Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models146 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System153 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply147 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes138 Questions

Exam 5: Externalities, environmental Policy, and Public Goods133 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply150 Questions

Exam 7: The Economics of Health Care115 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance141 Questions

Exam 9: Comparative Advantage and the Gains From International Trade123 Questions

Exam 10: Consumer Choice and Behavioral Economics154 Questions

Exam 11: Technology, production, and Costs165 Questions

Exam 12: Firms in Perfectly Competitive Markets151 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting143 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets135 Questions

Exam 15: Monopoly and Antitrust Policy134 Questions

Exam 16: Pricing Strategy134 Questions

Exam 17: The Markets for Labor and Other Factors of Production147 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income139 Questions

Select questions type

Income inequality in the United States has increased somewhat over the past 25 years.Two factors that appear to have contributed to this are

(Multiple Choice)

4.8/5  (33)

(33)

In the United States,the largest source of funds for public schools is

(Multiple Choice)

4.9/5  (36)

(36)

The burden of a tax on soft drinks would fall more on ________ the more ________.

(Multiple Choice)

4.8/5  (41)

(41)

Congressman Gallstone seeks support from his colleagues for a bill he sponsors that will establish a new national park in his district.He offers to support Congresswoman Disrail's proposal to build a new library in her district in exchange for her vote for his national park bill.This is an example of

(Multiple Choice)

4.8/5  (49)

(49)

In reference to the federal income tax system,a tax bracket is

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following statements concerning the federal corporate income tax is true?

(Multiple Choice)

4.8/5  (40)

(40)

Table 18-3

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

-Refer to Table 18-3.Calculate the percent of income paid in taxes by a family with $20,000 income and by a family with $24,000 income.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

-Refer to Table 18-3.Calculate the percent of income paid in taxes by a family with $20,000 income and by a family with $24,000 income.

(Multiple Choice)

4.7/5  (43)

(43)

When members of Congress vote to pass new legislation,they will

(Multiple Choice)

4.8/5  (23)

(23)

Which of the following explains one difference between a consumption tax and an income tax?

(Multiple Choice)

4.9/5  (40)

(40)

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is the largest source of revenue for the U.S.federal government?

(Multiple Choice)

4.9/5  (46)

(46)

Income inequality increases as the Gini coefficient approaches 1.

(True/False)

4.8/5  (34)

(34)

In the United States,over the past 40 years federal revenues as a share of gross domestic product have

(Multiple Choice)

4.9/5  (42)

(42)

Many state governments use lotteries to raise revenue.If a lottery is viewed as a tax,is it most likely a progressive tax or a regressive tax? What information would you need to determine whether the burden of a lottery is progressive or regressive?

(Essay)

4.7/5  (32)

(32)

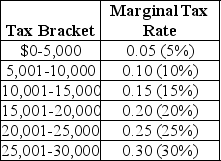

Last year,Anthony Millanti earned exactly $30,000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a.Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket,and the total tax he owes the government.(Assume that there are no allowable tax deductions,tax credits,personal exemptions or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

(Essay)

4.7/5  (43)

(43)

Showing 81 - 100 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)