Exam 3: Time Value of Money: an Introduction

Exam 1: Corporate Finance and the Financial Manager86 Questions

Exam 2: Introduction to Financial Statement Analysis95 Questions

Exam 3: Time Value of Money: an Introduction112 Questions

Exam 4: Time Value of Money: Valuing Cash Flow Streams62 Questions

Exam 5: Interest Rates110 Questions

Exam 6: Bonds109 Questions

Exam 7: Stock Valuation64 Questions

Exam 8: Investment Decision Rules123 Questions

Exam 9: Fundamentals of Capital Budgeting113 Questions

Exam 10: Stock Valuation: a Second Look46 Questions

Exam 11: Risk and Return in Capital Markets110 Questions

Exam 12: Systematic Risk and the Equity Risk Premium104 Questions

Exam 13: The Cost of Capital107 Questions

Exam 14: Raising Equity Capital107 Questions

Exam 15: Debt Financing101 Questions

Exam 16: Capital Structure109 Questions

Exam 17: Payout Policy110 Questions

Exam 18: Financial Modeling and Pro Forma Analysis95 Questions

Exam 19: Working Capital Management107 Questions

Exam 20: Short-Term Financial Planning104 Questions

Exam 21: Option Applications and Corporate Finance102 Questions

Exam 22: Mergers and Acquisitions47 Questions

Exam 23: International Corporate Finance108 Questions

Exam 24: Leasing46 Questions

Exam 25: Insurance and Risk Management38 Questions

Exam 26: Corporate Governance45 Questions

Select questions type

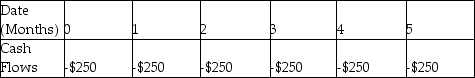

Which of the following situations is best described by the timeline shown below?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

A

If the rate of interest (r) is 8%, then you should be indifferent about receiving $500.00 today or ________.

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

A company intends to install new management software for its warehouse. The software will cost $47,000 to buy and will cost an additional $148,000 to install and implement. It is anticipated that it will save the company $44,000 through reductions in staff and $69,000 in general inventory costs in the first year after installation. What is the total benefit to the company in the first year if they choose to install the software?

Free

(Multiple Choice)

4.7/5  (37)

(37)

Correct Answer:

C

To calculate a cash flow's present value (PV), you must compound it.

(True/False)

4.8/5  (32)

(32)

What is the future value (FV) of $50,000 in thirty years, assuming the interest rate is 6% per year?

(Multiple Choice)

4.8/5  (35)

(35)

An investment will pay you $120 in one year and $200 in two years. If the interest rate is 4%, what is the present value of these cash flows?

(Multiple Choice)

4.8/5  (46)

(46)

How can we make a financial decision with cash flows occurring at different points in time?

(Essay)

4.7/5  (36)

(36)

Which of the following statements regarding the Law of One Price is INCORRECT?

(Multiple Choice)

4.9/5  (36)

(36)

Why is it usually necessary to use the time value of money when performing a cost-benefit analysis?

(Multiple Choice)

4.8/5  (39)

(39)

A lender lends $10,100, which is to be repaid in annual payments of $2070 for 6 years. Which of the following shows the timeline of the loan from the lender's perspective?

(Multiple Choice)

4.8/5  (37)

(37)

Cronus Airlines has a contract that gives them the opportunity to purchase up to 13,000,000 gallons of jet fuel at $2.00 per gallon. The current market price of jet fuel is $2.3 per gallon. Cronus believes they will only need 4,000,000 gallons of jet fuel. What is the value of this opportunity?

(Multiple Choice)

4.8/5  (36)

(36)

Use the information for the question(s) below.

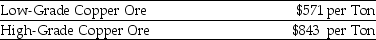

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

-A company that manufactures copper piping is offering to trade you 5,925 tons of low-grade copper ore for 4,000 tons of high-grade copper ore. Assuming you currently have 4,000 tons of high-grade ore, what are the total benefits and added benefits of taking the trade?

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

-A company that manufactures copper piping is offering to trade you 5,925 tons of low-grade copper ore for 4,000 tons of high-grade copper ore. Assuming you currently have 4,000 tons of high-grade ore, what are the total benefits and added benefits of taking the trade?

(Essay)

5.0/5  (34)

(34)

If money is invested at 8% per year, after approximately how many years will the interest earned be equal to the original investment?

(Multiple Choice)

4.7/5  (39)

(39)

Jeff has the opportunity to receive lump-sum payments either now or in the future. Which of the following opportunities is the best, given that the interest rate is 4% per year?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following best explains why market prices are useful to a financial manager when performing a cost-benefit analysis?

(Multiple Choice)

4.7/5  (34)

(34)

A manufacturer of breakfast cereals has the opportunity to purchase barley at $3.00 a bushel for 10,000 bushels, if it also buys 5,000 bushels of wheat at $16.00 per bushel. However, the manufacturer does not use any barley in its products, and currently needs 20,000 bushels of wheat. If the current market price of barley is $3.80 per bushel and that of wheat is $15.80 per bushel, should this opportunity be taken, and why?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following best describes the valuation principle?

(Multiple Choice)

4.7/5  (36)

(36)

What is one of the prerequisite conditions for the Valuation Principle to work?

(Essay)

4.9/5  (33)

(33)

Why is the personal decision a financial manager makes as to whether to buy or to rent an apartment as a personal residence most like the professional decision that manager makes as to whether her firm should try to acquire a stake in a fast growing new Internet-based company?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)