Exam 2: Analyzing for Business Transactions

Exam 1: Accounting in Business331 Questions

Exam 2: Analyzing for Business Transactions293 Questions

Exam 3: Adjusting Accounts for Financial Statements445 Questions

Exam 4: Accounting for Merchandising Operations267 Questions

Exam 5: Inventories and Cost of Sales258 Questions

Exam 6: Cash, fraud, and Internal Controls230 Questions

Exam 7: Accounting for Receivables237 Questions

Exam 8: Accounting for Long-Term Assets283 Questions

Exam 9: Accounting for Current Liabilities258 Questions

Exam 10: Accounting for Long-Term Liabilities250 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows265 Questions

Exam 13: Analysis of Financial Statements263 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Investments228 Questions

Exam 16: Partnership Accounting189 Questions

Select questions type

During the month of February,Victor Services had cash receipts of $7,500 and cash disbursements of $8,600.The February 28 cash balance was $1,800.What was the February 1 beginning cash balance?

(Multiple Choice)

4.9/5  (33)

(33)

If Taylor Willow,the sole stockholder of Willow Hardware,uses cash of the business to purchase a family automobile,the business should record this use of cash with an entry to:

(Multiple Choice)

4.8/5  (39)

(39)

A company provided $12,000 of consulting services,and was immediately paid in cash by the customer.Identify the journal entry below that properly records this transaction.

(Multiple Choice)

4.8/5  (38)

(38)

A company's formal promise to pay (in the form of a promissory note)a future amount is a(n):

(Multiple Choice)

4.9/5  (36)

(36)

If a company is highly leveraged,this means that it has relatively high risk of not being able to repay its debt.

(True/False)

4.9/5  (29)

(29)

Revenues and expenses are two categories of ________ accounts.

(Short Answer)

5.0/5  (42)

(42)

Identify the correct formula below used to calculate the debt ratio.

(Multiple Choice)

4.8/5  (42)

(42)

Identify the following accounts as appearing on either the Income Statement (IS) or Balance Sheet (BS).

-Accounts Payable

(Multiple Choice)

4.8/5  (38)

(38)

A balanced trial balance is proof that no errors were made in journalizing transactions,posting to the ledger,and preparing the trial balance.

(True/False)

4.9/5  (41)

(41)

Items such as sales tickets,bank statements,checks,and purchase orders are examples of a business's source documents.

(True/False)

4.7/5  (50)

(50)

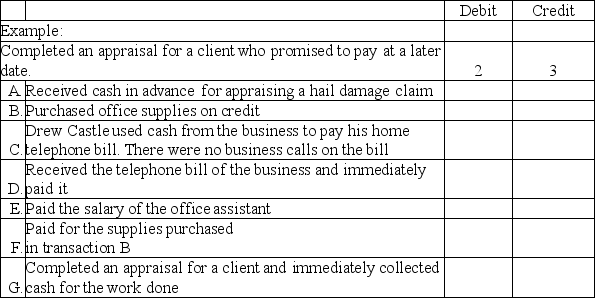

Drew Castle is an insurance appraiser.Shown below are (a)several accounts in his ledger with each account preceded by an identification number,and (b)several transactions completed by Castle.Indicate the accounts debited and credited when recording each transaction by placing the proper account identification numbers to the right of each transaction.

1. Accounts Payable

2. Accounts Receivable

3. Appraisal Fees Earned

4. Cash

5. Insurarice Expense

6. Office Equipment

7. Office Supplies

8. Office Supplies Expense

9. Prepaid Insurance

10. Salaries Expense

11. Telephone Expense

12. Unearned Appraisal Fees

13. Common Stock

14. Dividends

(Essay)

4.9/5  (38)

(38)

At a given point in time,a business's trial balance is a list of all of its general ledger accounts and their balances.

(True/False)

4.8/5  (30)

(30)

Identify each of the following accounts as a revenue (R), expense (E), asset (A), liability (L), or equity (SE).

-Equipment

(Multiple Choice)

4.9/5  (36)

(36)

Identify each of the following accounts as a revenue (R), expense (E), asset (A), liability (L), or equity (SE).

-Office Furniture

(Multiple Choice)

4.8/5  (34)

(34)

Identify each of the following accounts as a revenue (R), expense (E), asset (A), liability (L), or equity (SE).

-Accounts Receivable

(Multiple Choice)

4.8/5  (45)

(45)

When a company bills a customer for $700 for services rendered,the journal entry to record this transaction will include a $700 debit to Services Revenue.

(True/False)

4.9/5  (47)

(47)

A journal entry that affects no more than two accounts is called a compound entry.

(True/False)

4.8/5  (34)

(34)

Wiley Hill opened Hill's Repairs on March 1 of the current year.During March,the following transactions occurred and were recorded in the company's books:

Wiley,the sole stockholder,invested $25,000 cash in the business in exchange for common stock.

Wiley contributed $100,000 of equipment to the business in exchange for common stock.

The company paid $2,000 cash to rent office space for the month of March.

The company received $16,000 cash for repair services provided during March.

The company paid $6,200 for salaries for the month of March.

The company provided $3,000 of services to customers on account.

The company paid cash of $500 for utilities for the month of March.

The company received $3,100 cash in advance from a customer for repair services to be provided in April.

The company paid Wiley $5,000 cash as a dividend.

Based on this information,total stockholder's equity reported on the balance sheet at the end of March would be:

(Multiple Choice)

4.8/5  (32)

(32)

The debt ratio helps to assess the risk a company has of failing to pay its debts and is helpful to both its owners and creditors.

(True/False)

4.8/5  (45)

(45)

Showing 81 - 100 of 293

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)