Exam 16: Accounting for Partnerships

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

Groh and Jackson are partners.Groh's capital balance in the partnership is $64,000 and Jackson's capital balance is $61,000.Groh and Jackson have agreed to share equally in income or loss.Groh and Jackson agree to accept Block with a 25% interest.Block will invest $35,000 in the partnership.The bonus that is granted to Block equals:

(Multiple Choice)

4.9/5  (41)

(41)

S.Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership.The journal entry to record the transaction for the partnership is:

(Multiple Choice)

4.8/5  (39)

(39)

Partnership net income of $150,000 is to be divided between two partners,Jessie Folk and Jessica Stephens,according to the following arrangement: There will be salary allowances of $86,000 for Folk and $43,000 for Stephens,with the remainder divided equally.How would the partnership record the allocation of new income to the partners?

(Multiple Choice)

4.9/5  (33)

(33)

The capital balances of Able,Bligh,and Coulter,who share income in the ratio of 2:2:1,are as follows: Able $240,000,Bligh $120,000,and Coulter $40,000.Jeshua invests $200,000 cash in the partnership for a 20% interest.How would the partnership record the admission of Jeshua?

(Multiple Choice)

4.9/5  (47)

(47)

During 2013,Carpenter invested $75,000 and DiAngelo invested $90,000 in a partnership.They agreed to share income and loss by allowing a $40,000 per year salary allowance to Carpenter and a $42,000 per year salary allowance to DiAngelo,plus an interest allowance on the partners' beginning-year capital investments at 8%,with the balance to be shared equally.Under this agreement,if the partnership earns net income of $300,000 during 2013 the income allocated to each partner is:

(Multiple Choice)

4.9/5  (46)

(46)

Beard,Tanner,Williams are operating as a partnership.The capital account balances at December 31,2013 are $254,000,$195,000 and $286,000 respectively.Record the entries for the following independent situations.

a.The partners vote to admit Sturges.She is going to invest $150,000 for a 15% interest in the partnership.Profit and losses are split equally between the existing partners.

b.Sturges agrees to buy 50% of Williams interest by paying him $150,000 directly.

c.The partners need new ideas and agree to give Sturges a 20% interest in exchange for $150,000.Profits and losses are shared equally between the existing partners.

d.Williams wants to retire and is willing to leave the partnership in exchange for $281,000.Profits and losses were shared on the ratio of 2:3:5.

(Essay)

5.0/5  (33)

(33)

Limited liability partnerships are designed to protect innocent partners from malpractice or negligence claims resulting from the acts of another partner.

(True/False)

4.9/5  (38)

(38)

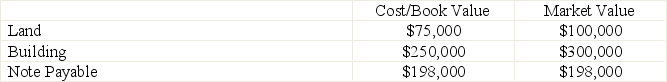

Kathleen Reilly and Ann Wolf decide to form a partnership on August 1.Reilly invested the following assets and liabilities in the new partnership:

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

(Essay)

4.8/5  (34)

(34)

A partnership that has two classes of partners,general and limited,where the limited partners have no personal liability beyond the amounts they invest in the partnership and no active role in the partnership except as specified in the partnership agreement,is a:

(Multiple Choice)

4.8/5  (39)

(39)

To buy into an existing partnership,the new partner must contribute cash.

(True/False)

4.8/5  (34)

(34)

The partnership shows the following capital balances after the allocation of liquidation gains and losses: Kapoor,$22,000,Patel,$11,000,and Punjab,$9,000.After selling the noncash assets and paying the liabilities of the partnership,the Cash account has a balance of $40,000.The partners share income and loss equally.Any remaining cash is divided among the partners according to their capital account balances.How would the partnership record this transaction?

(Multiple Choice)

4.8/5  (30)

(30)

Nguyen invested $100,000 and Hansen invested $200,000 in a partnership.They agreed to share income and loss by allowing a $60,000 per year salary allowance to Nguyen and a $40,000 per year salary allowance to Hansen,plus an interest allowance on the partners' beginning-year capital investments at 10%,with the balance to be shared equally.Under this agreement,the shares of the partners when the partnership earns a $105,000 in income are:

(Multiple Choice)

4.8/5  (44)

(44)

When partners invest in a partnership,their capital accounts are credited for the amount invested.

(True/False)

4.8/5  (34)

(34)

Partners in a partnership are taxed on _______________________,not on their withdrawals.

(Short Answer)

4.8/5  (35)

(35)

Groh and Jackson are partners.Groh's capital balance in the partnership is $64,000 and Jackson's capital balance is $61,000.Groh and Jackson have agreed to share equally in income or loss.Groh and Jackson agree to accept Block with a 25% interest.Block will invest $35,000 in the partnership.The capital account balances after admission of Block are:

(Multiple Choice)

4.9/5  (35)

(35)

A partner can be admitted into a partnership by ________________________ or by ______________________________.

(Essay)

4.8/5  (36)

(36)

Showing 21 - 40 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)