Exam 23: Flexible Budgets and Standard Cost Systems

Exam 1: Accounting and the Business Environment198 Questions

Exam 2: Recording Business Transactions177 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Merchandising Operations203 Questions

Exam 6: Merchandise Inventory163 Questions

Exam 7: Internal Control and Cash185 Questions

Exam 8: Receivables170 Questions

Exam 9: Plant Assets, natural Resources, and Intangibles181 Questions

Exam 10: Investments146 Questions

Exam 11: Current Liabilities and Payroll187 Questions

Exam 12: Long-Term Liabilities192 Questions

Exam 13: Stockholders Equity206 Questions

Exam 14: The Statement of Cash Flows164 Questions

Exam 15: Financial Statement Analysis167 Questions

Exam 16: Introduction to Managerial Accounting210 Questions

Exam 17: Job Order Costing170 Questions

Exam 18: Process Costing167 Questions

Exam 19: Cost Management Systems: Activity-Based, just-In-Time, and Quality Management Systems154 Questions

Exam 20: Cost-Volume-Profit Analysis173 Questions

Exam 21: Variable Costing135 Questions

Exam 22: Master Budgets172 Questions

Exam 23: Flexible Budgets and Standard Cost Systems204 Questions

Exam 24: Responsibility Accounting and Performance Evaluation155 Questions

Exam 25: Short-Term Business Decisions182 Questions

Exam 26: Capital Investment Decisions142 Questions

Exam 27: Accounting Information Systems143 Questions

Select questions type

A company is setting its direct materials and direct labor standards for its leading product.Direct material costs from the supplier are $9 per square foot,net of purchase discount.Freight-in amounts to $0.30 per square foot.Basic wages of the assembly line personnel are $19 per hour.Payroll taxes are approximately 23% of wages.How much is the direct labor cost standard per hour? (Round your answer to the nearest cent. )

(Multiple Choice)

4.9/5  (39)

(39)

Unfavorable variances are subtracted from each other to arrive at a favorable variance.

(True/False)

4.8/5  (33)

(33)

Which of the following is a reason companies use standard costs?

(Multiple Choice)

4.7/5  (36)

(36)

For each of the following efficiency standards,indicate which parties are responsible for the standard and list one factor that should be used in setting the standard.

Efficiency standard Responsible party Factor used in setting the standard Direct materials Direct labor

(Essay)

5.0/5  (37)

(37)

On a standard cost income statement,the variances with debit balances are shown in parentheses because they are contra expenses and therefore decrease the expense Cost of Goods Sold.

(True/False)

4.9/5  (33)

(33)

Rees Manufacturing uses a standard cost system.Standards for direct materials are as follows: Direct materials (pounds per unit of output) 3 Cost per pound of direct materials \ 6 Actual purchases of direct materials for the current month are 10,000 pounds for $48,600.Planned and actual production for the month is 3,100 units.Rees has issued 10,000 pounds of direct materials to production.The journal entry to record this transaction is ________.

(Multiple Choice)

4.9/5  (37)

(37)

The fixed overhead volume variance is a cost variance that explains why fixed overhead is overallocated or underallocated.

(True/False)

4.7/5  (42)

(42)

Western Outfitters projected sales of 79,000 units for the year at a unit sales price of $12.00.Actual sales for the year were 73,000 units at $14.00 per unit.Variable costs were budgeted at $4.00 per unit,and the actual variable cost was $5.00 per unit.Budgeted fixed costs totaled $375,000 while actual fixed costs amounted to $415,000.What is the flexible budget variance for operating income?

(Multiple Choice)

4.8/5  (39)

(39)

The following information relates to Bloomberg Manufacturing's overhead costs for the month:

Static budget variable overhead \ 14,200 Static budget fixed overhead \ 5,600 Static budget direct labor hours 1,000 hours Static budget number of units 5,000 units Bloomberg allocates manufacturing overhead to production based on standard direct labor hours.

Bloomberg reported the following actual results for last month: actual variable overhead,$14,500; actual fixed overhead,$5,400; actual production of 4,700 units at 0.22 direct labor hours per unit.The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead efficiency variance.(round the answer to the nearest dollar)

(Essay)

4.7/5  (37)

(37)

The management of Chung Fire Alarms has calculated the following variances: Direct materials cost variance \ 8,000 Direct materials efficiency variance 40,000 Direct labor cost variance 15,000 Direct labor efficiency variance 13,500 Total variable overhead variance 8,500 Total fixed overhead variance 3,500 What is the total direct labor variance of the company?

(Multiple Choice)

4.9/5  (33)

(33)

For each of the following variances,state which manager is most likely to be responsible for the variance.

Variance Responsible Manager Direct Materials Cost Direct Labor Efficiency Variable Overhead Efficiency

(Essay)

4.9/5  (39)

(39)

The difference between cost variances and efficiency variances pertains to ________.

(Multiple Choice)

4.8/5  (30)

(30)

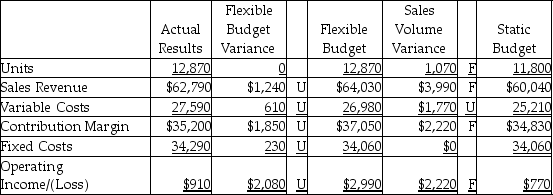

The Washington Fish Company completed the flexible budget analysis for the second quarter,which is given below.  Which of the following statements would be a correct analysis of the sales volume variance for operating income?

Which of the following statements would be a correct analysis of the sales volume variance for operating income?

(Multiple Choice)

4.9/5  (38)

(38)

The following information relates to Leonard Manufacturing's overhead costs for the month:

Static budget variable overhead \ 14,200 Static budget fixed overhead \ 5,600 Static budget direct labor hours 1,000 hours Static budget number of units 5,000 units Leonard allocates manufacturing overhead to production based on standard direct labor hours.

Leonard reported the following actual results for last month: actual variable overhead,$14,500; actual fixed overhead,$5,400; actual production of 4,700 units at 0.22 direct labor hours per unit.The standard direct labor time is 0.20 direct labor hours per unit.

Compute the fixed overhead cost variance.

(Essay)

4.7/5  (33)

(33)

A cost variance measures the difference in quantities of actual inputs used and the standard quantity of inputs allowed for the actual number of units produced.

(True/False)

4.8/5  (36)

(36)

The static budget,at the beginning of the month,for Assembly Furniture Company follows: Static budget:

Sales volume: 1,100 units; Sales price: per unit

Variable costs: per unit; Fixed costs: per month

Operating income:

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 980 units; Sales price: per unit

Variable costs: per unit; Fixed costs: per month

Operating income:

Calculate the sales volume variance for fixed costs.

(Multiple Choice)

4.9/5  (38)

(38)

Cheapo Sales Company uses a standard cost system.Overhead costs are allocated based on direct labor hours.In the first quarter,Cheapo Sales had a favorable efficiency variance for variable overhead costs.Which of the following scenarios is a reasonable explanation for this variance?

(Multiple Choice)

4.9/5  (30)

(30)

What does a favorable direct materials cost variance indicate?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 61 - 80 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)