Exam 4: Completing the Accounting Cycle

Exam 1: Accounting and the Business Environment263 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations277 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Internal Control and Cash258 Questions

Exam 8: Receivables234 Questions

Exam 9: Plant Assets, Natural Resources, and Intangibles212 Questions

Exam 10: Investments192 Questions

Exam 11: Current Liabilities and Payroll225 Questions

Exam 12: Long-Term Liabilities207 Questions

Exam 13: Stockholders Equity277 Questions

Exam 14: The Statement of Cash Flows183 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Managerial Accounting245 Questions

Exam 17: Job Order Costing191 Questions

Exam 18: Process Costing173 Questions

Exam 19: Cost Management Systems: Activity-Based Just-In-Time 189 Questions

Exam 20: Cost Volume Profit Analysis196 Questions

Exam 21: Variable Costing148 Questions

Exam 22: Master Budgets181 Questions

Exam 23: Flexible Budgets and Standard Cost Systems223 Questions

Exam 24: Responsibility Accounting and Performance Evaluation188 Questions

Exam 25: Short-Term Business Decisions200 Questions

Exam 26: Capital Investment Decisions152 Questions

Exam 27: Understanding Accounting Information Systems and their Components164 Questions

Select questions type

Which of the following are NOT included in a post-closing trial balance?

(Multiple Choice)

4.9/5  (35)

(35)

The following is the adjusted trial balance as of December 31, 2019 of Brooks Design Studio:

Account Debit Credit Cash \ 1,700 Accounts Receivable 8,500 Supplies 100 Equipment 7,500 Accumulated Depreciation-Equipment \ 2,000 Accounts Payable 1,200 Salaries Payable 800 Unearned Revenue 600 Common Stock 3,400 Dividends 2,300 Service Revenue 40,000 Salaries Expense 24,000 Supplies Expense 2,300 Depreciation Expense-Equipment 1,600 Total \ 48,000 \ 48,000 Prepare the closing entry for expenses. Omit explanation.

(Essay)

4.7/5  (34)

(34)

Patents, copyrights, and trademarks are examples of ________.

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following statements is true if the income statement debit column exceeds the income statement credit column of a worksheet?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements regarding intangible assets is incorrect?

(Multiple Choice)

4.9/5  (31)

(31)

Regarding a classified balance sheet, which of the following statements regarding liabilities is incorrect?

(Multiple Choice)

4.8/5  (44)

(44)

In regards to a company using a computerized accounting system, which of the following statements is incorrect?

(Multiple Choice)

4.9/5  (42)

(42)

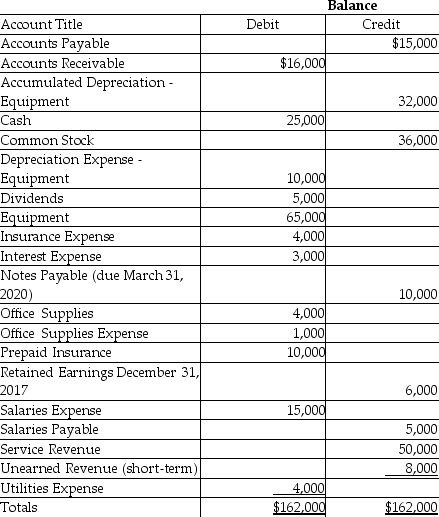

Wilson Engraving just completed operations for the year ending December 31, 2018. Accounts from the adjusted trial balance dated December 31, 2018 are listed in alphabetical order below:

Requirement:

a. Prepare the closing entries. Omit explanations.

b. Prepare, in good form, the income statement, statement of retained earnings, and balance sheet.

c. Compute the current ratio. Label your work. Comment on the current ratio.

Requirement:

a. Prepare the closing entries. Omit explanations.

b. Prepare, in good form, the income statement, statement of retained earnings, and balance sheet.

c. Compute the current ratio. Label your work. Comment on the current ratio.

(Essay)

4.8/5  (39)

(39)

The post-closing trial balance shows the updated Retained Earnings balance.

(True/False)

4.7/5  (31)

(31)

Net income or net loss is the balancing amount on the worksheet and should always be entered on the side that makes the debit and credit columns balance.

(True/False)

4.8/5  (36)

(36)

Which of the following is an example of an intangible asset?

(Multiple Choice)

4.7/5  (39)

(39)

On December 31, 2018, Absolute Services, Inc. prepared the following accrual adjustment:

Salaries Expense 1,000 Salaries Payable 1,000 The company paid salaries amounting to $1,500 on January 7, 2019 for the two-week pay period that ended on January 6, 2019. Journalize the entries for January 1, 2019 and January 7, 2019, assuming the company uses reversing entries. Omit explanations.

(Essay)

4.8/5  (39)

(39)

In the closing process, the Dividends account is closed to the Retained Earnings account.

(True/False)

4.8/5  (38)

(38)

The balances of select accounts of McMurray, Inc. as of December 31, 2018 are given below: Notes Payable-short-term \ 1,300 Salaries Payable 3,000 Notes Payable-long-term 24,000 Accounts Payable 3,300 Unearned Revenue 1,000 Interest Payable 2,400 The Unearned Revenue is the amount of cash received for services to be rendered in January 2019. Interest Payable will be paid on February 5, 2019. What are the total long-term liabilities shown on the balance sheet at December 31, 2018?

(Multiple Choice)

4.9/5  (30)

(30)

List the steps of the accounting cycle that take place at the end of the period.

(Short Answer)

4.8/5  (32)

(32)

Which of the following entries is necessary to close the appropriate depreciation account at the end of the year?

(Multiple Choice)

4.8/5  (39)

(39)

Only permanent accounts appear on the post-closing trial balance.

(True/False)

4.9/5  (25)

(25)

Which of the following would be considered a long-term asset?

(Multiple Choice)

4.8/5  (33)

(33)

As a part of the closing process, revenues and expenses may be closed to a temporary account called the Net Income (Loss).

(True/False)

4.9/5  (38)

(38)

The financial statement that reports assets, liabilities, and stockholders' equity as of the last day of the period is called the ________.

(Multiple Choice)

4.8/5  (36)

(36)

Showing 181 - 200 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)