Exam 13: A Macroeconomic Theory of the Small Open Economy

Exam 1: Ten Principles of Economics216 Questions

Exam 2: Thinking Like an Economist234 Questions

Exam 3: Interdependence and the Gains From Trade206 Questions

Exam 4: The Market Forces of Supply and Demand349 Questions

Exam 5: Measuring a Nations Income169 Questions

Exam 6: Measuring the Cost of Living181 Questions

Exam 7: Production and Growth191 Questions

Exam 8: Saving, investment, and the Financial System213 Questions

Exam 9: Unemployment and Its Natural Rate197 Questions

Exam 10: The Monetary System204 Questions

Exam 11: Money Growth and Inflation195 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts220 Questions

Exam 13: A Macroeconomic Theory of the Small Open Economy196 Questions

Exam 14: Aggregate Demand and Aggregate Supply257 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand222 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment207 Questions

Exam 17: Five Debates Over Macroeconomic Policy119 Questions

Select questions type

Explain why saving need not equal domestic investment in an open economy.

(Essay)

4.8/5  (33)

(33)

In the open-economy macroeconomic model,what would make Panama's net capital outflow decrease?

(Multiple Choice)

4.9/5  (36)

(36)

Which statement best describes the effects of trade policies?

(Multiple Choice)

4.8/5  (45)

(45)

Suppose a foreign real estate company wants to build a number of new resort condominiums in Canada.How does this affect the Canadian market for loanable funds?

(Multiple Choice)

4.9/5  (34)

(34)

In the open-economy macroeconomic model,where does the supply of loanable funds come from?

(Multiple Choice)

4.9/5  (31)

(31)

According to the open-economy macroeconomic model,if the Canadian government decreased the government budget deficit,both Canadian domestic investment and Canadian net capital outflow would fall.

(True/False)

4.9/5  (30)

(30)

Suppose that Canada imposes restrictions on the importation of steel into Canada.According to the open-economy macroeconomic model,what would be the most likely result?

(Multiple Choice)

4.7/5  (38)

(38)

Which of the following will decrease Canadian net capital outflow?

(Multiple Choice)

4.8/5  (32)

(32)

If a government increases its budget deficit,which statement would best describe the consequences?

(Multiple Choice)

4.9/5  (26)

(26)

Suppose the Federal Reserve,which is the central bank of the U.S.,decided to lower the monetary policy interest rate.Use the macroeconomic model studied in thisChapter to analyze the possible effects of this event on Canada's net capital outflow,net exports,and exchange rate.(Hint: Consider the United States a large economy,which is able to influence the world interest rate.)

(Essay)

4.8/5  (37)

(37)

What is the most likely result from an increase in the government's budget surplus?

(Multiple Choice)

4.9/5  (32)

(32)

The market for loanable funds in country 1 is described by the equations I = 18 - 6r and S = 8+4r; in country 2,it is I = 18 - 4r and S = 8 + 2r.

a)Find the relationships between net capital outflow and the world interest rate (rw)in the two countries.

b)What is the nature of these relationships? (Are they both positive,both negative,or one positive and the other negative?)

c)Calculate the world equilibrium interest rate.

d)How can you reconcile the result from part b with the one from part c?

(Essay)

4.9/5  (29)

(29)

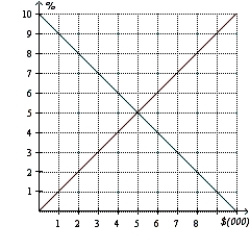

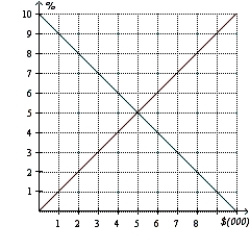

Figure 13-1  -Refer to the Figure 13-1.In the figure shown,if the world real interest rate went from 6 to 7 percent,what changes would occur?

-Refer to the Figure 13-1.In the figure shown,if the world real interest rate went from 6 to 7 percent,what changes would occur?

(Multiple Choice)

4.7/5  (37)

(37)

Figure 13-1  -Refer to the Figure13-1.In the figure shown,if the real interest rate is 6 percent,what is the result?

-Refer to the Figure13-1.In the figure shown,if the real interest rate is 6 percent,what is the result?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following would NOT be a consequence of an increase in the Canadian government's budget deficit?

(Multiple Choice)

4.7/5  (44)

(44)

Suppose the market for loanable funds is described by the equations I = 18 - 6r and S = 8 + 4r.

a)Find the relationship between net capital outflow and the world interest rate rw.

b)If net exports are described by NX = 16 - 4X,find the relationship between NX and the world interest rate at the equilibrium exchange rate.

c)For rw = 1.4,what is the elasticity of NX with respect to rw?

d)What is the relationship between the equilibrium exchange rate and the world interest rate? Discuss your result.

(Essay)

4.7/5  (39)

(39)

Showing 21 - 40 of 196

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)