Exam 7: Cost Assignment

Exam 1: Introduction to Management Accounting78 Questions

Exam 2: An Introduction to Cost Terms and Concepts79 Questions

Exam 3: Cost-Volume-Profit Analysis121 Questions

Exam 4: Measuring Relevant Costs and Revenues for Decision-Making82 Questions

Exam 5: Pricing Decisions and Profitability Analysis62 Questions

Exam 6: Capital Investment Decisions110 Questions

Exam 7: Cost Assignment81 Questions

Exam 8: Activity-Based Costing108 Questions

Exam 9: The Budgeting Process120 Questions

Exam 10: Management Control Systems83 Questions

Exam 11: Standard Costing and Variance Analysis95 Questions

Exam 12: Divisional Financial Performance Measurement86 Questions

Exam 13: Transfer Pricing in Divisionalized Companies63 Questions

Exam 14: Cost Management156 Questions

Exam 15: Strategic Performance Management49 Questions

Select questions type

Winter Manufacturing has four categories of overhead. The four categories and expected overhead costs for each category for next year are listed as follows: Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. 100,000 direct labour hours are budgeted for next year.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 10 percent.

Estimates for the proposed job are as follows:

The plant manager has heard of a new way of applying overhead that uses cost pools and activity cost drivers. Expected activity for the four activity drivers that would be used are:

The plant manager has heard of a new way of applying overhead that uses cost pools and activity cost drivers. Expected activity for the four activity drivers that would be used are:

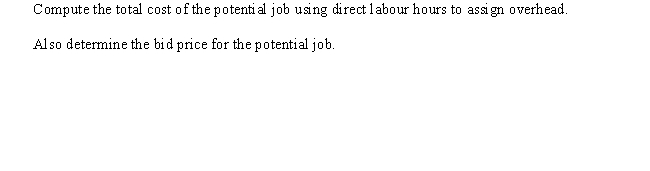

What is the total cost of the proposed job if Winter Manufacturing uses direct labour hours as its only activity driver?

What is the total cost of the proposed job if Winter Manufacturing uses direct labour hours as its only activity driver?

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is a reason to accumulate and separately assign costs by departments?

(Multiple Choice)

4.8/5  (43)

(43)

The support departments typically found in manufacturing and nonmanufacturing organizations are as follows:

Cafeteria

Personnel

Maintenance

Purchasing

Accounting

Required:

For each of the preceding support departments, indicate potential bases that could be used to allocate costs to the producing departments.

(Essay)

4.8/5  (29)

(29)

Figure 1

Harrison Co. produces two products, AB and XY. Information about the current period's production is as follows:

Harrison uses a plantwide rate of £4 per machine hour to apply overhead to production. Budgeted overhead was £392,000, but actual overhead was £376,000.

-Refer to Figure 1 above. What was Harrison Company's unit manufacturing cost for product XY?

(Multiple Choice)

4.9/5  (45)

(45)

Compare/contrast cost assignment and cost allocation. Be sure to include direct assignment (tracing) and driver tracing in your discussion.

(Essay)

5.0/5  (35)

(35)

Traditional-based product costing uses which of the following procedures?

(Multiple Choice)

4.8/5  (37)

(37)

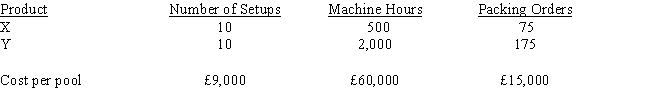

Zipp Company manufactures two products (X and Y). The overhead costs (£84,000) have been divided into three cost pools that use the following cost drivers: What is the amount of overhead cost to be assigned to Product X using machine hours as the cost driver ?

(Multiple Choice)

4.9/5  (36)

(36)

Figure 3

Ray Manufacturing has four categories of overhead. The four categories and the expected overhead costs for each category for next year are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 100,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 10 percent.

Estimates for the proposed job are as follows:

The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers. Expected activity for the four activity-based cost drivers that would be used are as follows:

The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers. Expected activity for the four activity-based cost drivers that would be used are as follows:

-Refer to Figure 3. If Ray Manufacturing used direct labour hours as the cost driver, the amount of overhead allocated to the proposed job would be

-Refer to Figure 3. If Ray Manufacturing used direct labour hours as the cost driver, the amount of overhead allocated to the proposed job would be

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following departments is NOT a support department?

(Multiple Choice)

4.9/5  (36)

(36)

The method of accounting for inventory that assigns all manufacturing costs to inventory is sometimes referred to as:

(Multiple Choice)

4.8/5  (37)

(37)

Examples of support departments include all of the following EXCEPT

(Multiple Choice)

4.8/5  (46)

(46)

The Greenbriar plant has two categories of overhead: maintenance and inspection. Costs expected for these categories for the coming year are as follows:

The plant currently applies overhead using direct labour hours and expected capacity of 20,000 direct labour hours. The data provided below has been assembled for use in developing a bid for a proposed job. Bid prices are calculated as full manufacturing cost plus 40 percent markup.

Total expected machine hours for all jobs during the year are 10,000, and the total expected number of inspections is 1,500.

Required:

Total expected machine hours for all jobs during the year are 10,000, and the total expected number of inspections is 1,500.

Required:

(Essay)

4.8/5  (37)

(37)

If conventional manufacturing is used, which of the following would be considered direct costs?

(Multiple Choice)

4.9/5  (46)

(46)

Which of the following describes the product costing continuum?

(Multiple Choice)

4.7/5  (47)

(47)

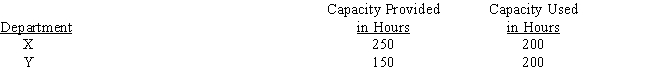

A company incurred £20,000 of common fixed costs and £30,000 of common variable costs. These costs are to be allocated to Departments X and Y. Data on capacity provided and capacity used are as follows: Assume that common fixed costs are to be allocated to Departments X and Y on the basis of capacity provided and that common variable costs are to be allocated to Departments X and Y on the basis of capacity used. The fixed and variable costs allocated to Department X are

(Multiple Choice)

4.8/5  (38)

(38)

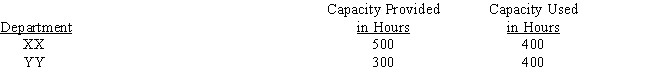

A company incurred £120,000 of common fixed costs and £180,000 of common variable costs. These costs are to be allocated to Departments XX and YY. Data on capacity provided and capacity used are as follows: Assume that common fixed costs are to be allocated to Departments XX and YY on the basis of capacity provided and that common variable costs are to be allocated to Departments XX and YY on the basis of capacity used. The fixed and variable costs allocated to Department XX are

(Multiple Choice)

4.8/5  (34)

(34)

The following information is provided for the year: The budgeted overhead used to calculate the predetermined rate must have been

(Multiple Choice)

4.7/5  (36)

(36)

Figure 3

Ray Manufacturing has four categories of overhead. The four categories and the expected overhead costs for each category for next year are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 100,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 10 percent.

Estimates for the proposed job are as follows:

The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers. Expected activity for the four activity-based cost drivers that would be used are as follows:

The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers. Expected activity for the four activity-based cost drivers that would be used are as follows:

-Refer to Figure 3 above. If Ray Manufacturing used machine hours to assign maintenance costs, the amount of maintenance costs allocated to the proposed job would be

-Refer to Figure 3 above. If Ray Manufacturing used machine hours to assign maintenance costs, the amount of maintenance costs allocated to the proposed job would be

(Multiple Choice)

4.9/5  (34)

(34)

Showing 41 - 60 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)