Exam 10: Reporting and Analyzing Long-Term Liabilities

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

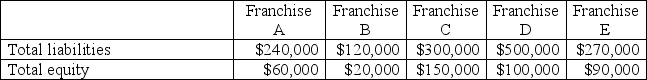

Using the debt to equity ratio,which of the following franchises would be assessed as having the riskiest financing structure?

(Multiple Choice)

4.8/5  (30)

(30)

Bonds that give the issuer an option of retiring them prior to the date of maturity are:

(Multiple Choice)

4.9/5  (41)

(41)

On January 1,2013,Jacob issues $800,000 of 9%,13-year bonds at a price of 96½.Six years later,on January 1,2019,Jacob retires 20% of these bonds by buying them on the open market at 105½.All semiannual interest is accounted for and paid through December 31,2018,the day before the purchase.The straight-line method is used to amortize any bond discount or premium.What is the journal entry to record the retirement of 20% of the bonds on January 1,2019?

(Multiple Choice)

4.9/5  (42)

(42)

On January 1,2013,$1,200,000,5-year,bonds with a stated rate of 10% payable annually were issued for cash of $1,295,844 when the market rate of interest was 8%.The first annual cash interest payment was $120,000 while that period's interest expense was calculated as $103,666.How would the company record the journal entry to record this first annual interest payment?

(Multiple Choice)

4.8/5  (31)

(31)

An ________________________________ is an obligation requiring a series of payments to the lender.

(Short Answer)

4.8/5  (38)

(38)

A company issues bonds at par on April 1.These 9% bonds have a par value of $100,000 and pay interest annually.April 1 is four months after the most recent interest payment date.How much total cash interest is received on April 1 by the bond issuer?

(Multiple Choice)

4.9/5  (39)

(39)

Shin Company has a loan agreement that provides it with cash today.The company must repay this loan in four years with $25,000.Shin agrees to a 6% interest rate.The present value factor for four periods,6%,is 0.7921.What is the amount of cash that Shin Company receives today?

(Short Answer)

5.0/5  (39)

(39)

If an issuer sells a bond at any other date than the interest payment date:

(Multiple Choice)

4.8/5  (32)

(32)

On January 1,2013,Jacob issues $600,000 of 11%,15-year bonds at a price of 102½.The straight-line method is used to amortize any bond discount or premium.What is the journal entry to record the first interest semi-annual interest payment on June 30,2013?

(Multiple Choice)

4.8/5  (38)

(38)

Carrington Industries converts $200,000 of par value bonds,with a carrying value of $100,000,into 50,000 shares of $1 par value common stock..How would the company record this transaction?

(Multiple Choice)

4.8/5  (41)

(41)

A company issued 10-year,9% bonds with a par value of $500,000 when the market rate was 9.5%.The company received $484,087 in cash proceeds.Using the straight-line method,prepare the issuer's journal entry to record the first annual interest payment and the amortization of any bond discount or premium.

(Essay)

4.7/5  (39)

(39)

Martin Corporation issued $3,000,000 of 8%,20-year bonds payable at par value on January 1,2013.Interest is payable each June 30 and December 31.

(a) Prepare the general journal entry to record the issuance of the bonds on January 1,2013.

(b) Prepare the general journal entry to record the first interest payment on June 30,2013.

(Essay)

4.7/5  (43)

(43)

____________________ leases are long-term or noncancelable leases by which the lessor transfers substantially all risks and rewards of ownership to the lessee.

(Short Answer)

4.9/5  (37)

(37)

An annuity is a series of equal payments made at equal time intervals.

(True/False)

4.8/5  (35)

(35)

A company has bonds outstanding with a par value of $100,000.The unamortized discount on these bonds is $4,500.The company retired these bonds by buying them on the open market at 97.What is the gain or loss on this retirement?

(Multiple Choice)

4.7/5  (40)

(40)

On January 1,2013,the Plimpton Corporation leased some equipment for two years,paying $15,000 per year each December 31.The lease is considered to be an operating lease.Prepare the general journal entry to record the first lease payment on December 31,2013.

(Essay)

4.9/5  (40)

(40)

To provide security to creditors and to reduce interest costs,bonds and notes payable can be secured by:

(Multiple Choice)

4.7/5  (33)

(33)

A company issues bonds at par on June 1.These 7% bonds have a par value of $500,000 and pay interest annually.June 1 is five months after the most recent interest payment date.How much total cash interest is received on June 1 by the bond issuer?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 161 - 180 of 194

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)