Exam 16: Cost Allocation: Joint Products and Byproducts

Exam 1: The Accountants Role in the Organization195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis207 Questions

Exam 4: Job Costing199 Questions

Exam 5: Activity-Based Costing and Activity-Based Management175 Questions

Exam 6: Master Budget and Responsibility Accounting229 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control180 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis208 Questions

Exam 10: Determining How Costs Behave182 Questions

Exam 11: Decision Making and Relevant Information220 Questions

Exam 12: Pricing Decisions and Cost Management210 Questions

Exam 13: Strategy, Balanced Scorecard, and Strategic Profitability Analysis171 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis170 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues144 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts125 Questions

Exam 17: Process Costing126 Questions

Exam 18: Spoilage, Rework, and Scrap125 Questions

Exam 19: Balanced Scorecard: Quality, Time, and the Theory of Constraints124 Questions

Exam 20: Inventory Management, Just-In-Time, and Simplified Costing Methods125 Questions

Exam 21: Capital Budgeting and Cost Analysis130 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations123 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations139 Questions

Select questions type

The sales value at splitoff method allocates joint costs to joint products produced during the accounting period on the basis of the relative total sales value at the splitoff point.

(True/False)

4.7/5  (38)

(38)

Answer the following questions using the information below:

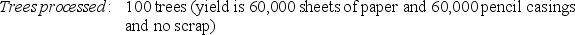

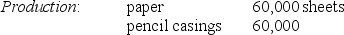

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

-What is the sales value at the splitoff point of the pencil casings?

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

-What is the sales value at the splitoff point of the pencil casings?

(Multiple Choice)

4.8/5  (40)

(40)

Answer the following questions using the information below:

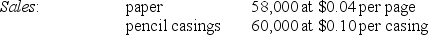

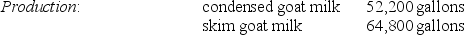

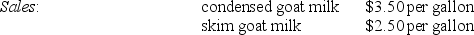

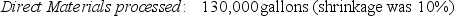

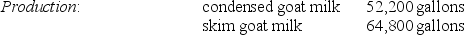

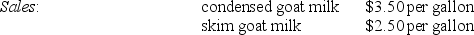

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-Using the sales value at splitoff method, what is the gross-margin percentage for skim goat milk at the splitoff point?

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-Using the sales value at splitoff method, what is the gross-margin percentage for skim goat milk at the splitoff point?

(Multiple Choice)

4.8/5  (30)

(30)

What are six reasons that joint costs should be allocated to individual products or services?

(Essay)

4.7/5  (40)

(40)

Explain the difference between a joint product and a byproduct. Can a byproduct ever become a joint product?

(Essay)

4.9/5  (31)

(31)

The Arvid Corporation manufactures widgets, gizmos, and turnbols from a joint process. May production is 2,000 widgets; 3,500 gizmos; and 4,000 turnbols. Respective per unit selling prices at splitoff are $30, $20, and $10. Joint costs up to the splitoff point are $75,000. If joint costs are allocated based upon the sales value at splitoff, what amount of joint costs will be allocated to the widgets?

(Multiple Choice)

4.9/5  (34)

(34)

Answer the following questions using the information below:

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

(Multiple Choice)

4.9/5  (35)

(35)

Why do accountants criticize the practice of carrying inventories at estimated net realizable values?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following is NOT a reason to use the sales value at splitoff method:

(Multiple Choice)

4.9/5  (38)

(38)

Answer the following questions using the information below:

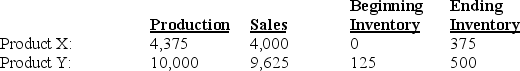

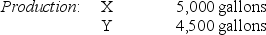

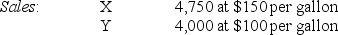

Athens Company processes 15,000 gallons of direct materials to produce two products, Product X and Product Y. Product X sells for $8 per gallon and Product Y, the main product, sells for $100 per gallon. The following information is for August:

The manufacturing costs totaled $30,000.

-How much is the ending inventory reduction for the byproduct if byproducts are recognized in the general ledger at the point of sale?

The manufacturing costs totaled $30,000.

-How much is the ending inventory reduction for the byproduct if byproducts are recognized in the general ledger at the point of sale?

(Multiple Choice)

4.7/5  (24)

(24)

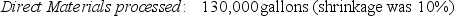

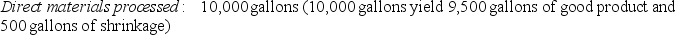

Chem Manufacturing Company processes direct materials up to the splitoff point where two products (X and Y)are obtained and sold. The following information was collected for the month of November:

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.

The beginning inventories totaled 50 gallons for X and 25 gallons for Y. Ending inventory amounts reflected 300 gallons of Product X and 525 gallons of Product Y. October costs per unit were the same as November.

Using the physical-volume method, what is Product X's approximate gross-margin percentage?

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.

The beginning inventories totaled 50 gallons for X and 25 gallons for Y. Ending inventory amounts reflected 300 gallons of Product X and 525 gallons of Product Y. October costs per unit were the same as November.

Using the physical-volume method, what is Product X's approximate gross-margin percentage?

(Multiple Choice)

4.9/5  (28)

(28)

If the sales value at splitoff method is used, what is the approximate production cost for each pencil casing?

(Multiple Choice)

4.8/5  (40)

(40)

New York Liberty Corporation makes miniature statues of the Empire State Building from cast iron. Sales total 50,000 units a year. The statues are finished either rough or polished, with an average demand of 60% rough and 40% polished. Iron ingots, the direct material, costs $6 per pound. Processing costs are $300 to convert 30 pounds into 60 statues. Rough statues are sold for $15 each, and polished statues can be sold for $18 or engraved for an additional cost of $5. Polished statues can then be sold for $30.

Required:

Determine whether New York Liberty Company should sell the engraved statutes. Why?

(Essay)

4.8/5  (36)

(36)

The only allowable method of joint cost allocation is specified by FASB.

(True/False)

4.9/5  (44)

(44)

Joint costs are the costs of a production process that yields multiple products simultaneously.

(True/False)

4.9/5  (34)

(34)

Which of the following is a DISADVANTAGE of the physical-measure method of allocating joint costs?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is NOT a primary reason for allocating joint costs?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following statements is true regarding main products and byproducts?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 21 - 40 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)