Exam 2: Consolidated Statements: Date of Acquisition

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice48 Questions

Exam 2: Consolidated Statements: Date of Acquisition44 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition37 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes43 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation48 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary42 Questions

Exam 9: The International Accounting Environment17 Questions

Exam 10: Foreign Currency Transactions75 Questions

Exam 11: Translation of Foreign Financial Statements79 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise63 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities36 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations47 Questions

Exam 15: Government and Not for Profit Accounting44 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds60 Questions

Exam 17: Financial Reporting Issues37 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations61 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations83 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role56 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations49 Questions

Exam 22: Derivatives and Related Accounting Issues60 Questions

Exam 23: Equity Method for Unconsolidated Investments25 Questions

Exam 24: Variable Interest Entities10 Questions

Select questions type

Pinehollow acquired 80% of the outstanding stock of Stonebriar by issuing 80,000 shares of its $1 par value stock.The shares have a fair value of $15 per share.Pinehollow also paid $25,000 in direct acquisition costs.Prior to the transaction, the companies have the following balance sheets: ?

?

Assets Pinehollow Stonebriar Cash \ 150,000 \ 50,000 Accounts receivable 500,000 350,000 Inventory 900,000 600,000 Property, plant, and equipment (net) 900,000 Total assets \ 3,400,000 \ 1,900,000 Liabilities and Stockholders' Equity Current liabilities \ 300,000 \ 100,000 Bonds payable 1,000,000 600,000 Common stock ( \ 1 par) 300,000 100,000 Paid-in capital in excess of par 800,000 900,000 Retained earnings Total liabilities and equity \ 3,400,000 \ 1,900,000

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

B

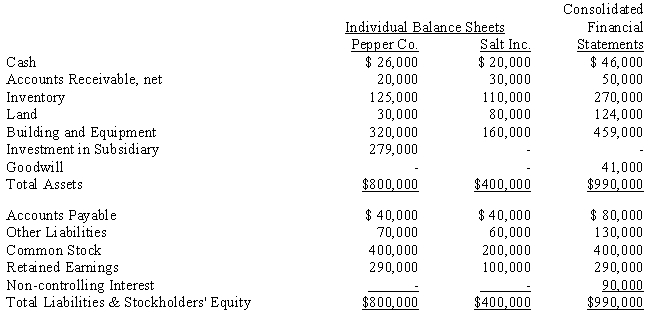

The following consolidated financial statement was prepared immediately following the acquisition of Salt, Inc.by Pepper Co.

Free

(Essay)

4.7/5  (41)

(41)

Correct Answer:

Answer the following based upon the above financial statements:

a.

How much did Pepper Co. pay to acquire Salt Inc.?

b.

What was the fair value of Salt's Inventory at the time of acquisition?

c.

Was the book value of Salt's Building and Equipment overvalued or undervalued relative to the Building and Equipment's fair value at the time of acquisition?

How is the non-controlling interest treated in the consolidated balance sheet?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

Which of the following statements about consolidation is not true?

(Multiple Choice)

4.9/5  (33)

(33)

On April 1, 2016, Paape Company paid $950,000 for all the issued and outstanding stock of Simon Corporation.The recorded assets and liabilities of the Simon Corporation on April 1, 2016, follow:

Cash \ 80,000 Inventory 240,000 Property and equipment (net of accumulated depreciation of \ 320,000) 480,000 Liabilities (180,000) On April 1, 2016, it was determined that the inventory of Simon had a fair value of $190,000, and the property and equipment (net) had a fair value of $560,000.What is the amount of goodwill resulting from the business combination?

(Multiple Choice)

4.8/5  (36)

(36)

Supernova Company had the following summarized balance sheet on December 31 of the current year:

?

?

Assets Accounts receivable \ 350,000 Inventory 450,000 Property and plant (net) \ Total \ Liabilities and Equity Notes payable \ 600,000 Common stock, \ 5 par 300,000 Paid-in capital in excess of par 400,000 Retained earnings 100,000 Total \

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

?

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20 per share, for 100% of the common stock of Supernova Company.Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

?

Required:

?

a.What journal entries will Redstar Corporation record for the investment in Supernova and issuance of stock?

?

?

b.Prepare a supporting value analysis and determination and distribution of excess schedule

?

?

c.Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

(Essay)

4.8/5  (38)

(38)

Which of the following is not an advantage of the parent issuing shares of stock in exchange for the subsidiary common shares being acquired?

(Multiple Choice)

5.0/5  (39)

(39)

The SEC requires the use of push-down accounting in some specific situations.Push-down accounting results in:

(Multiple Choice)

4.9/5  (39)

(39)

On April 1, 2016, Paape Company paid $950,000 for all the issued and outstanding stock of Simon Corporation.The recorded assets and liabilities of the Simon Corporation on April 1, 2016, follow:

Cash \ 80,000 Inventory 240,000 Property and equipment (net of accumulated depreciation of \ 320,000) 480,000 Liabilities (180,000) On April 1, 2016, it was determined that the inventory of Simon had a fair value of $190,000, and the property and equipment (net) had a fair value of $560,000.The entry to distribute the excess of fair value over book value will include:

(Multiple Choice)

4.8/5  (40)

(40)

On December 31, 2016, Parent Company purchased 80% of the common stock of Subsidiary Company for $280,000.On this date, Subsidiary had total owners' equity of $250,000 (common stock $20,000; other paid-in capital, $80,000; and retained earnings, $150,000).Any excess of cost over book value is due to the under or overvaluation of certain assets and liabilities.Inventory is undervalued $5,000.Land is undervalued $20,000.Buildings and equipment have a fair value which exceeds book value by $30,000.Bonds payable are overvalued $5,000.The remaining excess, if any, is due to goodwill.

?

Required:

?

a.Prepare a value analysis schedule for this business combination.?

?

b.Prepare the determination and distribution schedule for this business combination

?

?

c.Prepare the necessary elimination entries in general journal form.

(Essay)

4.9/5  (33)

(33)

Discuss the conditions under which the SEC would assume a presumption of control.Additionally, under what circumstances might consolidation be required even though the parent does not control the subsidiary?

When would it not be appropriate to consolidate when more than 50% of the voting stock is held?

(Essay)

4.9/5  (37)

(37)

Pesto Company paid $10 per share to acquire 80% of Sauce Company's 100,000 outstanding shares; however the market price of the remaining shares was $8.50.The fair value of Sauce's net assets at the time of the acquisition was $850,000.In this case, where Pesto paid a premium to achieve control:

(Multiple Choice)

4.7/5  (44)

(44)

When a company purchases another company that has existing goodwill and the transaction is accounted for as a stock acquisition, the goodwill should be treated in the following manner:

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is true of the consolidation process?

(Multiple Choice)

4.8/5  (43)

(43)

Consolidation might not be appropriate even when the majority owner has control if:

(Multiple Choice)

4.9/5  (45)

(45)

Consolidated financial statements are appropriate even without a majority ownership if which of the following exists:

(Multiple Choice)

4.8/5  (31)

(31)

Pinehollow acquired 70% of the outstanding stock of Stonebriar by issuing 70,000 shares of its $1 par value stock.The shares have a fair value of $15 per share.Pinehollow also paid $25,000 in direct acquisition costs.Prior to the transaction, the companies have the following balance sheets:

Assets Pinehollow Stonebriar Cash \ 150,000 \ 50,000 Accounts receivable 500,000 350,000 Inventory 900,000 600,000 Property, plant, and equipment (net) 900,000 Total assets \ 3,400,000 \ 1,900,000 Liabilities and Stockholders' Equity Current liabilities \ 300,000 \ 100,000 Bonds payable 1,000,000 600,000 Common stock ( \ 1 par) 300,000 100,000 Paid-in capital in excess of par 800,000 900,000 Retained earnings Total liabilities and equity \ 3,400,000 \ 1,900,000

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.What is the amount of the non-controlling interest that will be included in the consolidated balance sheet immediately after the acquisition

(Multiple Choice)

4.8/5  (37)

(37)

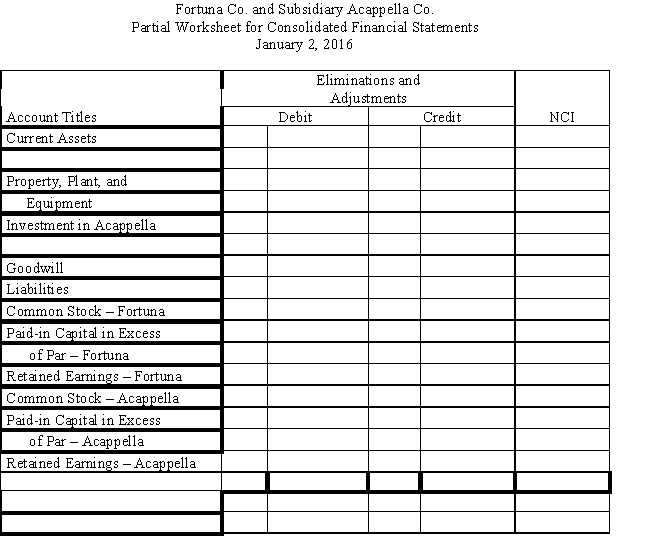

Fortuna Company issued 70,000 shares of $1 par stock, with a fair value of $20 per share, for 80% of the outstanding shares of Acappella Company.The firms had the following separate balance sheets prior to the acquisition:

?

?

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which has a fair value of $1,600,000.

?

Required:

?

a.Prepare a value analysis schedule

?

?

b.Prepare a determination and distribution of excess schedule.?

?

c.Provide all eliminations on the partial balance sheet worksheet provided in Figure 2-9 and complete the non-controlling interest column.?

Figure 2-9

Fortuna Co.and Subsidiary Acappella Co.Partial Worksheet for Consolidated Financial Statements

January 2, 2016

?

?

?

?

Balance Sheet

?

Account Titles

Fortuna

Acappella

Current Assets

2,100,000

960,000

?

?

?

Property, Plant, and

?

?

Equipment

4,600,000

1,300,000

Investment in Acappella

1,400,000

?

?

?

?

Goodwill

?

240,000

Liabilities

(3,000,000)

(800,000)

Common Stock - Fortuna

(870,000)

?

Paid-in Capital in Excess

?

?

of Par - Fortuna

(3,530,000)

?

Retained Earnings - Fortuna

(700,000)

?

Common Stock - Acappella

?

(200,000)

Paid-in Capital in Excess

?

?

of Par - Acappella

?

(300,000)

Retained Earnings - Acappella

?

(1,200,000)

?

?

?

?

?

?

?

?

?

?

?

?

?

(Essay)

4.8/5  (36)

(36)

Pagach Company purchased 100% of the voting common stock of Rage Company for $1,800,000.The following book and fair values are available:

Book Value Fair Value Current assets \ 150,000 \ 300,000 Land and building 280,000 280,000 Machinery 400,000 700,000 Bonds payable (300,000) (250,000) Goodwill 150,000 ?

The bonds payable will appear on the consolidated balance sheet

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 44

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)