Exam 18: Macroeconomics in an Open Economy

Exam 1: Economics: Foundations and Models211 Questions

Exam 2: Trade-Offs,comparative Advantage,and the Market System239 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply233 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes211 Questions

Exam 5: The Economics of Health Care164 Questions

Exam 6: Firms,the Stock Market,and Corporate Governance276 Questions

Exam 7: Comparative Advantage and the Gains From International Trade190 Questions

Exam 8: GDP: Measuring Total Production and Income266 Questions

Exam 9: Unemployment and Inflation292 Questions

Exam 10: Economic Growth, the Financial System, and Business Cycles257 Questions

Exam 11: Long-Run Economic Growth: Sources and Policies268 Questions

Exam 12: Aggregate Expenditure and Output in the Short Run306 Questions

Exam 13: Aggregate Demand and Aggregate Supply Analysis284 Questions

Exam 14: Money, banks, and the Federal Reserve System280 Questions

Exam 15: Monetary Policy277 Questions

Exam 16: Fiscal Policy303 Questions

Exam 17: Inflation, unemployment, and Federal Reserve Policy257 Questions

Exam 18: Macroeconomics in an Open Economy278 Questions

Exam 19: The International Financial System262 Questions

Select questions type

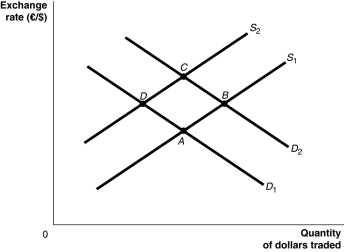

Figure 18-1  -Refer to Figure 18-1.The French fall in love with California wines and triple their purchases of this beverage.Assuming all else remains constant,this would be represented as a movement from

-Refer to Figure 18-1.The French fall in love with California wines and triple their purchases of this beverage.Assuming all else remains constant,this would be represented as a movement from

(Multiple Choice)

4.9/5  (38)

(38)

The current account does not include which of the following?

(Multiple Choice)

4.8/5  (40)

(40)

Why does continued foreign investment in U.S.stocks and bonds and foreign companies continuing to build factories in the United States result in a current account deficit in the United States?

(Essay)

4.8/5  (39)

(39)

How will contractionary monetary policy in Japan affect the demand and supply of the yen in the foreign exchange market?

(Multiple Choice)

5.0/5  (34)

(34)

Ceteris paribus,an increase in the government budget deficit increases interest rates in the United States and causes a real appreciation of the dollar.

(True/False)

4.8/5  (28)

(28)

If net foreign investment is negative,which of the following must be true?

(Multiple Choice)

4.8/5  (38)

(38)

Saving exceeds domestic investment in Japan,which generates a financial account deficit in Japan's balance of payments.

(True/False)

4.8/5  (25)

(25)

How will an increase in federal government spending without an increase in taxes affect real GDP and the price level in the short run in a closed economy and in an open economy?

(Essay)

4.9/5  (28)

(28)

Article Summary

Over the past two years, the Indian rupee has fallen 26 percent in value against the U.S. dollar, reaching a record low of 61.80 rupees per dollar in August 2013. The decline reflects increasing capital outflows and pessimism regarding the government's attempts to reverse this trend. The Indian government was expected to announce potential measures to increase the inflow of capital, including the possibility of raising debt abroad, raising money from Indians who live abroad, easing restrictions on overseas borrowing, and raising interest rates. Critics argue that current and well-entrenched policies deter capital inflow from investors and corporations, and raising interest rates may reduce confidence in the economy, which experienced a decade-low growth rate of 5 percent in 2013.

Source: Rafael Nam, "Rupee over 60: Why Indian currency weakness may be here to stay," Reuters, August 8, 2013.

-Refer to the Article Summary.All else equal,a depreciation of the Indian rupee relative to a currency such as the U.S.dollar should ________ Indian exports and ________ imports to India.

(Multiple Choice)

4.8/5  (27)

(27)

In 2013,global profits for McDonald's ________ when measured in local currencies than they did when measured in dollars.This occurred because the value of the U.S.dollar increased relative to most other currencies.

(Multiple Choice)

4.7/5  (34)

(34)

If foreign holdings of U.S.dollars increase,holding all else constant,

(Multiple Choice)

5.0/5  (33)

(33)

In an open economy,the current account balance equals ________.(Assume that the capital account is zero and net transfers are zero.)

(Multiple Choice)

4.8/5  (39)

(39)

How does a decrease in the federal budget deficit affect the demand for dollars and the supply of dollars on the foreign exchange market?

(Multiple Choice)

4.9/5  (41)

(41)

Explain why economies with financial account surpluses usually have current account deficits.

(Essay)

4.9/5  (45)

(45)

An increase in capital outflows from the United States will

(Multiple Choice)

4.9/5  (38)

(38)

The decline in the value of the yen after 2012 occurred as a result of the Japanese central bank,the Bank of Japan,following an expansionary monetary policy.Investors expected that the result would be lower nominal Japanese interest rates and a higher inflation rate.In response,investors ________,causing the value of the yen to decline against the dollar.

(Multiple Choice)

4.8/5  (37)

(37)

If the Fed does not take into account the additional policy channels available in an open economy,then ________ when conducting contractionary monetary policy,

(Multiple Choice)

4.7/5  (27)

(27)

Showing 261 - 278 of 278

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)