Exam 10: Reporting and Analyzing Long-Term Liabilities

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

A company issued 8%,15-year bonds with a par value of $550,000.The current market rate is 8%.The journal entry to record each semiannual interest payment is:

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following statements is true? For the issuer:

(Multiple Choice)

4.7/5  (37)

(37)

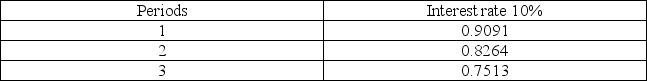

Assume that a company has a loan agreement that provides it with cash today and that the company must pay $25,000 one year from today,$15,000 two years from today,and $5,000 three years from today.The company agrees to pay 10% interest.The following factors are from the present value of $1 table:

What is the amount of cash the company receives today?

What is the amount of cash the company receives today?

(Essay)

4.8/5  (28)

(28)

A discount on bonds payable occurs when a company issues bonds at a price less than par value.

(True/False)

4.9/5  (35)

(35)

A company issued 10-year,9% bonds,with a par value of $500,000 when the market rate was 9.5%.The issuer received $484,087 in cash proceeds.Prepare the issuer's journal entry to record the issuance of the bonds.

(Essay)

4.9/5  (34)

(34)

A bond listed at 103 on a stock exchange is selling at 103% of its par value.

(True/False)

4.7/5  (36)

(36)

On October 1 of the current year a corporation sold,at par plus accrued interest,$1,000,000 of its 12% bonds,which were dated July 1 of this year.What amount of bond interest expense should the company report on its current year income statement?

(Short Answer)

4.9/5  (35)

(35)

A company can reserve the right to retire bonds before their maturity date by issuing _______________ bonds.

(Short Answer)

4.9/5  (35)

(35)

A company issues bonds with a par value of $900,000 on their stated issue date.The bonds mature in 10 years and pays 10% annual interest in semiannual payments.On the issue date,the annual market rate for the bonds is 12%.What is the selling price of the bond?

(Short Answer)

4.7/5  (35)

(35)

Adidas issued 10-year,8% bonds with a par value of $200,000,where interest is paid semiannually.The market rate on the issue date was 7.5%.Adidas received $206,948 in cash proceeds.Which of the following statements is true?

(Multiple Choice)

4.9/5  (33)

(33)

On January 1,2013,Jacob issues $600,000 of 11%,15-year bonds at a price of 102½.What is the journal entry to record the issuance of these bonds?

(Multiple Choice)

5.0/5  (30)

(30)

A corporation borrowed $125,000 cash by signing a five-year,9% installment note requiring annual payments each December 31 of accrued interest plus equal amounts of principal.What journal entry would the issuer record for the first payment?

(Multiple Choice)

4.9/5  (35)

(35)

Explain the accounting procedures when a bond's interest period does not coincide with the issuer's accounting period.

(Essay)

4.8/5  (26)

(26)

A common payment pattern for installment notes is to pay the accrued interest periodically and to pay the principle amount on the maturity date.

(True/False)

4.9/5  (46)

(46)

A company borrowed $300,000 cash from the bank by signing a five-year,8% installment note.The present value factor for an annuity at 8% for five years is 3.9927.Each annuity payment equals $75,137.How much cash did the company receive from the bank on the day they borrowed this money?

(Multiple Choice)

4.9/5  (39)

(39)

A company has $200,000 par value,10% bonds outstanding.Prepare the company's journal entry to retire the bonds at the date of maturity.

(Essay)

5.0/5  (33)

(33)

On January 1,2013,Jacob issued $600,000 of 11%,15-year bonds at a price of 102½.The straight-line method is used to amortize any bond discount or premium and interest is paid semiannually.All interest has been accounted for (and paid) through December 31,2018.The company retires 30% of these bonds by buying them on the open market at 98½. What is the journal entry to record the retirement of 30% of the bonds on January 1,2019?

(Multiple Choice)

4.8/5  (28)

(28)

A _______________________ is a contractual agreement between an employer and its employees for the employer to provide benefits (payments) to employees after they retire.

(Short Answer)

4.9/5  (32)

(32)

Showing 101 - 120 of 194

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)