Exam 18: Financial Modeling and Pro Forma Analysis

Exam 1: Corporate Finance and the Financial Manager86 Questions

Exam 2: Introduction to Financial Statement Analysis95 Questions

Exam 3: Time Value of Money: an Introduction112 Questions

Exam 4: Time Value of Money: Valuing Cash Flow Streams62 Questions

Exam 5: Interest Rates110 Questions

Exam 6: Bonds109 Questions

Exam 7: Stock Valuation64 Questions

Exam 8: Investment Decision Rules123 Questions

Exam 9: Fundamentals of Capital Budgeting113 Questions

Exam 10: Stock Valuation: a Second Look46 Questions

Exam 11: Risk and Return in Capital Markets110 Questions

Exam 12: Systematic Risk and the Equity Risk Premium104 Questions

Exam 13: The Cost of Capital107 Questions

Exam 14: Raising Equity Capital107 Questions

Exam 15: Debt Financing101 Questions

Exam 16: Capital Structure109 Questions

Exam 17: Payout Policy110 Questions

Exam 18: Financial Modeling and Pro Forma Analysis95 Questions

Exam 19: Working Capital Management107 Questions

Exam 20: Short-Term Financial Planning104 Questions

Exam 21: Option Applications and Corporate Finance102 Questions

Exam 22: Mergers and Acquisitions47 Questions

Exam 23: International Corporate Finance108 Questions

Exam 24: Leasing46 Questions

Exam 25: Insurance and Risk Management38 Questions

Exam 26: Corporate Governance45 Questions

Select questions type

A firm expects growth next year to be 12%. Its sustainable growth rate is 10%. Which of the following is true?

(Multiple Choice)

4.7/5  (35)

(35)

Use the tables for the question(s) below.

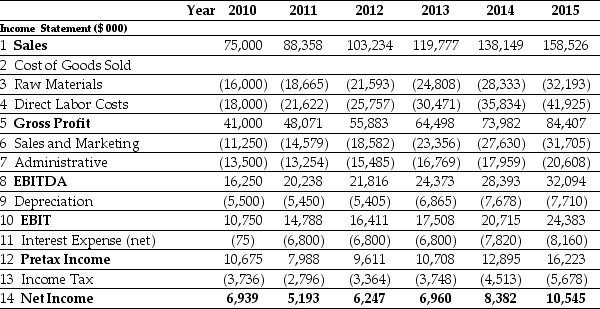

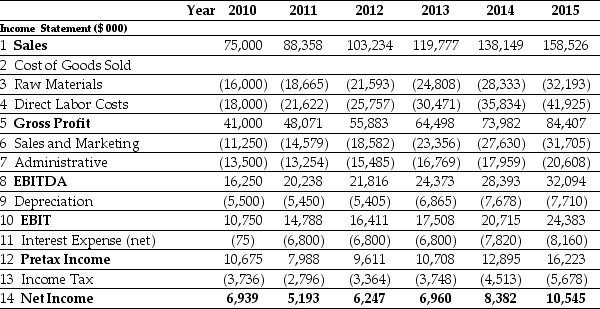

Pro Forma Income Statement for Ideko, 2010-2015

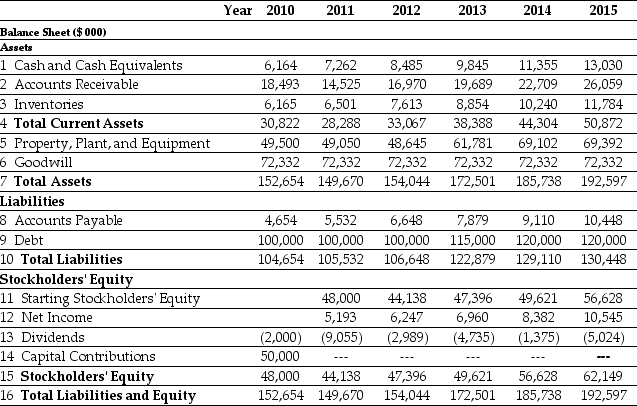

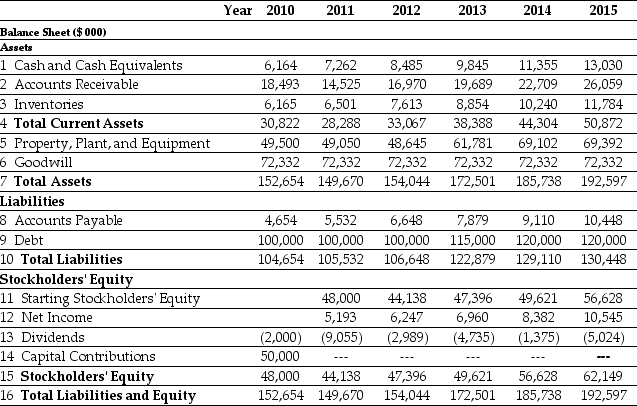

Pro Forma Balance Sheet for Ideko, 2010-2015

Pro Forma Balance Sheet for Ideko, 2010-2015

-Assuming that Ideko has an EBITDA multiple of 8.5, then the continuation levered price-earnings ratio of Ideko in 2015 is closest to ________.

-Assuming that Ideko has an EBITDA multiple of 8.5, then the continuation levered price-earnings ratio of Ideko in 2015 is closest to ________.

(Multiple Choice)

4.8/5  (42)

(42)

The amount of dividends a company pays will affect the ________ it has to finance future growth.

(Multiple Choice)

4.9/5  (34)

(34)

A firm has $50 million in equity and $20 million of debt, it pays dividends of 30% of net income, and has a net income of $10 million. What is the firm's internal growth rate?

(Multiple Choice)

4.7/5  (35)

(35)

Long term financial planning helps a financial manager in budgeting but has little to do with understanding how the business operates.

(True/False)

4.8/5  (32)

(32)

When making long term plans, any increases in ________ and ________ reflect capital structure decisions that require managers to actively raise capital.

(Multiple Choice)

4.8/5  (36)

(36)

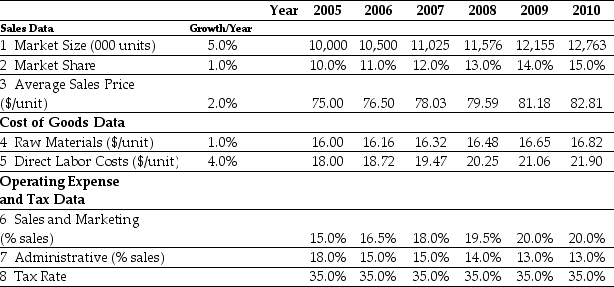

Use the table for the question(s) below.

Ideko Sales and Operating Cost Assumptions

-Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2008?

-Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2008?

(Multiple Choice)

4.7/5  (32)

(32)

A firm expects growth next year to be 10%. Its sustainable growth rate is 12%. Which of the following is true?

(Multiple Choice)

4.7/5  (32)

(32)

The estimate of a firm's value at the end of the forecast horizon using a valuation multiple is also called its ________.

(Multiple Choice)

4.9/5  (34)

(34)

Compute the after-tax interest expense for a firm with Interest on Excess Cash = $2,000, Interest on Debt = $7,000, and a tax rate of 30%.

(Multiple Choice)

4.8/5  (36)

(36)

A firm has interest expense of $2,500 each year for ten years. If the tax rate is 30% and the discount rate is 7%, compute the value of the interest rate tax shield.

(Multiple Choice)

4.9/5  (45)

(45)

The ________ method assumes that as sales grow, many income statement and balance sheet items will grow, remaining the same percent of sales.

(Multiple Choice)

4.9/5  (41)

(41)

Compute the after-tax interest expense for a firm with Interest on Excess Cash = $1,000, Interest on Debt = $5,000, and a tax rate of 30%.

(Multiple Choice)

4.8/5  (37)

(37)

Building a model for long-term forecasting reveals points in the future where the firm will have ________.

(Multiple Choice)

4.9/5  (34)

(34)

A firm has $50 million in equity and $20 million of debt, it pays dividends of 30% of net income, and has a net income of $10 million. What is the firm's sustainable growth rate?

(Multiple Choice)

4.7/5  (30)

(30)

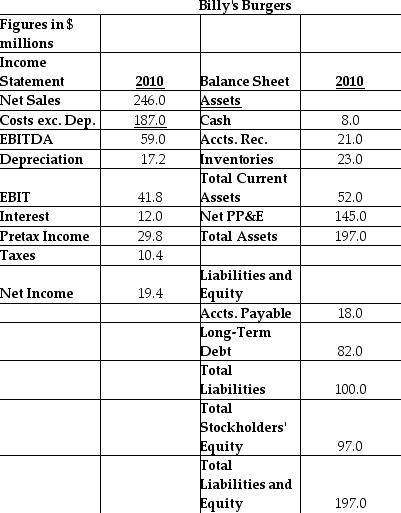

Use the information about Billy's Burgers to answer the following question(s):

-Using the percent of sales method, and assuming 20% growth in sales, estimate Billy's Burgers' depreciation for 2011.

-Using the percent of sales method, and assuming 20% growth in sales, estimate Billy's Burgers' depreciation for 2011.

(Multiple Choice)

4.8/5  (32)

(32)

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2010-2015

Pro Forma Balance Sheet for Ideko, 2010-2015

Pro Forma Balance Sheet for Ideko, 2010-2015

-Assuming that Ideko has an EBITDA multiple of 9.4, then the continuation EV/Sales ratio of Ideko in 2015 is closest to ________.

-Assuming that Ideko has an EBITDA multiple of 9.4, then the continuation EV/Sales ratio of Ideko in 2015 is closest to ________.

(Multiple Choice)

4.8/5  (42)

(42)

Compute the value of a firm with free cash flows of $9,000, $7,000, and $5,000 over the next three years, a terminal firm value of $30,000 after three years, and the unlevered cost of capital is 10%. Assume that the interest rate tax shield is zero.

(Multiple Choice)

4.8/5  (35)

(35)

A services firm does all its business in cash only. The firm projects a cash balance of $3,000 in its account after all taxes and costs are paid. The owners plan to invest $8,000 and pay a dividend of $1000. How much net new financing is needed?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 61 - 80 of 95

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)