Exam 19: Cost Management Systems: Activity-Based, just-In-Time, and Quality Management Systems

Exam 1: Accounting and the Business Environment153 Questions

Exam 2: Recording Business Transactions154 Questions

Exam 3: The Adjusting Process152 Questions

Exam 4: Completing the Accounting Cycle156 Questions

Exam 5: Merchandising Operations160 Questions

Exam 6: Merchandise Inventory155 Questions

Exam 7: Internal Control and Cash160 Questions

Exam 8: Receivables138 Questions

Exam 9: Plant Assets, natural Resources, and Intangibles151 Questions

Exam 10: Investments135 Questions

Exam 11: Current Liabilities and Payroll162 Questions

Exam 12: Long-Term Liabilities151 Questions

Exam 13: Stockholders Equity158 Questions

Exam 14: The Statement of Cash Flows154 Questions

Exam 15: Financial Statement Analysis113 Questions

Exam 16: Introduction to Managerial Accounting179 Questions

Exam 17: Job Order Costing152 Questions

Exam 18: Process Costing144 Questions

Exam 19: Cost Management Systems: Activity-Based, just-In-Time, and Quality Management Systems124 Questions

Exam 20: Cost-Volume-Profit Analysis150 Questions

Exam 21: Variable Costing120 Questions

Exam 22: Master Budgets114 Questions

Exam 23: Flexible Budgets and Standard Cost Systems174 Questions

Exam 24: Responsibility Accounting and Performance Evaluation120 Questions

Exam 25: Short-Term Business Decisions161 Questions

Exam 26: Capital Investment Decisions122 Questions

Exam 27: Accounting Information Systems137 Questions

Select questions type

Which of the following is the most appropriate cost driver for allocating the cost of warranty services?

(Multiple Choice)

4.9/5  (34)

(34)

Dunby Inc.is a consulting firm that offers optimal legal solutions.It allocates indirect costs using a single plantwide rate with direct labor hours as the allocation base.The estimated indirect costs for this year amount to $150,000.The company is expected to work for 5,000 direct labor hours during the year.The direct labor rate is $250 per hour.Clients are billed at 140% of direct labor cost.Last month,Dunby's consultants spent 175 hours on Xyme Inc.Calculate the operating income from Xyme.

(Multiple Choice)

4.9/5  (36)

(36)

For a pharmaceutical company,the most suitable base for allocating research and development costs to the finished products would be the ________.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is an attribute of traditional costing systems?

(Multiple Choice)

4.8/5  (48)

(48)

Quality management systems (QMS)are systems that help managers improve the business's performance by providing quality products and services.

(True/False)

4.7/5  (42)

(42)

Which of the following statements is true of costing systems?

(Multiple Choice)

4.8/5  (45)

(45)

The ________ system attracts materials,labor,and overhead into production under a just-in-time management system.

(Multiple Choice)

4.8/5  (38)

(38)

Target cost is calculated by deducting desired gross profit from target sales price.

(True/False)

4.7/5  (32)

(32)

Which of the following statements is true of just-in-time management systems?

(Multiple Choice)

4.9/5  (35)

(35)

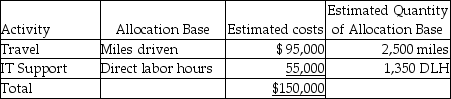

Dunby Inc.,a law consulting firm,has been using a single plantwide rate with direct labor hours as the allocation base to allocate overhead costs.The direct labor rate is $250 per hour.Chandler Massey,the president of Dunby,decided to develop an ABC system to accurately allocate the indirect costs.He identified two activities that amount to the total indirect costs- travel and information technology support.The other relevant details are given below:  During the current month,Dunby's consultants spent 175 labor hours for Xyme Inc.The job required the professionals to travel 30 miles in total.Determine the total cost of the consulting job using the ABC system.

During the current month,Dunby's consultants spent 175 labor hours for Xyme Inc.The job required the professionals to travel 30 miles in total.Determine the total cost of the consulting job using the ABC system.

(Multiple Choice)

4.9/5  (34)

(34)

Adriano Corp.sold 2,500 cell phones on account for $700 each.The standard direct material and conversion costs of each unit are $173.85 and $57.95,respectively.Record the journal entries for this transaction under the just-in-time costing system.

(Essay)

4.9/5  (46)

(46)

Cilia Corp.specializes in the production of finials which is mostly sold within the territory.The selling price for each finial is $15.Using the traditional allocation method to allocate manufacturing overhead,the full-product cost is determined to be $10.The company recently introduced activity-based costing method to allocate its overhead.The refinement of costs shows that the full-product cost is less by $2.50 from the traditional estimate.

Requirement:

1.Calculate and analyze the change in net profit percentage as a result of introduction of activity-based costing.

2.The desired net profit margin of the company is 60%.If the production costs cannot be reduced,by how much should the selling price be increased in order to achieve the desired profit? (Use the cost estimates under activity-based costing.)

(Essay)

4.9/5  (29)

(29)

Direct material costs and direct labor costs cannot be easily traced to products.Therefore,they are allocated to products.

(True/False)

4.9/5  (33)

(33)

Which of the following would most likely be treated as an activity in an activity-based costing system?

(Multiple Choice)

4.8/5  (32)

(32)

Companies which use a just-in-time management system do not benefit from a quality management system.

(True/False)

4.8/5  (38)

(38)

An activity-based costing system is developed in four steps. a.Compute the allocation rate for each activity.

B.Identify activities and estimate their total costs.

C.Identify the cost driver for each activity and then estimate the quantity of each driver's allocation base.

D.Allocate the indirect costs to the cost object.

Which of the following is the correct order of performing these steps?

(Multiple Choice)

4.7/5  (33)

(33)

Companies calculate the predetermined overhead rate at the beginning of an accounting period using the actual values of overhead costs.

(True/False)

4.8/5  (49)

(49)

Showing 21 - 40 of 124

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)