Exam 11: Cost Allocation and Activity-Based Costing

Exam 1: Managerial Accounting Concepts and Principles201 Questions

Exam 2: Job Order Costing195 Questions

Exam 3: Process Cost Systems198 Questions

Exam 4: Cost Behavior and Cost-Volume-Profit Analysis225 Questions

Exam 5: Variable Costing for Management Analysis160 Questions

Exam 6: Budgeting197 Questions

Exam 7: Performance Evaluation Using Variances From Standard Costs175 Questions

Exam 8: Performance Evaluation for Decentralized Operations218 Questions

Exam 9: Differential Analysis, Product Pricing, and Activity-Based Costing175 Questions

Exam 10: Capital Investment Analysis190 Questions

Exam 11: Cost Allocation and Activity-Based Costing110 Questions

Exam 12: Lean Principles, Lean Accounting, and Activity Analysis137 Questions

Exam 13: Statement of Cash Flows189 Questions

Exam 14: Financial Statement Analysis198 Questions

Select questions type

What is the Fabrication Department overhead rate per machine hour?

(Multiple Choice)

4.8/5  (31)

(31)

Explain why it is imperative that proper factory overhead be allocated in factories that produce multiple products.

(Essay)

4.8/5  (39)

(39)

Estimated activity-base usage quantities are the total activity-base quantities related to each product.

(True/False)

4.8/5  (33)

(33)

Use of a plantwide factory overhead rate distorts product costs when there are differences in the factory overhead rates across different production departments and when products require different ratios of allocation-base usage in each production department.

(True/False)

4.8/5  (40)

(40)

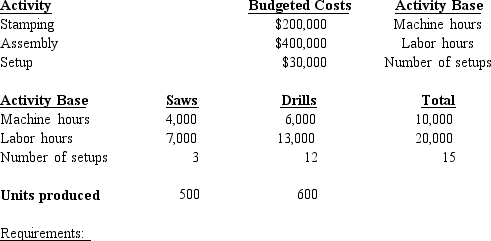

The Klamath Corp.produces two products, saws and drills.Three activities are used in their manufacture.These activities and their associated costs and bases are as follows:

a Determine the activity rate for each activity.

b Determine the overhead cost per unit for each product.

a Determine the activity rate for each activity.

b Determine the overhead cost per unit for each product.

(Essay)

4.8/5  (42)

(42)

Determine the activity rate for product development per change.

(Multiple Choice)

4.9/5  (33)

(33)

Activity rates are computed by dividing the cost budgeted for each activity pool by the estimated activity base for that pool.

(True/False)

4.7/5  (35)

(35)

Shanghai Company sells glasses, fine china, and everyday dinnerware.They use activity-based costing to determine the cost of the shipping and handling activity.The shipping and handling activity has an activity rate of $14 per pound.A box of glasses weighs 2 lbs., the box of china weighs 4 lbs., and a box of everyday dinnerware weighs 6 lbs.a Determine the shipping and handling activity for each product and b determine the total shipping and receiving costs for the china if 3,500 boxes are shipped.

(Essay)

4.8/5  (31)

(31)

Calculate the overhead rate per unit for Product A in the painting department of Adirondack Marketing Inc.

(Multiple Choice)

4.7/5  (33)

(33)

Which of the following is a cost pool used with the activity-based costing method?

(Multiple Choice)

4.8/5  (36)

(36)

If the budgeted factory overhead cost is $460,000, the budgeted direct labor hours is 80,000, and the actual direct labor hours is 6,700 for the month, the factory overhead rate for the month is $68.65 if the allocation is based on direct labor hours.

(True/False)

4.8/5  (40)

(40)

Activity-based costing can be used to allocate period costs to various products that the company sells.

(True/False)

4.9/5  (41)

(41)

Using a plantwide factory overhead rate distorts product costs when:

(Multiple Choice)

4.9/5  (39)

(39)

The Anazi Leather Company manufactures leather handbags and moccasins.The company has been using the factory overhead rate method but has decided to evaluate the multiple production department factory overhead rate to allocate factory overhead.The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.

Handbags = 60,000 units, 3 hours of direct labor

Moccasins= 40,000 units, 2 hours of direct labor

Total budgeted factory overhead cost = $360,000

The company has two different production departments: Cutting and Sewing.The Cutting Department has a factory overhead budget of $80,000.Each unit will require 1 direct labor hour or a total of 100,000 direct labor hours.

The Sewing Department estimates factory overhead in the amount of $280,000.Handbags require 2 hours of sewing time and Moccasins require 1 hour for a total of 160,000 labor hours.

Calculate the total factory overhead to be allocated to each product using direct labor hours.

(Essay)

4.8/5  (39)

(39)

The Ramapo Company uses a single overhead rate to apply all overhead costs.What would the single plantwide rate be if it was based on machine hours instead of labor hours?

(Multiple Choice)

4.9/5  (41)

(41)

Product costing consists of only direct materials and direct labor.

(True/False)

4.7/5  (40)

(40)

Service companies can effectively use multiple department overhead rate costing to compute product service costs.

(True/False)

4.8/5  (31)

(31)

Determine the overhead rate in the Finishing Department for each unit of Product A if Blue Ridge Marketing Inc.uses a multiple department rate system.

(Multiple Choice)

4.7/5  (38)

(38)

Showing 81 - 100 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)