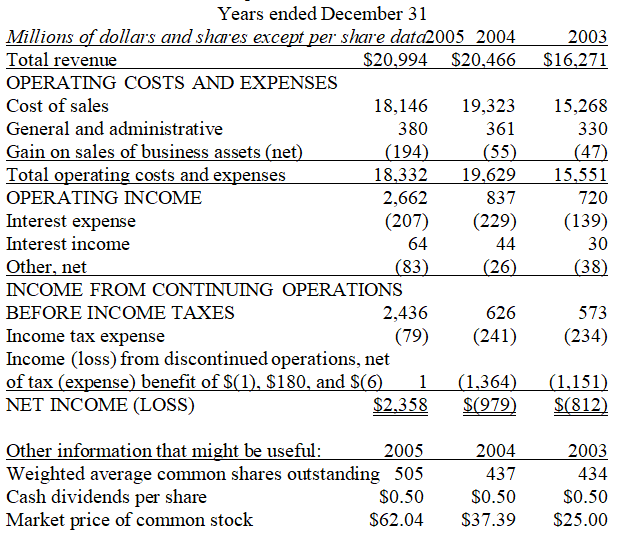

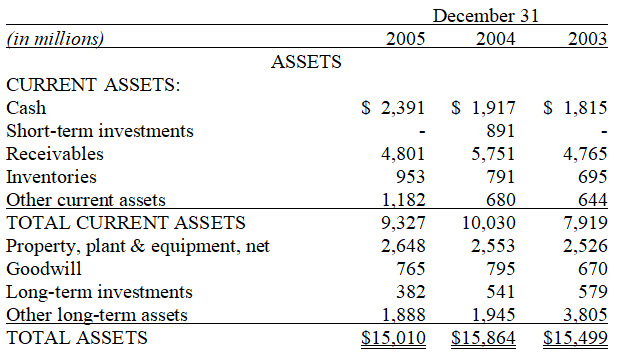

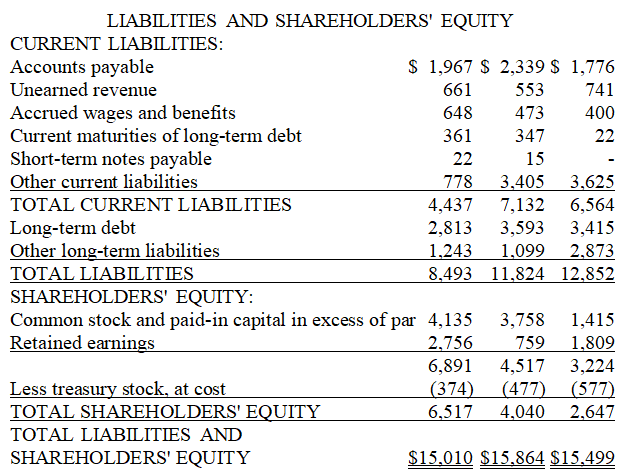

The following information has been adapted from the 2004 and 2005 annual reports of Halliburton Company's worldwide operations, available online at

http://ir.halliburton.com/phoenix.zhtml?c=67605&p=irol-irhome

HALLIBURTON COMPANY

Consolidated Statements of Operations

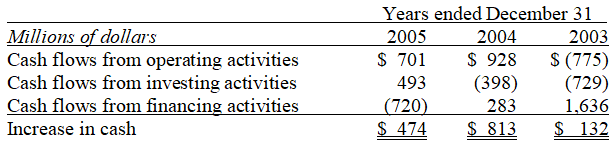

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

HALLIBURTON COMPANY

Consolidated Balance Sheets

HALLIBURTON COMPANY

Consolidated Balance Sheets

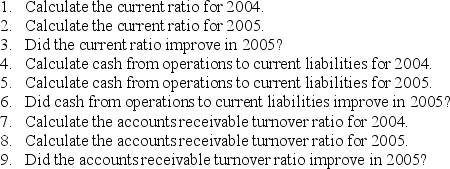

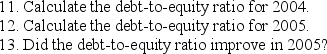

-Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final,correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

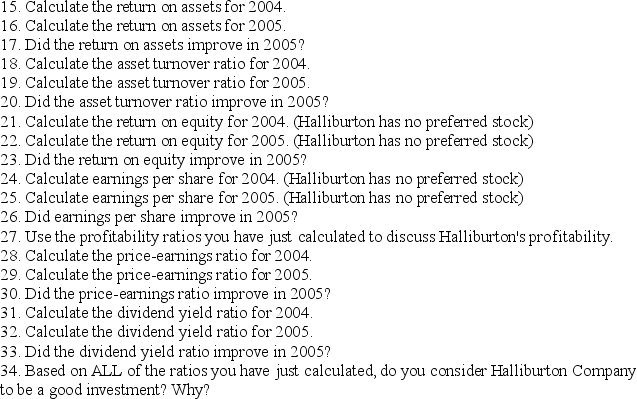

Use the adapted financial statements from Halliburton Company to answer the following questions:

-Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final,correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

Use the adapted financial statements from Halliburton Company to answer the following questions:

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

(Essay)

4.9/5  (46)

(46)

The following information is from Acme's annual report for the years ended Dec. 31:

-Refer to the Acme annual report above.Calculate the current ratio for 2010.

-Refer to the Acme annual report above.Calculate the current ratio for 2010.

(Multiple Choice)

4.9/5  (39)

(39)

Owning only stocks is riskier than owning both stocks and bonds.

(True/False)

4.9/5  (46)

(46)

Discontinued operations need to be treated separately from regular business operations on the ________.

(Multiple Choice)

5.0/5  (33)

(33)

In horizontal analysis,each item on a balance sheet is expressed as a percentage of total assets.

(True/False)

4.9/5  (38)

(38)

Comprehensive income is the total of all items that affect shareholders' equity except transactions with the owners.

(True/False)

4.9/5  (34)

(34)

Which financial statement(s)do you need to calculate the debt-to-equity ratio?

(Multiple Choice)

4.8/5  (36)

(36)

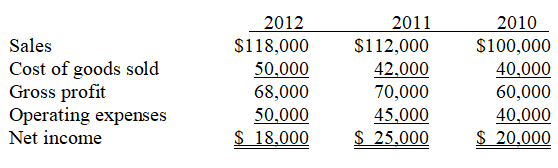

The following information is provided from Ace Electronics' annual report for the years ended December 31:

-Refer to the Ace Electronics annual report above.Using horizontal analysis with 2010 as the base year, Gross profit would be represented as ________.

-Refer to the Ace Electronics annual report above.Using horizontal analysis with 2010 as the base year, Gross profit would be represented as ________.

(Multiple Choice)

4.9/5  (44)

(44)

Showing 141 - 160 of 273

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)