Exam 10: The Monetary System

Exam 1: Ten Principles of Economics216 Questions

Exam 2: Thinking Like an Economist234 Questions

Exam 3: Interdependence and the Gains From Trade206 Questions

Exam 4: The Market Forces of Supply and Demand349 Questions

Exam 5: Measuring a Nations Income169 Questions

Exam 6: Measuring the Cost of Living181 Questions

Exam 7: Production and Growth191 Questions

Exam 8: Saving, investment, and the Financial System213 Questions

Exam 9: Unemployment and Its Natural Rate197 Questions

Exam 10: The Monetary System204 Questions

Exam 11: Money Growth and Inflation195 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts220 Questions

Exam 13: A Macroeconomic Theory of the Small Open Economy196 Questions

Exam 14: Aggregate Demand and Aggregate Supply257 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand222 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment207 Questions

Exam 17: Five Debates Over Macroeconomic Policy119 Questions

Select questions type

Which statement best describes the consequences of open-market sales conducted by the Bank of Canada?

(Multiple Choice)

4.8/5  (36)

(36)

Table 10-3

The following information pertains to the Bank of Kamloops.  -Refer to the Table 10-3.If the Bank of Kamloops has loaned out all the money it wants,given its deposits,what is its reserve ratio?

-Refer to the Table 10-3.If the Bank of Kamloops has loaned out all the money it wants,given its deposits,what is its reserve ratio?

(Multiple Choice)

4.9/5  (43)

(43)

The bank of Hinton has $100 reserves,$10,000 long-term loans,$500 securities,$8800 deposits,and $1400 debt.Due to a macroeconomic slowdown,many people lose their jobs and need to live off their savings for a while.Discuss the possible effects of this situation on the bank of Hinton's assets,liabilities,and capital.Is the bank insolvent? Use numerical examples to illustrate your points.

(Essay)

4.7/5  (44)

(44)

Suppose the public decides to hold more currency and fewer deposits in banks.Which statement describes the effects of this decision?

(Multiple Choice)

4.8/5  (43)

(43)

What is the difference between commodity money and fiat money? Why do people accept fiat currency in trade for goods and services?

(Essay)

4.7/5  (31)

(31)

During the early 1930s,there were a number of bank failures.What did this do to the money supply? The central banks advocated open-market purchases.Would these purchases have reversed the change in the money supply and helped banks? Explain.

(Essay)

4.7/5  (30)

(30)

In order to support the Canadian dollar,the Bank of Canada buys an amount of Euros from some major commercial Canadian banks (a type of operation the Bank of Canada rarely undertakes).

a.What is the immediate and the long-term impact of this operation on the money supply?

b.If the Bank of Canada does not wish that the currency swap influence the money supply,what does it have to do?

(Essay)

4.8/5  (43)

(43)

Why was changing of reserve requirements phased out as a tool used by the Bank of Canada to control the money supply?

(Multiple Choice)

4.8/5  (40)

(40)

Bottles of very fine wine have less liquidity than demand deposits.

(True/False)

4.8/5  (37)

(37)

When Arnold uses dollars to record his income and expenses,how is he using money?

(Multiple Choice)

4.7/5  (33)

(33)

Since 1994,what was phased out as a tool used by the Bank of Canada to control the money supply?

(Multiple Choice)

4.9/5  (32)

(32)

If currency is $50 billion,chequable deposits $700 billion,other minor,less liquid categories $300 billion,and credit card debt $500 billion,how much is M1+?

(Multiple Choice)

4.9/5  (41)

(41)

If the reserve ratio is 20 percent,how much is the money multiplier?

(Multiple Choice)

4.8/5  (30)

(30)

What is the average currency holding of Canadian dollars relative to Canadian population?

(Multiple Choice)

4.8/5  (39)

(39)

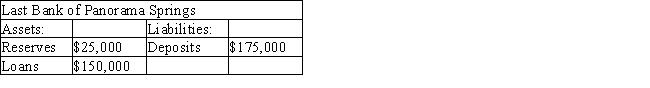

Table 10-2  -Refer to the Table 10-2.If the reserve requirement is 10 percent and then someone deposits $50,000 into the bank,what is the bank's reserve position?

-Refer to the Table 10-2.If the reserve requirement is 10 percent and then someone deposits $50,000 into the bank,what is the bank's reserve position?

(Multiple Choice)

4.8/5  (37)

(37)

If you deposit $100 into a demand deposit at a bank,what does this action do to the money supply?

(Multiple Choice)

4.9/5  (38)

(38)

As the reserve ratio increases,what happens to the money multiplier and money supply?

(Multiple Choice)

4.8/5  (37)

(37)

If the Bank of Canada buys bonds in the open market,the money supply decreases.

(True/False)

4.7/5  (34)

(34)

Showing 141 - 160 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)