Exam 16: Accounting for Partnerships

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

In the absence of a partnership agreement,the law says that income and loss should be allocated based on:

(Multiple Choice)

4.9/5  (43)

(43)

Assets invested by a partner into a partnership remain the property of the individual partner.

(True/False)

4.8/5  (48)

(48)

Assume that the S & B partnership agreement gave Steely 60% and Breck 40% of partnership income and losses.The partnership recorded a loss of $27,000 in the current period.Steely's share of the loss equals $16,200 and Breck's share equals $10,800.

(True/False)

4.8/5  (34)

(34)

In closing the accounts at the end of a period,the partners' capital accounts are credited for their share of the partnership loss or debited for their share of the partnership net income.

(True/False)

4.7/5  (44)

(44)

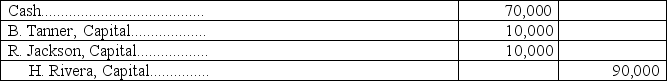

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

(Multiple Choice)

4.8/5  (22)

(22)

The equity section of the balance sheet of a partnership can report the separate capital account balances of each partner.

(True/False)

4.9/5  (37)

(37)

When a partner leaves a partnership,the withdrawing partner is entitled to a bonus if the recorded equity is overstated.

(True/False)

4.7/5  (33)

(33)

The partnership shows the following capital balances at the date of Lance's withdrawal: Willow,$84,000,Lance,$38,000,and Jordan,$38,000.The partners (Willow,Lance,and Jordan) share income and loss equally.Lance withdraws and is paid $38,000 of cash.How would the partnership record the withdrawal of Lance?

(Multiple Choice)

4.8/5  (32)

(32)

The BlueFin Partnership agreed to dissolve.The remaining cash balance after liquidating partnership assets and liabilities is $60,000.The final capital account balances are: Smith,$30,000; Nagy,$20,000; and Russ,$10,000.Prepare the journal entry to distribute the remaining cash to the partners.

(Essay)

4.8/5  (44)

(44)

Elaine Valero is a limited partner in a marketing and design firm.During the previous year her return on partnership equity was 14%.During this time,the beginning and ending balances in her capital account were $210,000 and $230,000 respectively.What was Elaine's partnership net income for this year?

(Multiple Choice)

4.8/5  (38)

(38)

The BlueFin Partnership agrees to dissolve.The cash balance after selling all assets and paying all liabilities is $56,000.The final capital account balances are: Smith,$33,000; Nagy,$27,000; and Russ, ($4,000).Russ agrees to pay $4,000 cash from personal funds to settle his deficiency.Prepare the journal entries to record the transactions required to dissolve this partnership.

(Essay)

4.8/5  (27)

(27)

Web Services is organized as a limited partnership,with Wren Littlefeather as one of its partners.Wren's capital account began the year with a balance of $87,000.During the year,Wren's share of the partnership income was $60,000 and she received $25,000 in distributions from the partnership.What is Wren's partner return on equity?

(Multiple Choice)

4.9/5  (31)

(31)

Brown and Rubix are partners.Brown's capital balance in the partnership is $73,000 and Rubix's capital balance is $62,000.Brown and Rubix have agreed to share equally in income or loss.Brown and Rubix agree to accept Cabela with a 20% interest.Cabela will invest $41,500 in the partnership.The bonus that is granted to Brown and Rubix equals:

(Multiple Choice)

4.8/5  (34)

(34)

Showing 121 - 134 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)