Exam 2: Job Order Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles198 Questions

Exam 2: Job Order Costing and Analysis154 Questions

Exam 3: Process Costing and Analysis186 Questions

Exam 4: Activity-Based Costing and Analysis172 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis180 Questions

Exam 6: Variable Costing and Performance Reporting177 Questions

Exam 7: Master Budgets and Performance Planning162 Questions

Exam 8: Flexible Budgets and Standard Costing177 Questions

Exam 9: Performance Measurement and Responsibility Accounting157 Questions

Exam 10: Relevant Costing for Managerial Decisions138 Questions

Exam 11: Capital Budgeting and Investment Analysis148 Questions

Exam 12: Reporting and Analyzing Cash Flows170 Questions

Exam 13: Analyzing Financial Statements183 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Basic Accounting for Transactions209 Questions

Exam 16: Accounting for Partnerships126 Questions

Select questions type

RC Corp.uses a job order cost accounting system.During the month of April, the following events occurred:

A.Purchased raw materials on credit, $32,000.

B.Raw materials requisitioned: $25,800 as direct materials and $10,500 indirect materials.

C.Paid factory payroll for the month totaling $37,700 which includes $8,200 indirect labor.

D.Assigned the factory payroll to jobs and overhead.

Make the necessary journal entries to record the above transactions and events.

(Essay)

4.8/5  (38)

(38)

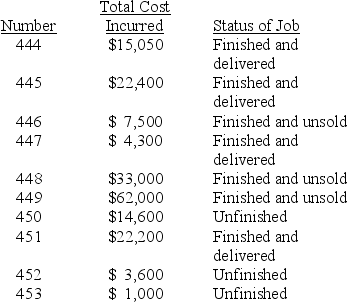

The Terrapin Manufacturing Company has the following job cost sheets on file.They represent jobs that have been worked on during June of the current year.This table summarizes information provided on each sheet:

a.What is the cost of the goods in process inventory on June 30?

b.What is the cost of the finished goods inventory on June 30?

c.What is the cost of goods sold for the month of June?

a.What is the cost of the goods in process inventory on June 30?

b.What is the cost of the finished goods inventory on June 30?

c.What is the cost of goods sold for the month of June?

(Essay)

4.9/5  (44)

(44)

A material amount of overapplied or underapplied overhead should be disposed of by allocating it to:

(Multiple Choice)

4.8/5  (36)

(36)

A job order cost accounting system would best fit the needs of a company that makes:

(Multiple Choice)

4.9/5  (38)

(38)

Explain what a predetermined overhead allocation rate is, how it is calculated, and why it is used.

(Essay)

5.0/5  (34)

(34)

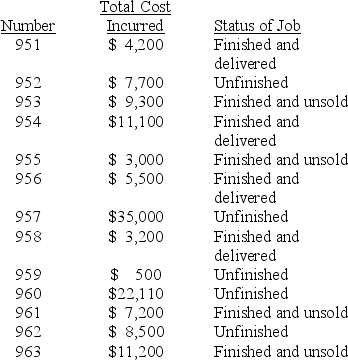

The Johnson Manufacturing Company has the following job cost sheets on file.They represent jobs that have been worked on during March of the current year.This table summarizes information provided on each sheet:

A.What is the cost of goods sold for the month of March?

B.What is the cost of the goods in process inventory on March 31?

C.What is the cost of the finished goods inventory on March 31?

A.What is the cost of goods sold for the month of March?

B.What is the cost of the goods in process inventory on March 31?

C.What is the cost of the finished goods inventory on March 31?

(Essay)

4.8/5  (38)

(38)

A clock card is a source document that an employee uses to report how much time was spent working on a job or on overhead and that is used to determine the amount of direct labor to charge to the job or to determine the amount of indirect labor to charge to factory overhead.

(True/False)

4.9/5  (48)

(48)

A materials requisition is a source document used by production managers to request materials for manufacturing and also used to assign materials costs to specific jobs or to overhead.

(True/False)

5.0/5  (43)

(43)

The amount by which the overhead applied to jobs during a period exceeds the overhead incurred during the period is known as:

(Multiple Choice)

4.8/5  (33)

(33)

Job cost sheets are used to track all of the costs assigned to a job, including direct materials, direct labor, overhead, and all selling and administrative costs.

(True/False)

4.8/5  (35)

(35)

A system of accounting for manufacturing operations that produces timely information about inventories and manufacturing costs per unit of product is a:

(Multiple Choice)

4.8/5  (31)

(31)

As direct materials are used on a job, their cost is debited to the Finished Goods Inventory account.

(True/False)

4.9/5  (31)

(31)

Briefly describe how manufacturing firms dispose of overapplied or underapplied factory overhead.

(Essay)

4.9/5  (37)

(37)

Job order manufacturing systems would be appropriate for companies that produce custom homes, specialized equipment, and special computer systems.

(True/False)

4.8/5  (42)

(42)

There are two basic types of cost accounting systems: job order costing and periodic costing.

(True/False)

4.8/5  (33)

(33)

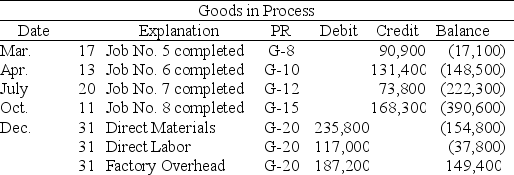

A company uses a job order cost accounting system and applies overhead on the basis of direct labor cost.At the end of a recent period, the company's Goods in Process Inventory account appeared as follows:

Write in the blanks for the following:

A.The total cost of the direct materials, direct labor, and factory overhead applied in the December 31 goods in process inventory is $_______________________.

B The company's overhead application rate is __________________%

C Job No.6 had $26,550 of direct labor cost.Therefore, the job must have had $________ of direct materials cost.

D.Job No.8 had $73,998 of direct materials cost.Therefore, the job must have had $________ of factory overhead cost.

Write in the blanks for the following:

A.The total cost of the direct materials, direct labor, and factory overhead applied in the December 31 goods in process inventory is $_______________________.

B The company's overhead application rate is __________________%

C Job No.6 had $26,550 of direct labor cost.Therefore, the job must have had $________ of direct materials cost.

D.Job No.8 had $73,998 of direct materials cost.Therefore, the job must have had $________ of factory overhead cost.

(Essay)

5.0/5  (32)

(32)

Predetermined overhead rates are necessary because cost accountants use periodic inventory systems.

(True/False)

4.8/5  (33)

(33)

A company has an overhead application rate of 125% of direct labor costs.How much overhead would be allocated to a job if it required total labor costing $20,000?

(Multiple Choice)

4.9/5  (42)

(42)

Factory overhead is often collected and summarized in a factory overhead ledger.

(True/False)

4.9/5  (40)

(40)

The R&R Company's manufacturing costs for August are: direct labor, $13,000; indirect labor, $6,500; direct materials, $15,000; taxes on raw materials and work in process, $800; heat, lights, and power, $1,000; and insurance on plant and equipment, $200.R&R Company's factory overhead incurred for August is:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 21 - 40 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)