Exam 17: Governmental Entities: Introduction and General Fund Accounting

Exam 1: Intercorporate Acquisitions and Investments in Other Entities58 Questions

Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential59 Questions

Exam 3: The Reporting Entity and Consolidation of Less-Than-Wholly-Owned Subsidiaries With No Differentials50 Questions

Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value67 Questions

Exam 5: Consolidation of Less-Than-Wholly-Owned Subsidiaries Acquired at More Than Book Value58 Questions

Exam 6: Intercompany Inventory Transactions68 Questions

Exam 7: Intercompany Transfers of Services and Noncurrent Assets57 Questions

Exam 8: Intercompany Indebtedness50 Questions

Exam 8: Appendix A: Intercompany Indebtedness40 Questions

Exam 9: Consolidation Ownership Issues62 Questions

Exam 10: Additional Consolidation Reporting Issues58 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments74 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements75 Questions

Exam 13: Segment and Interim Reporting76 Questions

Exam 14: Sec Reporting49 Questions

Exam 15: Partnerships: Formation,operation,and Changes in Membership77 Questions

Exam 16: Partnerships: Liquidation67 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting86 Questions

Exam 18: Governmental Entities: Special Funds and Government-Wide Financial Statements84 Questions

Exam 19: Not-For-Profit Entities126 Questions

Exam 20: Corporations in Financial Difficulty45 Questions

Select questions type

Goshen City acquires $36,000 of inventory on November 1, 20X5, having held no inventory previously. On December 31, 20X5, the end of Goshen City's fiscal year, a physical count shows $7,000 still in stock. During 20X6, $5,000 of this inventory is used, resulting in a $2,000 remaining balance of supplies on December 31, 20X6.

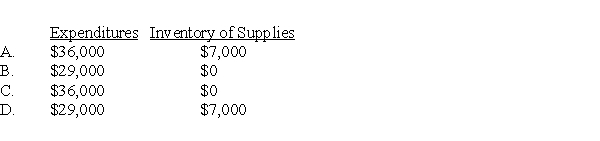

-Based on the preceding information,which of the following would be the correct account balances for 20X5 if Goshen City used the purchase method of accounting for inventories?

(Short Answer)

4.8/5  (33)

(33)

The Board of Commissioners of Vane City adopted its budget for the year ending July 31,comprising estimated revenues of $30,000,000 and appropriations of $29,000,000.Vane formally integrates its budget into the accounting records.What entry should be made for budgeted revenues?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following observations concerning encumbrances is NOT true?

(Multiple Choice)

4.8/5  (27)

(27)

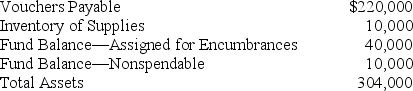

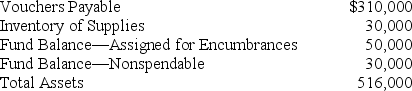

The following information was obtained from the general fund balance sheet of Lima Village on June 30,20X9,the close of its fiscal year:

On June 30,20X9,what was Lima's unassigned fund balance in its general fund?

On June 30,20X9,what was Lima's unassigned fund balance in its general fund?

(Multiple Choice)

5.0/5  (39)

(39)

All of the following are elements of the statement of financial condition for state and local governments with the exception of:

(Multiple Choice)

4.7/5  (34)

(34)

Which of the following items should not be included as revenue for a state government?

(Multiple Choice)

4.9/5  (38)

(38)

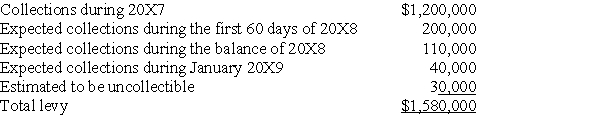

The following information pertains to property taxes levied by Sycamore City for 20X7:

What amount should Sycamore report for 20X7 net property tax revenues?

What amount should Sycamore report for 20X7 net property tax revenues?

(Multiple Choice)

4.8/5  (37)

(37)

A budgetary fund balance - assigned in excess of a balance of encumbrances indicates

(Multiple Choice)

4.7/5  (38)

(38)

What is the correct sequence in the expenditure process in governmental accounting?

(Multiple Choice)

4.8/5  (42)

(42)

Which governmental fund includes resources that are legally restricted so that the governmental entity must maintain the principal and can use only the earnings from the fund's resources to benefit the government's programs for all of its citizens?

(Multiple Choice)

4.8/5  (35)

(35)

In a statement of revenues,expenditures,and changes in fund balance,the unassigned fund balance will be increased by:

I.a decrease in the fund balance-Nonspendable

II.an excess of other financing sources over other financing uses.

(Multiple Choice)

4.8/5  (32)

(32)

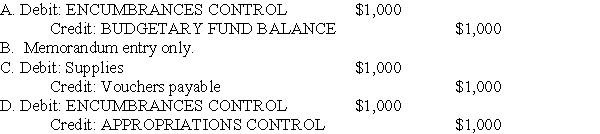

Albee Township's fiscal year ends on June 30.Albee uses encumbrance accounting.On April 5,20X5,an approved $1,000 purchase order was issued for supplies.Albee received these supplies on May 2,20X5,and the $1,000 invoice was approved for payment.What journal entry should Albee make on April 5,20X5,to record the approved purchase order?

(Short Answer)

4.9/5  (36)

(36)

At any time,the remaining appropriating authority available to the fund managers is equal to:

(Multiple Choice)

4.9/5  (36)

(36)

Elm City issued a purchase order for supplies with an estimated cost of $5,000.When the supplies were received,the accompanying invoice indicated an actual price of $4,950.What amount should Elm debit (credit)to the budgetary fund balance account after the supplies and invoice were received?

(Multiple Choice)

4.8/5  (37)

(37)

GASB 31 "Accounting for Financial Reporting for Certain Investments and for External Reporting Investment Pools," establishes a general rule that government entities value investments in option contracts,open-ended mutual funds,and debt securities for balance sheet presentation at:

(Multiple Choice)

4.9/5  (37)

(37)

All of the following funds have a financial resources measurement focus with the exception of which fund?

(Multiple Choice)

4.8/5  (37)

(37)

The following information was obtained from the general fund balance sheet of Lincoln County on June 30,20X2,the close of its fiscal year:

On June 30,20X2,what was Lincoln's unassigned fund balance in its general fund?

On June 30,20X2,what was Lincoln's unassigned fund balance in its general fund?

(Multiple Choice)

4.9/5  (37)

(37)

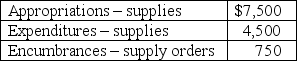

The following balances are included in the subsidiary records of Burwood Village's Parks and Recreation Department at March 31st:

How much does the Department have available for additional purchases of supplies?

How much does the Department have available for additional purchases of supplies?

(Multiple Choice)

4.8/5  (31)

(31)

Discuss major differences between a governmental entity's uses of the modified accrual method and a for-profit corporation's use of the accrual method.

(Essay)

4.7/5  (32)

(32)

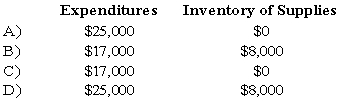

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

-Based on the preceding information,which of the following would be the correct account balances for 20X7 if Gotham City used the purchase method of accounting for inventories?

(Short Answer)

4.9/5  (46)

(46)

Showing 21 - 40 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)