Exam 15: Basic Accounting for Transactions

Exam 1: Managerial Accounting Concepts and Principles198 Questions

Exam 2: Job Order Costing and Analysis154 Questions

Exam 3: Process Costing and Analysis186 Questions

Exam 4: Activity-Based Costing and Analysis172 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis180 Questions

Exam 6: Variable Costing and Performance Reporting177 Questions

Exam 7: Master Budgets and Performance Planning162 Questions

Exam 8: Flexible Budgets and Standard Costing177 Questions

Exam 9: Performance Measurement and Responsibility Accounting157 Questions

Exam 10: Relevant Costing for Managerial Decisions138 Questions

Exam 11: Capital Budgeting and Investment Analysis148 Questions

Exam 12: Reporting and Analyzing Cash Flows170 Questions

Exam 13: Analyzing Financial Statements183 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Basic Accounting for Transactions209 Questions

Exam 16: Accounting for Partnerships126 Questions

Select questions type

If the Debit and Credit column totals of a trial balance are equal, then:

(Multiple Choice)

4.8/5  (34)

(34)

Wisconsin Rentals purchased office supplies on credit.The journal entry made by Wisconsin Rentals to record this transaction will include a:

(Multiple Choice)

4.8/5  (45)

(45)

A trial balance that is in balance is proof that no errors were made in journalizing the transactions, posting to the ledger, and preparing the trial balance.

(True/False)

4.8/5  (39)

(39)

A trial balance that balances is not proof of complete accuracy in recording transactions.

(True/False)

4.8/5  (41)

(41)

A company failed to post a $50 debit to the Office Supplies account.The effect of this error will be that:

(Multiple Choice)

4.8/5  (41)

(41)

Explain the debt ratio and its use in analyzing a company's financial condition.

(Essay)

4.8/5  (36)

(36)

On November 30, a company had an Accounts Receivable balance of $5,100.During the month of December, total credits to Accounts Receivable were $76,000 from customer payments.The December 31 Accounts Receivable balance was $43,000.What was the amount of credit sales during December?

(Multiple Choice)

4.8/5  (38)

(38)

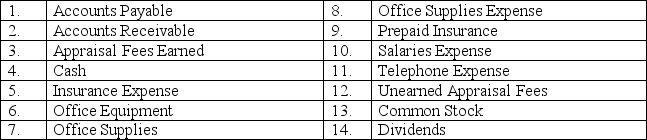

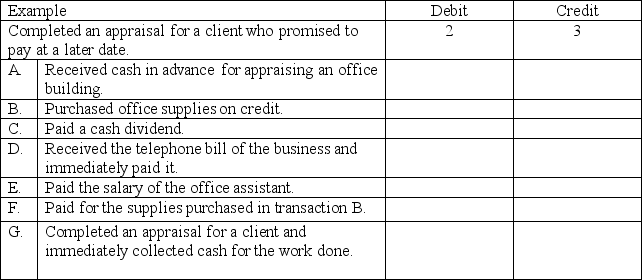

David Roberts is a real estate appraiser.Shown below are (a)several accounts in his ledger with each account preceded by an identification number and (b)several transactions completed by Roberts.Indicate the accounts debited and credited when recording each transaction by placing the proper account identification numbers to the right of each transaction.

(Essay)

4.9/5  (39)

(39)

An account is a record of increases and decreases in a specific asset, liability, equity, revenue, or expense item.

(True/False)

4.8/5  (40)

(40)

Robert Haddon contributed $70,000 in cash and some land worth $130,000 to open a new business, RH Consulting.Which of the following general journal entries will RH Consulting make to record this transaction?

(Multiple Choice)

4.7/5  (30)

(30)

If a company pays cash to purchase land, the journal entry to record this transaction will include a debit to Cash.

(True/False)

4.9/5  (32)

(32)

On December 3, the Matador Company paid $5,400 cash in salaries to office personnel.Prepare the general journal entry to record this transaction.

(Essay)

4.9/5  (43)

(43)

If a company provides services to a customer on credit, the service provider company should credit Accounts Receivable.

(True/False)

4.8/5  (36)

(36)

___________________ is a promise of payment from customers to sellers.

(Short Answer)

4.8/5  (36)

(36)

A collection of all accounts (with account balances)used by a business is called a:

(Multiple Choice)

4.7/5  (38)

(38)

On October 1, 2011, Smith invested $20,000 cash, office equipment costing $15,000, and drafting equipment costing $12,000 into the company in exchange for common stock.Show the general journal entry to record this transaction.

(Essay)

4.9/5  (33)

(33)

Showing 161 - 180 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)