Exam 7: Advanced Interpretation of Company and Group Accounts

Exam 1: The Statement of Financial Position Balance Sheetand What It Tells Us30 Questions

Exam 2: The Income Statement Profit and Loss Account31 Questions

Exam 3: The Development of Financial Reporting33 Questions

Exam 4: Ratios and Interpretation: a Straightforward Introduction25 Questions

Exam 5: How the Stock Market Assesses Company Performance25 Questions

Exam 6: Cash Flow Statements: Understanding and Preparation25 Questions

Exam 7: Advanced Interpretation of Company and Group Accounts25 Questions

Exam 8: Current Issues in Financial Reporting25 Questions

Exam 9: Bookkeeping to Trial Balance24 Questions

Exam 10: Trial Balance to Final Accounts25 Questions

Exam 11: Financing a Business24 Questions

Exam 12: Management of Working Capital25 Questions

Exam 13: Introduction to Management Accounting30 Questions

Exam 14: Investment Appraisal25 Questions

Exam 15: Budgetary Planning and Control25 Questions

Exam 16: Absorption Costing25 Questions

Exam 17: Marginal Costing and Decision-Making25 Questions

Exam 18: Standard Costing and Variance Analysis25 Questions

Exam 19: Incomplete Records20 Questions

Select questions type

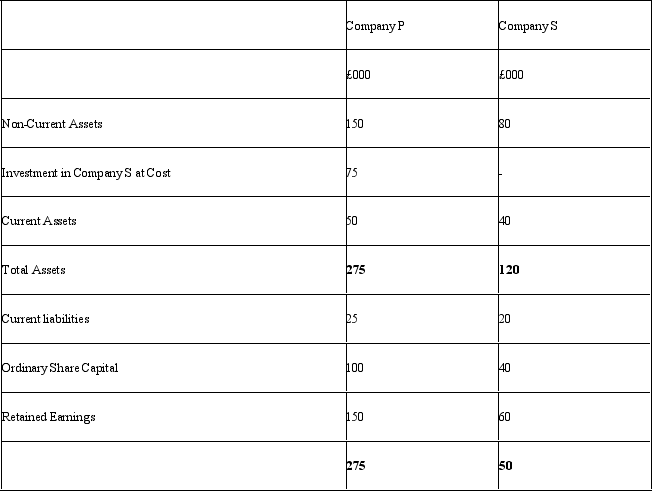

The Statements of Financial Position for company P and company S are shown below:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include,as well as 100% of the assets and liabilities of both companies:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include,as well as 100% of the assets and liabilities of both companies:

(Multiple Choice)

4.8/5  (38)

(38)

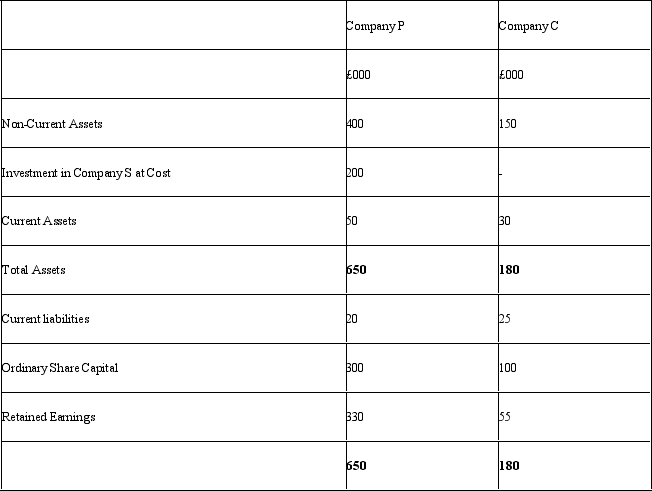

The Statements of Financial Position for company P and company C are shown below:

At the time of the acquisition,the net asset value of C was £100,000.This was made up entirely of £100,000 share capital.If company P owns 100% of Company C,then the consolidated Statement of Financial Position will show a Total Assets figure of:

At the time of the acquisition,the net asset value of C was £100,000.This was made up entirely of £100,000 share capital.If company P owns 100% of Company C,then the consolidated Statement of Financial Position will show a Total Assets figure of:

(Multiple Choice)

4.9/5  (34)

(34)

The following segmental information is provided for Powerage Ltd.

Audio America Audio Europe Visual America Visual Europe £ £ £ £ Sales 600 360 70 120 Operating profit 18 20 17 16 Net operating assets 240 300 30 40

Which segment would you suggest needs to become more profitable?

(Multiple Choice)

4.8/5  (35)

(35)

A company with interest cover of 10 is less safe than a company with interest cover of 2

(True/False)

4.9/5  (27)

(27)

A company is about to buy another company,but this would result in "negative goodwill".For example,Company A pays £2m for Company S which has net assets of £3m.However,the fair value of the net assets of S is actually only £2.1m Which of the following is the correct treatment of this situation?

(Multiple Choice)

4.9/5  (38)

(38)

Showing 21 - 25 of 25

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)