Exam 3: Time Value of Money: an Introduction

Exam 1: Corporate Finance and the Financial Manager86 Questions

Exam 2: Introduction to Financial Statement Analysis95 Questions

Exam 3: Time Value of Money: an Introduction112 Questions

Exam 4: Time Value of Money: Valuing Cash Flow Streams62 Questions

Exam 5: Interest Rates110 Questions

Exam 6: Bonds109 Questions

Exam 7: Stock Valuation64 Questions

Exam 8: Investment Decision Rules123 Questions

Exam 9: Fundamentals of Capital Budgeting113 Questions

Exam 10: Stock Valuation: a Second Look46 Questions

Exam 11: Risk and Return in Capital Markets110 Questions

Exam 12: Systematic Risk and the Equity Risk Premium104 Questions

Exam 13: The Cost of Capital107 Questions

Exam 14: Raising Equity Capital107 Questions

Exam 15: Debt Financing101 Questions

Exam 16: Capital Structure109 Questions

Exam 17: Payout Policy110 Questions

Exam 18: Financial Modeling and Pro Forma Analysis95 Questions

Exam 19: Working Capital Management107 Questions

Exam 20: Short-Term Financial Planning104 Questions

Exam 21: Option Applications and Corporate Finance102 Questions

Exam 22: Mergers and Acquisitions47 Questions

Exam 23: International Corporate Finance108 Questions

Exam 24: Leasing46 Questions

Exam 25: Insurance and Risk Management38 Questions

Exam 26: Corporate Governance45 Questions

Select questions type

Which of the following statements is FALSE about valuing cash at different points in time?

(Multiple Choice)

4.9/5  (41)

(41)

A firm has contracted to supply 500,000 gallons of propane fuel for $1.46 million to the local municipality. The municipality wants to break the contract. What does the minimum current market price of propane need to be in order for the firm to benefit from breaking the contract?

(Multiple Choice)

4.9/5  (38)

(38)

The one-year discount factor is the discount at which we can purchase money in the future, one year from now.

(True/False)

4.8/5  (40)

(40)

If $17,000 is invested at 10% per year, in approximately how many years will the investment double?

(Multiple Choice)

4.8/5  (37)

(37)

The rule of 72 tells you approximately how long it takes for money invested at a given rate of compound interest to double in value.

(True/False)

4.9/5  (46)

(46)

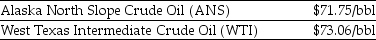

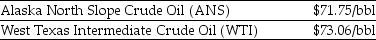

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you just purchased 9950 bbl of WTI crude at the current market price, the total revenue (cost) to you if you were to refine this crude oil and sell the unleaded gasoline is closest to ________.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you just purchased 9950 bbl of WTI crude at the current market price, the total revenue (cost) to you if you were to refine this crude oil and sell the unleaded gasoline is closest to ________.

(Multiple Choice)

4.8/5  (35)

(35)

What is the present value (PV) of $90,000 received six years from now, assuming the interest rate is 5% per year?

(Multiple Choice)

4.8/5  (30)

(30)

If the interest rate is 9%, the one-year discount factor is equal to ________.

(Multiple Choice)

4.8/5  (45)

(45)

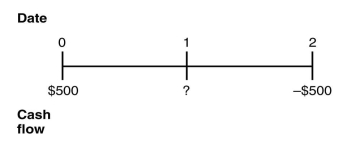

Consider the following timeline:  If the current market rate of interest is 7%, then the value as of year 1 is closest to ________.

If the current market rate of interest is 7%, then the value as of year 1 is closest to ________.

(Multiple Choice)

4.8/5  (49)

(49)

Stella deposits $4500 in a savings account at a bank that offers interest of 4.7% on such accounts. What is the value of the money in her savings account in one year's time?

(Multiple Choice)

4.9/5  (37)

(37)

On Commodity Exchange A, it is possible to buy and sell crude oil at $116 per barrel, while on Commodity Exchange B crude oil can be bought and sold at $117 per barrel. If there are transaction costs of 1% when buying or selling on either exchange, what is the net effect of buying a barrel of oil on Exchange A and selling it on Exchange B?

(Multiple Choice)

4.7/5  (41)

(41)

Use the information for the question(s) below.  As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you currently have 10,000 bbl of WTI crude, the total benefits to you if you were to sell the 10,000 bbl of WTI crude and use the proceeds to purchase and refine ANS crude is closest to ________.

As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you currently have 10,000 bbl of WTI crude, the total benefits to you if you were to sell the 10,000 bbl of WTI crude and use the proceeds to purchase and refine ANS crude is closest to ________.

(Multiple Choice)

4.9/5  (36)

(36)

Is there a need to distinguish between cash inflows and outflows on a timeline?

(Essay)

4.9/5  (42)

(42)

A dollar today and a dollar in one year may be considered to be equivalent.

(True/False)

4.8/5  (42)

(42)

In order to distinguish between inflows and outflows, different colors are assigned to each of these cash flows when constructing a timeline.

(True/False)

4.9/5  (42)

(42)

Whenever a good trades in a competitive market, the ________ determines the value of the good.

(Multiple Choice)

4.9/5  (42)

(42)

Like other metals, uranium 308 is traded in competitive markets like the New York Metals Exchange. Which of the following would value a given weight of uranium 308 the most?

(Multiple Choice)

4.9/5  (30)

(30)

A coin collector treasures his 1969-S doubled die obverse Lincoln cent because he found it in his pocket change, rather than purchasing it. He can sell it on the open market for $35,000, but would only sell it for at least twice that price, due to its sentimental value to him. It is anticipated that the coin will increase in market value in the foreseeable future. What is the value of the coin?

(Multiple Choice)

4.8/5  (31)

(31)

A company decides to close down its plastics division. It has on hand 20 tons of styrene monomer, a raw material that has a market price of $800 per ton, which had been originally purchased at $750 per ton. Given that the company has no use for the styrene monomer, and that it would cost the company $5200 to store it, what is the total value of the 20 tons of styrene monomer to the company?

(Multiple Choice)

4.8/5  (31)

(31)

You are scheduled to receive $10,000 in one year. What will be the effect of an increase in the interest rate on the future value of this cash flow?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 61 - 80 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)