Exam 5: The Operating Cycle and Merchandising Operations

Exam 1: Uses of Accounting Information and the Financial Statements173 Questions

Exam 2: Analyzing Business Transactions194 Questions

Exam 3: Measuring Business Income245 Questions

Exam 3: Supplement - Closing Entries and the Work Sheet60 Questions

Exam 4: Financial Reporting and Analysis166 Questions

Exam 5: The Operating Cycle and Merchandising Operations178 Questions

Exam 6: Inventories156 Questions

Exam 7: Cash and Receivables180 Questions

Exam 8: Current Liabilities and Fair Value Accounting186 Questions

Exam 9: Long Term Assets242 Questions

Exam 10: Long-Term Liabilities203 Questions

Exam 11: Contributed Capital191 Questions

Exam 12: Investments164 Questions

Exam 13: The Corporate Income Statement and the Statement of Stockholders Equity178 Questions

Exam 14: The Statement of Cash Flows149 Questions

Exam 15: The Changing Business Environment - a Managers Perspective132 Questions

Exam 16: Cost Concepts and Cost Allocation189 Questions

Exam 17: Costing Systems- Job Order Costing77 Questions

Exam 18: Costing Systems- Process Costing130 Questions

Exam 19: Value-Based Systems- Abm and Lean150 Questions

Exam 20: Cost Behavior Analysis168 Questions

Exam 21: The Budgeting Process116 Questions

Exam 22: Performance Management and Evaluation117 Questions

Exam 23: Standard Costing and Variance Analysis121 Questions

Exam 24: Short Run Decision Analysis90 Questions

Exam 25: Capital Investment Analysis123 Questions

Exam 26: Pricing Decisions, incltarget Costing and Transfer Pricing142 Questions

Exam 27: Quality Management and Measurement79 Questions

Exam 28: Financial Analysis of Performance164 Questions

Select questions type

Under the periodic inventory system,Cost of goods sold must be computed on the income statement because it is not updated for purchases,sales,and other transactions during the accounting period.

(True/False)

4.8/5  (37)

(37)

Use this information to answer the following question. The selected accounts and balances for Keystone Market appear as follows:

Advertieing Esguense 14,000 Common Stock 100,000 Dividends 21,000 Fraight-In 7,000 Freight-Out Esgense 10,000 Interest Income 24,000 Merchandise Inventory (Jan. 1) 70,000 Merchandise Inventory (Dec. 31) 56,000 Purchases 60,000 Purchases Returns and Allowances 4,000 Rent Exgense 9,000 Retained Earning 40,000 Sales 151,000 Sales Returns and Allowances 19,000 Wages Engense 32,000 Gross margin from sales would be

(Multiple Choice)

4.8/5  (35)

(35)

A system of internal control cannot be considered good until the possibility of human error has been completely eliminated.

(True/False)

4.9/5  (40)

(40)

Sale and purchase of goods should be recorded at their list price,less any trade discount involved.

(True/False)

4.9/5  (41)

(41)

The collection of a $1,000 account beyond the 2 percent discount period would result in a(n)

(Multiple Choice)

4.8/5  (42)

(42)

Under the perpetual inventory system,in addition to making the entry to record a sales return,a company would

(Multiple Choice)

4.9/5  (40)

(40)

Freight-In is treated as a deduction in the cost of goods sold section of the income statement.

(True/False)

4.8/5  (35)

(35)

Which of the following documents remains within the originating company in a purchase transaction?

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following is not a goal of a system of internal control over merchandising transactions?

(Multiple Choice)

4.8/5  (36)

(36)

Use this information to answer the following question. Accaunt Name Debit Credit Sales 300,000 Sales Returns and Allowances 10,000 Purchases 68,000 Purchases Returns and Allowances 8,000 Freight-In 12,000 Selling Eagenses 30,000 General and Adninictrative Eagenses 110,000 In addition,beginning merchandise inventory was $22,000 and ending merchandise inventory was $14,000.

If beginning and ending merchandise inventories were ignored in computing net income,then net income would be

(Multiple Choice)

4.9/5  (34)

(34)

Under an effective system of internal control,errors occur only as a result of fraud or dishonesty.

(True/False)

4.7/5  (36)

(36)

Use this information to answer the following question. Account Name Debit Credit Sales 300,000 Sales Retums and Allowances 10,000 Purcha5es 53,000 Purchases Returns and Allowances 8,000 Freight-In 12,000 Selling Exgenses 30,000 General and Administrative Exgenses 110,000 In addition,beginning merchandise inventory was $22,000 and ending merchandise inventory was $14,000.

Net cost of purchases for the period were

(Multiple Choice)

4.8/5  (46)

(46)

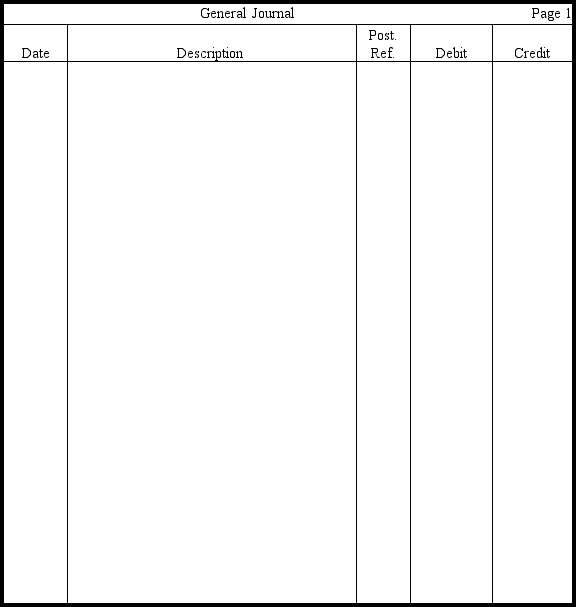

Khan Products,Inc.,entered into the transactions listed below.In the journal provided,prepare Khan's journal entries,assuming use of the periodic inventory system.Omit explanations.

June 3 Purchased of merchandise on credit, terms .

6 Returned of the goods purchased on June 3.

7 Paid freight charges of on goods purchased on June 3.

12 Paid for the goods purchased on June 3.

13 Sold goods on credit for , terms .

14 The customer of June 13 returned of the goods.

23 Received payment from the customer of June 13.

25 Purchased office supplies for .

(Essay)

4.9/5  (33)

(33)

Which of the following would not be found in a good system of internal control?

(Multiple Choice)

4.8/5  (38)

(38)

A company would be more likely to know the amount of inventory on hand if it used the periodic inventory system rather than the perpetual inventory system.

(True/False)

4.9/5  (36)

(36)

Which of the following companies would be most likely to use a computerized perpetual inventory system?

(Multiple Choice)

4.9/5  (32)

(32)

The collection of a $400 account within the 2 percent discount period would result in a(n)

(Multiple Choice)

4.8/5  (39)

(39)

Assuming the use of the periodic inventory system,use the data below to calculate the net cost of purchases and the goods available for sale for the year ended December 31,2010.

Merchandise Inventory, December 31, 2009 \2 ,307 Merchandise Inventory, December 31, 2010 2,041 Cost of Goods Sold 7,604

(Essay)

4.9/5  (43)

(43)

Showing 161 - 178 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)