Exam 11: Cost Allocation and Activity-Based Costing

Exam 1: Managerial Accounting Concepts and Principles201 Questions

Exam 2: Job Order Costing195 Questions

Exam 3: Process Cost Systems198 Questions

Exam 4: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 5: Variable Costing for Management Analysis160 Questions

Exam 6: Budgeting197 Questions

Exam 7: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 8: Performance Evaluation for Decentralized Operations218 Questions

Exam 9: Differential Analysis, Product Pricing, and Activity-Based Costing175 Questions

Exam 10: Capital Investment Analysis190 Questions

Exam 11: Cost Allocation and Activity-Based Costing110 Questions

Exam 12: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Exam 13: Statement of Cash Flows189 Questions

Exam 14: Financial Statement Analysis198 Questions

Select questions type

Activity cost pools are assigned to products, using factory overhead rates for each activity.

Free

(True/False)

4.8/5  (37)

(37)

Correct Answer:

True

Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will Challenger Factory allocate to deluxe widget production if budgeted production for the period is 50,000 units and actual production for the period is 58,000 units?

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

A

Calculate the overhead per unit to be charged to small lamps.

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

A

Determine the activity rate for production per machine hour.

(Multiple Choice)

4.7/5  (34)

(34)

Bob's Biscuit Corporation budgeted $1,200,000 of factory overhead cost for the coming year.Its plantwide allocation base, machine hours, is budgeted at 100,000 hours.Budgeted units to be produced are 200,000 units.Bob's plantwide factory overhead rate is $12.00 per machine hour.

(True/False)

4.7/5  (32)

(32)

Determine the activity rate for materials handling per move.

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following is not a reason for banks to use activity-based costing?

(Multiple Choice)

4.8/5  (41)

(41)

If the budgeted factory overhead cost is $460,000, the budgeted direct labor hours is 80,000, and the actual direct labor hours is 6,700 for the month, the amount of factory overhead to be allocated is $38,525 if the allocation is based on direct labor hours.

(True/False)

4.7/5  (39)

(39)

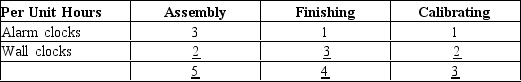

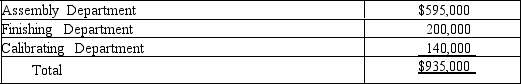

Ratchford Clocks manufactures alarm clocks and wall clocks and allocates overhead based on direct labor hours.The production process is set up in three departments: Assembly, Finishing, and Calibrating.The following is information regarding the direct labor used to produce one unit of the two clocks:

The budget includes the following factory overhead by department:

The budget includes the following factory overhead by department:

Ratchford Clocks is planning to manufacture 50,000 alarm clocks and 10,000 wall clocks.

a Determine the total number of hours that will be needed by department.

b Determine the factory overhead rate by department using the multiple production department factory overhead rate method.

c Determine the amount of factory overhead to be allocated to each unit of alarm clocks and wall clocks.

d Determine the amount of total factory overhead to be allocated to the alarm clocks and wall clocks.

Ratchford Clocks is planning to manufacture 50,000 alarm clocks and 10,000 wall clocks.

a Determine the total number of hours that will be needed by department.

b Determine the factory overhead rate by department using the multiple production department factory overhead rate method.

c Determine the amount of factory overhead to be allocated to each unit of alarm clocks and wall clocks.

d Determine the amount of total factory overhead to be allocated to the alarm clocks and wall clocks.

(Essay)

4.9/5  (36)

(36)

Determine the activity-based cost for each disk drive unit.

(Multiple Choice)

4.9/5  (32)

(32)

Zorn Co.budgeted $600,000 of factory overhead cost for the coming year.Its plantwide allocation base, machine hours, is budgeted at 100,000 hours.Budgeted units to be produced are 200,000 units.Zorn's plantwide factory overhead rate is $6.00 per unit.

(True/False)

4.9/5  (48)

(48)

A single plantwide overhead rate method is very expensive to apply.

(True/False)

4.8/5  (44)

(44)

Determine the overhead rate in the Painting Department for each unit of Product B if Blue Ridge Marketing Inc.uses a multiple department rate system.

(Multiple Choice)

4.7/5  (39)

(39)

Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will Blackwelder Factory allocate to small lamp production if actual direct hours for the period is 285,000?

(Multiple Choice)

4.7/5  (41)

(41)

The selection of the factory overhead allocation method is important because the method selected determines the accuracy of the product cost.

(True/False)

4.9/5  (36)

(36)

Use of a plantwide factory overhead rate does not distort product costs when products require different ratios of allocation-base usage in each production department.

(True/False)

4.9/5  (34)

(34)

If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, what is the total amount of factory overhead the Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 26,000 units are produced?

(Multiple Choice)

5.0/5  (28)

(28)

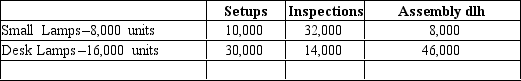

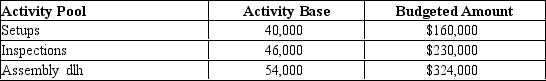

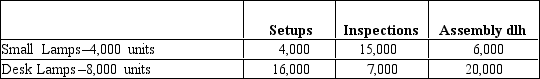

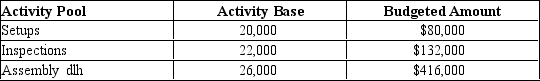

The Valhalla Company manufactures small lamps and desk lamps.The following shows the activities per product:

Using the following information prepared by the Valhalla Company, determine a the activity rates for each activity and b the activity-based factory overhead per unit for each product.

Using the following information prepared by the Valhalla Company, determine a the activity rates for each activity and b the activity-based factory overhead per unit for each product.

(Essay)

4.7/5  (49)

(49)

The Bonnington Company manufactures small lamps and desk lamps.The following shows the activities per product:  Using the following information prepared by the Bonnington Company, determine the total factory overhead to be charged to small lamps.

Using the following information prepared by the Bonnington Company, determine the total factory overhead to be charged to small lamps.

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following does not rely on managerial decisions involving accurate product costing?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 1 - 20 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)