Exam 15: Investments

Exam 1: Accounting in Business331 Questions

Exam 2: Analyzing for Business Transactions293 Questions

Exam 3: Adjusting Accounts for Financial Statements445 Questions

Exam 4: Accounting for Merchandising Operations267 Questions

Exam 5: Inventories and Cost of Sales258 Questions

Exam 6: Cash, fraud, and Internal Controls230 Questions

Exam 7: Accounting for Receivables237 Questions

Exam 8: Accounting for Long-Term Assets283 Questions

Exam 9: Accounting for Current Liabilities258 Questions

Exam 10: Accounting for Long-Term Liabilities250 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows265 Questions

Exam 13: Analysis of Financial Statements263 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Investments228 Questions

Exam 16: Partnership Accounting189 Questions

Select questions type

Land used in the company's operations is reported as a long-term investment.

Free

(True/False)

4.8/5  (36)

(36)

Correct Answer:

False

When an investor company owns more than 25% of the voting stock of an investee company,it has a controlling influence.

Free

(True/False)

4.8/5  (37)

(37)

Correct Answer:

False

Match the following terms with the appropriate definitions.

-Financial statements that show the financial position,results of operations,and cash flows of all entities under the parent's control,including those of any subsidiaries.

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

D

On November 12,Higgins,Inc.,a U.S.Company,sold merchandise on credit to Kagome of Japan at a price of 1,500,000 yen.The exchange rate was $0.00837 per yen on the date of sale.On December 31,when Higgins prepared its financial statements,the exchange rate was $0.00843.Kagome paid in full on January 12,when the exchange rate was $0.00861.On December 31,Higgins should prepare the following journal entry:

(Multiple Choice)

4.9/5  (46)

(46)

The cost method of accounting is used for long-term investments in equity securities with significant influence.

(True/False)

5.0/5  (36)

(36)

Financial statements that show the financial position,results of operations,and cash flows of all entities under the parent company's control,including all subsidiaries are known as:

(Multiple Choice)

4.9/5  (36)

(36)

Silver Era Co.exports Southwestern artwork to Japan.Prepare journal entries for the following transactions.

Nov 10 Sold artwork to Ito Company for ¥10,000,000 , terms n/30. The exchange rate was \ 0.009 per yen. Dec 5 Received payment from Ito Company for the November 10 sale. The exchange rate was \ 0.0087 per yen.

(Essay)

4.7/5  (39)

(39)

On January 3,Kostansas Corporation purchased 5,000 shares of Morton,Inc.for $40 per share plus $700 in broker commissions.These shares represent a 40% ownership in Morton,Inc.Prepare the journal entry Kostansas Corporation should record for the investment transaction.

(Essay)

4.8/5  (44)

(44)

What are the accounting basics for debt securities,including recording their acquisition,interest earned,and their disposal?

(Essay)

4.9/5  (40)

(40)

Investments can be classified as all but which of the following:

(Multiple Choice)

4.9/5  (41)

(41)

What is comprehensive income and how is it usually reported in the financial statements?

(Essay)

5.0/5  (39)

(39)

Match the following terms with the appropriate definitions.

-A company that owns a more than 50% controlling interest in a subsidiary.

(Multiple Choice)

4.9/5  (32)

(32)

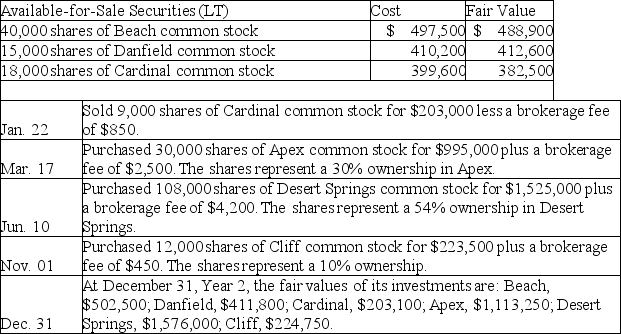

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction, (1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities, (2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in available-for-sale securities, (3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

(Essay)

4.8/5  (33)

(33)

A company has net income of $250,000,net sales of $2,000,000,and average total assets of $1,500,000.Its return on total assets equals:

(Multiple Choice)

4.7/5  (22)

(22)

Zhang Corp.owns 40% of Magnor Company's common stock.Magnor pays $97,000 in total cash dividends to its shareholders.Zhang's entry to record this transaction should include a:

(Multiple Choice)

4.8/5  (35)

(35)

Foreign exchange rates fluctuate due to changes in all but which of the following?

(Multiple Choice)

4.8/5  (32)

(32)

On January 4,Year 1,Barber Company purchased 5,000 shares of Convell Company for $59,500 plus a broker's fee of $1,000.Convell Company has a total of 25,000 shares of common stock outstanding and it is presumed the Barber Company will have a significant influence over Convell.During each of the next two years,Convell declared and paid cash dividends of $0.85 per share,and its net income was $72,000 and $67,000 for Year 1 and Year 2,respectively.

-What is the book value of Barber's investment in Convell at the end of Year 2?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 1 - 20 of 228

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)