Exam 10: Liabilities: Current, Installment Notes, and Contingencies

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

The payroll register of Seaside Architecture Company indicates $870 of social security and $217 of Medicare tax withheld on total salaries of $14,500 for the period. Assume earnings subject to state and federal unemployment compensation taxes are $5,250 at the federal rate of 0.8% and state rate of 5.4%. Prepare the journal entry to record the payroll tax expense for the period.

(Essay)

4.9/5  (35)

(35)

Blast sells portable CD players and each unit carries a one-year replacement warranty. The cost of repair defects under the warranty is estimated at 10% of the sales price. During May, Blast sells 650 portable CD players for $50 each. For what amount in May would Blast debit Product Warranty Expense?

(Multiple Choice)

4.9/5  (37)

(37)

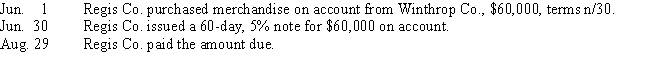

Journalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.)

(Essay)

5.0/5  (32)

(32)

On June 1, Davis Inc. issued an $84,000, 5%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using a 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar.

(Multiple Choice)

4.9/5  (41)

(41)

The journal entry to record the cost of warranty repairs that were incurred during the current period, but related to sales made in prior years, includes a debit to Warranty Expense.

(True/False)

4.9/5  (30)

(30)

The entry to record accrual of employer's payroll taxes would include a

(Multiple Choice)

4.8/5  (38)

(38)

The journal entry used to record the issuance of a discounted note for the purpose of borrowing funds for the business is

(Multiple Choice)

4.9/5  (40)

(40)

Florida Keys Construction installs swimming pools. It calculates that warranty obligations are 3% of sales. For the year just ending, Florida Keys' sales were $1,450,000. Previous quarterly entries debiting Product Warranty Expense totaled $28,700. Determine the estimated warranty expense for the year and make the journal entry necessary to bring the account to the needed balance.

(Essay)

4.9/5  (35)

(35)

The use of a separate payroll bank account is not an advantageous control, because it creates more complexity in reconciliation functions for a company and invites theft.

(True/False)

4.8/5  (33)

(33)

Amounts withheld from each employee for social security and Medicare vary by state.

(True/False)

4.8/5  (33)

(33)

Which of the following is required to be withheld from employee's gross pay?

(Multiple Choice)

4.9/5  (34)

(34)

An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the first week of the calendar year are as follows: hours worked, 46; federal income tax withheld, $110; Social security tax rate, 6%; and Medicare tax rate, 1.5%; state unemployment tax, 5.4% on the first $7,000; federal unemployment tax, 0.8% on the first $7,000. What is the net amount to be paid to the employee? If required, round your answers to the nearest cent.

(Multiple Choice)

4.9/5  (36)

(36)

All long-term liabilities eventually become current liabilities.

(True/False)

4.9/5  (29)

(29)

Davis and Thompson have earnings of $850 each. The social security tax rate is 6% and the Medicare tax rate is 1.5%. Assuming that the payroll will be paid on December 29, what will be the employer's total FICA tax for this payroll period?

(Multiple Choice)

4.8/5  (41)

(41)

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar.

(Multiple Choice)

4.8/5  (31)

(31)

For proper matching of revenues and expenses, the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

(True/False)

4.8/5  (35)

(35)

Taylor Bank lends Guarantee Company $150,000 on January 1. Guarantee Company signs a $150,000, 8%, 9-month, interest-bearing note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is

(Multiple Choice)

4.9/5  (30)

(30)

Roseland Design borrowed $700,000 on a 90-day note from CorpOne Funding Company. CorpOne discounts the note at 8%. (Assume a 360-day year is used for interest calculations.) (a) Joumalize Roseland's entries to record:

a. The issuance of the note.

b. The payment of the note at maturity.

(b) Journalize CorpOne's entries to record:

a. The receipt of the note.

b. The receipt of the payment of the note at maturity.

(Essay)

4.8/5  (45)

(45)

Showing 21 - 40 of 182

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)