Exam 21: Transfer Pricing and Multinational Management Control Systems

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes171 Questions

Exam 3: Cost-Volume-Profit Analysis156 Questions

Exam 4: Job Costing145 Questions

Exam 5: Activity-Based Costing and Management144 Questions

Exam 6: Master Budget and Responsibility Accounting170 Questions

Exam 7: Flexible Budgets,variances,and Management Control: I172 Questions

Exam 8: Flexible Budgets,variances,and Management Control: II148 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation171 Questions

Exam 10: Analysis of Cost Behaviour212 Questions

Exam 11: Decision Making and Relevant Information174 Questions

Exam 12: Pricing Decisions, product Profitability Decisions, and Cost Management150 Questions

Exam 13: Strategy,balanced Scorecard,and Profitability Analysis161 Questions

Exam 14: Period Cost Allocation163 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts167 Questions

Exam 16: Revenue and Customer Profitability Analysis152 Questions

Exam 17: Process Costing147 Questions

Exam 18: Spoilage, rework, and Scrap137 Questions

Exam 19: Inventory Cost Management Strategies152 Questions

Exam 20: Capital Budgeting: Methods of Investment Analysis187 Questions

Exam 21: Transfer Pricing and Multinational Management Control Systems157 Questions

Exam 22: Multinational Performance Measurement and Compensation156 Questions

Select questions type

Subunits X and Y determined the price for interdepartmental services during the last monthly meeting,using the selling prices charged to outside parties.This is an example of

(Multiple Choice)

4.8/5  (36)

(36)

Companies may approach tax authorities to obtain an Advanced Transfer Price Arrangement to ascertain if a proposed transfer pricing arrangement is acceptable.

(True/False)

4.8/5  (33)

(33)

Discuss some of the recent legislation and frameworks relating to assurance and internal controls.

(Essay)

4.9/5  (29)

(29)

Suboptimal decision making is also called congruent decision making.

(True/False)

4.9/5  (33)

(33)

Market-based transfer prices are generally accepted by tax authorities because they represent arm's length prices.

(True/False)

4.9/5  (36)

(36)

Market price is the only price that a firm should use when transferring goods from one subunit to another subunit.

(True/False)

4.9/5  (36)

(36)

Negotiated transfer prices are always transacted at the top management levels.

(True/False)

4.8/5  (38)

(38)

Effort in terms of management control systems is defined in terms of physical exertion such as a worker producing at a faster rate.

(True/False)

4.7/5  (37)

(37)

A(n)________ is a binding agreement between a multinational and the taxing authority to obtain approval for a specific transfer price for a number of years.

(Multiple Choice)

4.8/5  (37)

(37)

Walton Industries has two divisions: Machining and Assembly.The Assembly Division is looking to source 20,000 units annually of specialized component product from Machining Division.The special components have variable costs of $260 per unit in variable production costs.The Machine Products Division has a bid from an outside supplier of $445 per unit.However,to meet the requirements of the Assembly Division,Machining would have to cut back production of an existing product.This product sells for $565 per unit,and requires $369 per unit in variable production costs.Packaging and shipping costs of the existing product are $12 per unit,but these would be slashed by 75% for the specialized component for Assembly.Machining currently sells 120,000 units of the existing product and this volume would have to be reduced by 25% to meet the Assembly Division's demand.

Required:

Should the transfer take place,and if so,what would be the range of acceptable transfer prices?

(Essay)

4.8/5  (37)

(37)

Sportswear Ltd.manufactures socks.The Athletic Division sells its socks for $6 a pair to outsiders.

Socks have manufacturing variable and fixed costs of $2.50 and $1.50,respectively.The division's total fixed manufacturing costs are $105,000 at the normal volume of 70,000 units.

The European Division has offered to buy 15,000 socks at the full cost of $4.The Athletic Division

has excess capacity and the 15,000 units can be produced without interfering with the current outside

sales of 70,000.The 85,000 volume is within the division's relevant operating range.

Explain whether the Athletic Division should accept the offer.

(Essay)

4.8/5  (32)

(32)

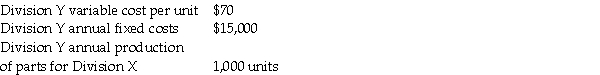

Mar Company has two decentralized divisions,X and Y.Division X has been purchasing certain component parts from Division Y at $75 per unit.Because Division Y plans to raise the price to $100 per unit,Division X desires to purchase these parts from external suppliers for $75 per unit.The following information is available:

If Division X buys from an external supplier,the facilities Division Y uses to manufacture these parts will be idle.Assuming Division Y's fixed costs cannot be avoided,what is the result if Mar requires Division X to buy from Division Y at a transfer price of $100 per unit?

If Division X buys from an external supplier,the facilities Division Y uses to manufacture these parts will be idle.Assuming Division Y's fixed costs cannot be avoided,what is the result if Mar requires Division X to buy from Division Y at a transfer price of $100 per unit?

(Essay)

5.0/5  (34)

(34)

Full-cost transfer pricing may be used because it yields relevant costs for short-run decisions even though full-cost allocations may lead to poor long-run decisions.

(True/False)

4.8/5  (37)

(37)

Use the information below to answer the following question(s).

Bon Accord uses two divisions in the production of soybean burgers.Division A sells soybean paste internally to Division B,which,in turn,produces soybean burgers that sell for $5 per kilogram.Division A incurs costs of $0.75 per kilogram,while Division B incurs additional costs of $2.50 per kilogram.

-What is Division B's operating income per kilogram assuming the transfer price of the soybean paste is set at $1.25 per kilogram?

(Multiple Choice)

4.9/5  (32)

(32)

All of the following criteria may be used to choose a transfer-pricing method EXCEPT

(Multiple Choice)

4.7/5  (40)

(40)

The essence of decentralization is the freedom for managers at lower levels of the organization to make decisions.

(True/False)

4.9/5  (32)

(32)

Alsation Ltd.has two divisions:.The Machining Division prepares the raw materials into component parts,and the Assembly Division assembles the components into finished product.No inventories exist in either division at the beginning of the year.During the year the Machining Division prepared 80,000 square metres of sheet metal at a cost of $480,000.All production was transferred to the Assembly Division where the metal was converted into 80,000 units of finished product at an additional costs of $5 per unit.The 80,000 units were sold for $2,000,000.

Required:

a.Determine the operating income for each division if the transfer price from Machining to Assembly is at cost.

b.Determine the operating income for each division if the transfer price is $5/square metre.

c.Since the Machining Division has all of its sales internally to the Assembly Division,does the manager care what price is selected? Why? Should the Machining Division be a cost centre or a profit centre under the circumstances?

(Essay)

4.8/5  (36)

(36)

Showing 141 - 157 of 157

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)