Exam 8: Long-Term Investments and the Time Value of Money

Exam 1: The Financial Statements140 Questions

Exam 2: Recording Business Transactions164 Questions

Exam 3: Accrual Accounting and the Financial Statements144 Questions

Exam 4: Internal Control and Cash110 Questions

Exam 5: Short-Term Investments and Receivables110 Questions

Exam 6: Inventory and Cost of Goods Sold106 Questions

Exam 7: Property, Plant, and Equipment, and Intangible Assets129 Questions

Exam 8: Long-Term Investments and the Time Value of Money97 Questions

Exam 9: Liabilities96 Questions

Exam 12: The Statement of Cash Flows127 Questions

Exam 13: Financial Statement Analysis116 Questions

Select questions type

Non-controlling interest occurs when a company owns only 90% of a company they control.

(True/False)

4.7/5  (38)

(38)

If a parent company and its subsidiary have accounts receivable from mutually exclusive external sources in the amounts of $35,000 and $20,000, respectively, the consolidated balance sheet for the parent and its subsidiary will show:

(Multiple Choice)

4.9/5  (47)

(47)

Barking Power Corporation acquired 80% of the voting common shares of Brighton Beach Corporation on December 31, 2014. During the year ended December 31, 2015, Barking Power Corporation and Brighton Beach Corporation reported net income of $110,000 and $75,000 from their own operations, respectively.

a. How much income attributable to the equity holders of the parent corporation will be reported on the consolidated income statement for the year ended December 31, 2015?

b. Discuss the way in which non-controlling interests in the subsidiary might be presented on consolidated financial statements. What exactly does non-controlling interest represent?

(Essay)

4.9/5  (33)

(33)

Purchases of bonds of other companies are reported as financing activities on the cash-flow statement.

(True/False)

4.9/5  (41)

(41)

An investment in common shares at fair value through other comprehensive income acquired during 2014 at a cost of $46,000 has a market value on December 31, 2014, of $46,721. The adjusting entry requires a debit to long term investments (at fair value through other comprehensive income) for $721.

(True/False)

4.7/5  (32)

(32)

A company that owns less than 20% of another company's stock must use the consolidation method of accounting.

(True/False)

4.7/5  (42)

(42)

An investor owns 40% of the voting common shares in an investee and has the ability to exercise significant influence over the investee. How should the investor account for the investment?

(Essay)

4.9/5  (36)

(36)

Investments in long-term bonds are shown on the balance sheet at their current market value.

(True/False)

4.9/5  (33)

(33)

If a company owns between 20 and 50% of the voting share of an investee it must normally use the equity method to account for its investment.

(True/False)

4.8/5  (37)

(37)

Long-term bond investments are reported on the balance sheet at their:

(Multiple Choice)

4.9/5  (48)

(48)

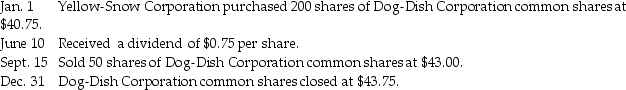

Prepare journal entries for the following transactions. Note that each item falls under the at fair value through other comprehensive income classification.

(Yellow-Snow Corporation had no prior investments to the investment in Dog-Dish Corporation)

(Yellow-Snow Corporation had no prior investments to the investment in Dog-Dish Corporation)

(Essay)

4.8/5  (36)

(36)

Amortization of a discount on a long-term bond investment will decrease the amount of interest revenue recorded by the investor.

(True/False)

4.8/5  (38)

(38)

The investor should generally use the equity method of accounting for the investee if the investor owns what percentage of the outstanding stock of the investee?

(Multiple Choice)

4.8/5  (36)

(36)

Why is understanding the extent to which ATCO Ltd. influences another company important for accounting purposes? What impact does the degree of influence ATCO Ltd. has over another company have on accounting?

(Essay)

4.8/5  (42)

(42)

As described in Chapter 8 of the textbook, hedging is a legal and ethical accounting method companies use to protect themselves from the effects of:

(Multiple Choice)

4.9/5  (39)

(39)

Amortizing a discount on a bond investment will cause the Investment account and interest revenue to respectively:

(Multiple Choice)

4.8/5  (36)

(36)

The parent and subsidiary relationship that is established in consolidation accounting is an example of the entity concept.

(True/False)

4.8/5  (36)

(36)

If 100% of a subsidiary's voting stock is acquired in the purchase of the subsidiary, goodwill is defined as the amount by which the purchase price paid by the parent company exceeds the:

(Multiple Choice)

4.8/5  (40)

(40)

The journal entry to record the sale of an investment includes a loss on sale of investment for $500. The income statement will reflect:

(Multiple Choice)

4.8/5  (30)

(30)

Showing 41 - 60 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)