Exam 12: Reporting and Analyzing Cash Flows

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

Explain the value of separating cash flows into operating activities,investing activities,and financing activities has to financial statement users when it comes analyzing cash flows and the company's financial condition.

(Essay)

4.8/5  (39)

(39)

When analyzing the changes on a spreadsheet used to prepare a statement of cash flows,the cash flows from investing activities generally affect:

(Multiple Choice)

4.9/5  (38)

(38)

The FASB recommends that the operating section of the statement of cash flows be reported using the direct method.

(True/False)

4.8/5  (32)

(32)

Define the cash flow on total assets ratio and explain how it is used to evaluate cash flows and to assess company performance.

(Essay)

4.7/5  (40)

(40)

Wessen Company reports net income of $180,000 for the year ended December 31,2013.It also reports $45,800 depreciation expense,$21,410 amortization expense,and a $15,000 gain on the sale of machinery.Its comparative balance sheets reveal a $28,300 increase in accounts receivable,$20,400 decrease in accounts payable,$10,470 increase in prepaid expenses,and $33,140 decrease in wages payable.What net cash flows are provided (used) by operating activities using the indirect method?

(Multiple Choice)

4.7/5  (40)

(40)

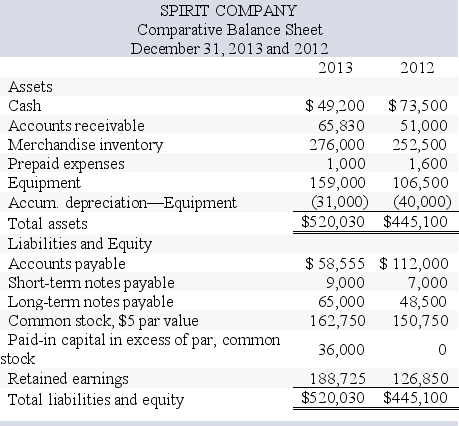

Spirit Company,a merchandiser,recently completed the 2013 calendar year.For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory,and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.The company's balance sheet and income statement follow:

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

a.The loss on the cash sale of equipment was $5,875 (details in b).

b.Sold equipment costing $46,500, for a loss of $5,875.

c.Purchased equipment costing $99,000 by paying $35,000 cash and signing a long-term note payable for the balance.

d.Borrowed $2,000 cash by signing a non-sales related short-term note payable.

e.Paid $47,500 cash to reduce the long-term notes payable.

f.Issued 2,400 shares of common stock for $20 cash per share.

g.Net income and dividends were the only items that affected retained earnings.

-Required: What is the amount of dividends declared and distributed in 2013?

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

a.The loss on the cash sale of equipment was $5,875 (details in b).

b.Sold equipment costing $46,500, for a loss of $5,875.

c.Purchased equipment costing $99,000 by paying $35,000 cash and signing a long-term note payable for the balance.

d.Borrowed $2,000 cash by signing a non-sales related short-term note payable.

e.Paid $47,500 cash to reduce the long-term notes payable.

f.Issued 2,400 shares of common stock for $20 cash per share.

g.Net income and dividends were the only items that affected retained earnings.

-Required: What is the amount of dividends declared and distributed in 2013?

(Multiple Choice)

4.9/5  (32)

(32)

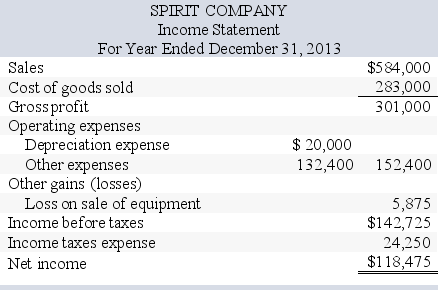

For each of the following items,indicate whether it would be classified as an (O) operating activity,an (I) investing activity,a (F) financing activity or a significant, (N) noncash financing and investing activity.

(Essay)

4.7/5  (34)

(34)

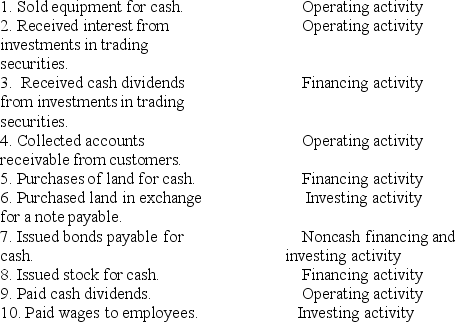

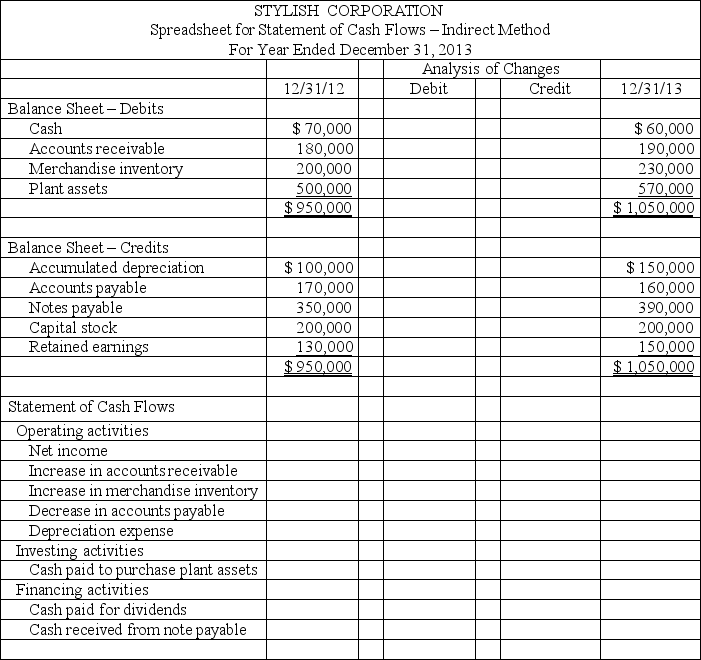

Based on the information provided below,complete the following worksheet to be used to prepare the statement of cash flows:

(a) Net income for the year was $30,000.

(b) Dividends of $10,000 were declared and paid.

(c) Stylish's only noncash expense was depreciation,which totaled $50,000.

(d) The company purchased plant assets for $70,000.

(e) Notes payable in the amount of $40,000 were issued during the year for cash.

(f) Accounts receivable increased $10,000.

(g) Merchandise inventory increased $30,000.

(h) Accounts payable decreased $10,000,

(Essay)

4.9/5  (42)

(42)

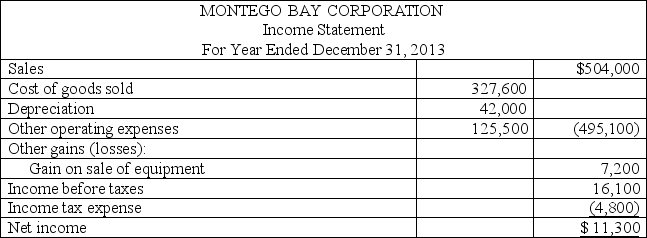

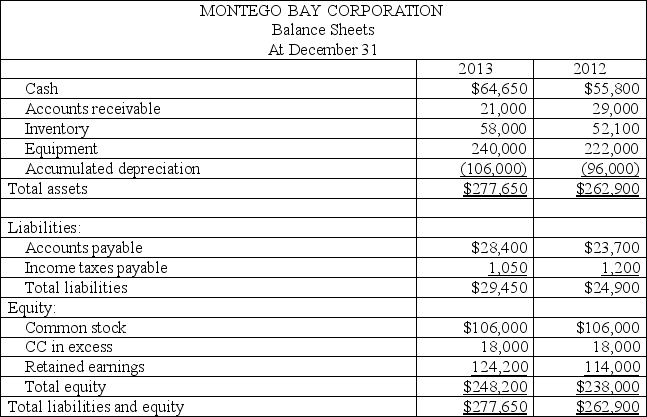

Based on the following income statement and balance sheet for Montego Bay Corporation,determine the cash flows from operating activities using the direct method.

(Essay)

4.9/5  (41)

(41)

A machine with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash.The amount that should be reported as a source of cash under cash flows from investing activities is:

(Multiple Choice)

4.8/5  (37)

(37)

The statement of cash flows explains how transactions and events impact the end-of-period cash balance to produce the end-of-period net income balance.

(True/False)

4.9/5  (30)

(30)

The reporting of financing activities is identical under either the direct and indirect methods for preparing the statement of cash flows.

(True/False)

4.9/5  (37)

(37)

Equipment costing $100,000 with accumulated depreciation of $40,000 is sold at a loss of $10,000.This implies that $90,000 cash was received from the sale.

(True/False)

4.8/5  (43)

(43)

A cash equivalent must be readily convertible to a known amount of cash and must be sufficiently close to its maturity so its market value is unaffected by interest rate changes.

(True/False)

4.8/5  (43)

(43)

A company's inventory balance was $200,000 at 12/31/11 and $188,000 at 12/31/12.Its accounts payable balance was $80,000 at 12/31/11 and $84,000 at 12/31/12,and its cost of goods sold for 2012 was $720,000.The company's total amount of cash payments for merchandise in 2012 equals:

(Multiple Choice)

4.9/5  (36)

(36)

Which one of the following is representative of typical cash flows from operating activities?

(Multiple Choice)

4.8/5  (37)

(37)

A company's transactions with its creditors to borrow money and/or to repay the principal amounts of loans are reported as cash flows from:

(Multiple Choice)

4.8/5  (34)

(34)

When preparing the operating section of the statement of cash flows using the indirect method,noncash operating expenses are added back to net income.

(True/False)

4.9/5  (36)

(36)

Describe the format of the statement of cash flows,including the reporting of significant noncash investing and financing activities.

(Essay)

5.0/5  (44)

(44)

Noncash financing activities are disclosed in a note in the financing section of the statement of cash flows.

(True/False)

4.8/5  (37)

(37)

Showing 21 - 40 of 172

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)