Exam 15: Segment and Interim Financial Reporting

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments - Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions Inventories40 Questions

Exam 6: Intercompany Profit Transactions Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests37 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories, Push-Down Accounting, and Corporate Joint Ventures41 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting40 Questions

Exam 16: Partnerships - Formation, Operations, and Changes in Ownership Interests40 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations40 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds37 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts38 Questions

Select questions type

Which of the following is not a quantitative threshold for determining a reportable segment?

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

D

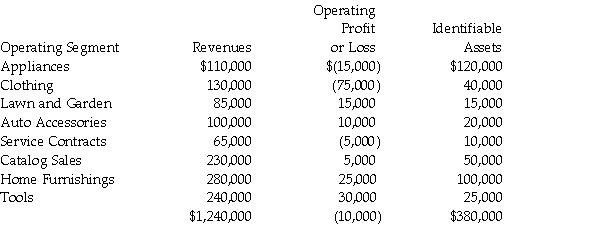

For internal decision-making purposes, Calam Corporation's operating segments have been identified as follows:

Required:

1. In applying the "operating profit or loss" test to identify reporting segments, what is the test value for Calam Corporation?

2. Using the "reported profit or loss" test, which of Calam's operating segments will also be reporting segments?

Required:

1. In applying the "operating profit or loss" test to identify reporting segments, what is the test value for Calam Corporation?

2. Using the "reported profit or loss" test, which of Calam's operating segments will also be reporting segments?

Free

(Essay)

4.8/5  (42)

(42)

Correct Answer:

Requirement 1

If the absolute value of the total segments showing operating losses, $95,000, is more than the absolute value of the profitable segments, $85,000, then the absolute value of the loss segments, when multiplied by 10%, would become the test value for each segment. The $95,000 is multiplied by 10% to get $9,500, which is the test value for both the profitable and loss segments.

Requirement 2

Using the test value of $9,500 for profit and loss of the segments, only the Service Contracts and Catalog Sales segments would not be considered reportable segments.

How does GAAP view interim accounting periods?

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

B

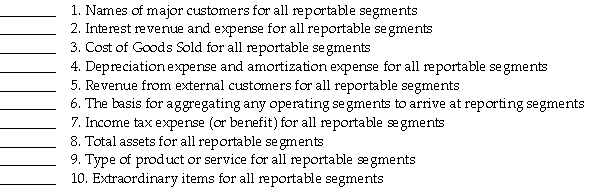

The following information was collected together for the Lawson Company relating to the preparation of their annual financial statements for 2011. For each item, indicate "yes" or "no" as to whether the item must be disclosed in the annual report.

(Essay)

4.9/5  (33)

(33)

Which one of the following operating segment information items is not directly named by GAAP to be reconciled to consolidated totals?

(Multiple Choice)

4.8/5  (38)

(38)

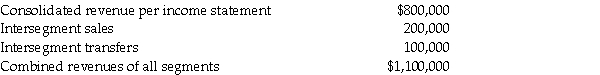

Cole Company has the following 2014 financial data:  Cole Company should add segments if

Cole Company should add segments if

(Multiple Choice)

4.7/5  (48)

(48)

GAAP requires disclosures for each reportable operating segment for each of the following, except for

(Multiple Choice)

4.9/5  (37)

(37)

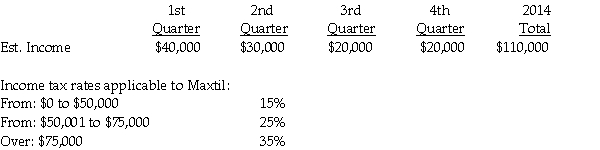

Maxtil Corporation estimates its income by calendar quarter as follows for 2014:

Required:

Determine Maxtil's estimated effective tax rate.

Required:

Determine Maxtil's estimated effective tax rate.

(Essay)

4.7/5  (39)

(39)

For an operating segment to be considered a reporting segment under the revenue threshold, its reported revenue must be 10% or more of

(Multiple Choice)

4.9/5  (37)

(37)

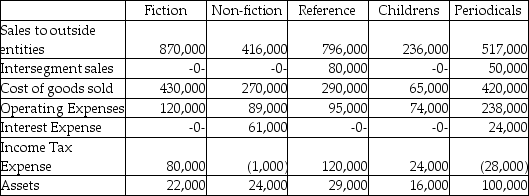

Rollins Publishing has five operating segments, as summarized below:

Required:

Determine which of the operating segments of Rollins Publishing are reportable segments for the period shown.

Required:

Determine which of the operating segments of Rollins Publishing are reportable segments for the period shown.

(Essay)

4.9/5  (33)

(33)

Dott Corporation experienced a $100,000 extraordinary loss in the second quarter of 2014 in their East Coast operating segment. The loss should be recognized

(Multiple Choice)

4.9/5  (31)

(31)

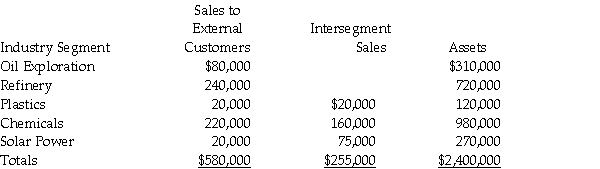

The following data relate to Falcon Corporation's industry segments:

Required:

1. Which of Falcon's operating segments would be considered reporting segments under the "revenue" test?

2. Which of Falcon's operating segments would be considered reporting segments under the "asset" test?

Required:

1. Which of Falcon's operating segments would be considered reporting segments under the "revenue" test?

2. Which of Falcon's operating segments would be considered reporting segments under the "asset" test?

(Essay)

4.7/5  (49)

(49)

On January 5, 2014, Eagle Corporation paid $50,000 in real estate taxes for the calendar year. In March of 2014, Eagle paid $180,000 for an annual machinery overhaul and $10,000 for the annual CPA audit fee. What amount was expensed for these items on Eagle's quarterly interim financial statements?

(Multiple Choice)

5.0/5  (39)

(39)

Which one of the following operating segment disclosures is not required by GAAP?

(Multiple Choice)

4.8/5  (44)

(44)

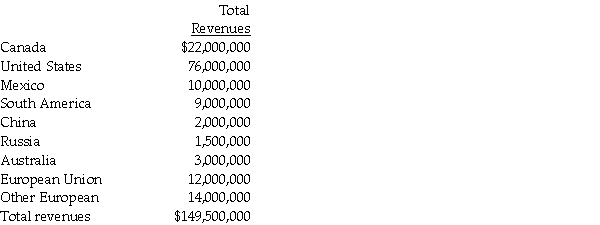

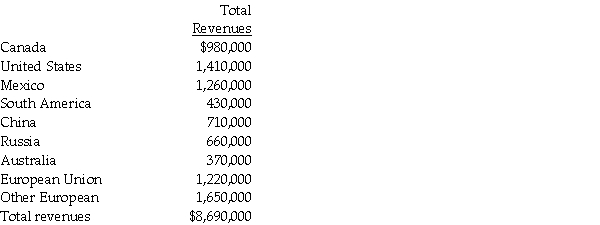

For internal decision-making purposes, Falcon Corporation identifies its industry segments by geographical area. For 2014, the total revenues of each segment are provided below. There are no intersegment revenues.

Required:

1. Which operating segments will be considered reporting segments based on the revenue test?

2. What is the test value for determining whether a sufficient number of segments are reported?

3. What will be the minimum number of segments that must be reported?

Required:

1. Which operating segments will be considered reporting segments based on the revenue test?

2. What is the test value for determining whether a sufficient number of segments are reported?

3. What will be the minimum number of segments that must be reported?

(Essay)

4.8/5  (34)

(34)

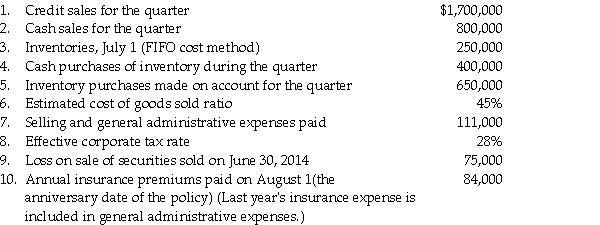

Jeale Corporation is preparing its interim financial statements for the third quarter of calendar 2014. The following information was provided for the preparation of the statements:

Additional information:

At the end of the year, Jeale accrues its annual pension and depreciation expenses which amount to $60,000 and $42,000, respectively.

Required:

Prepare Jeale's interim income statement for the third quarter of calendar year 2014.

Additional information:

At the end of the year, Jeale accrues its annual pension and depreciation expenses which amount to $60,000 and $42,000, respectively.

Required:

Prepare Jeale's interim income statement for the third quarter of calendar year 2014.

(Essay)

4.9/5  (36)

(36)

The estimated taxable income for Shebill Corporation on January 1, 2014, was $80,000, $100,000, $100,000, and $120,000, respectively, for each of the four quarters of 2014. Shebill's estimated annual effective tax rate was 30%. During the second quarter of 2014, the estimated annual effective tax rate was increased to 34%. Given only this information, Shebill's second quarter income tax expense was

(Multiple Choice)

4.8/5  (40)

(40)

For internal decision-making purposes, Geogh Corporation identifies its industry segments by geographical area. For 2014, the total revenues of each segment are provided below. There are no intersegment revenues.

Required:

1. Which operating segments will be considered reporting segments based on the revenue test?

2. What is the test value for determining whether a sufficient number of segments are reported?

3. What will be the minimum number of segments that must be reported?

Required:

1. Which operating segments will be considered reporting segments based on the revenue test?

2. What is the test value for determining whether a sufficient number of segments are reported?

3. What will be the minimum number of segments that must be reported?

(Essay)

4.9/5  (33)

(33)

Sandpiper Corporation paid $120,000 for annual property taxes on January 15, 2014, and $20,000 for building repair costs on March 10, 2014. Total repair expenses for the year were estimated to be $200,000, and are normally accrued during the year until incurred. What total amount of expense for these items was reported in Sandpiper's first quarter 2014 interim income statement?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 40

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)